FKLI - Deeper Retracement Developing

rhboskres

Publish date: Mon, 15 Jul 2019, 10:49 AM

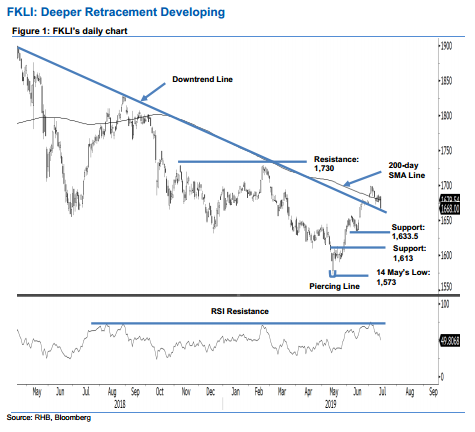

Initiate short positions as a deeper than expected retracement is developing. The FKLI experienced a negative session in the latest trade. It generally slid lower for the entire session, with the high and low registered at 1,685 pts and 1,667 pts, before closing at 1,668 pts, indicating a decline of 15 pts. The closing level has also crossed below the 200- day SMA line and our previous long positions’ trailing-stop of 1,671 pts. The index has been in the correction mode over the past two weeks – after it came near to test the 1,700-pt immediate resistance on 2 Jul. With the giveaway of the said SMA line, chances are high for the index to develop a deeper correction phase. Switch our trading bias to negative.

Our previous long positions initiated on 29 May at 1,619.5 pts were closed out in the latest session at 1,671 pts. On the bias that the index is at the risk of developing deeper correction phase on a failed attempt to cross the said immediate resistance, we initiate short positions at the latest closing. For risk management purposes, a stop-loss can be placed above 1,700-pt mark.

The immediate support is maintained at 1,633.5 pts, the low of 17 Jun. This is followed by 1,613 pts, the high of 13 May. On the other hand, the immediate resistance is set at 1,700 pts, followed by 1,730 pts, near the high of 21 Feb.

Source: RHB Securities Research - 15 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024