E-mini Dow Futures - Fourth Consecutive White Candle

rhboskres

Publish date: Tue, 16 Jul 2019, 10:35 AM

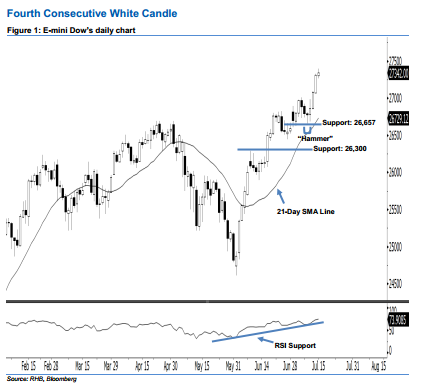

Bullish trend is likely to continue; stay long. The E-mini Dow’s upside move continued as expected, as a fourth consecutive white candle was formed last night. This indicated persistent upward momentum. It rose 33 pts to close at 27,342 pts, after hovering between a high of 27,397 pts and low of 27,263 pts. Currently, the index has marked a higher close vis-à-vis the previous sessions since 10 Jul, implying that the bullish sentiment remains intact. From a technical viewpoint, yesterday’s candle can be viewed as a continuation of bulls extending the upside swing from 9 Jul’s “Hammer” pattern. As such, we think the bulls are still in control of the market.

Based on the daily chart, we are eyeing the immediate support level at 26,657 pts, ie the low of 9 Jul’s “Hammer” pattern. The next support would likely be at 26,300 pts, situated near the midpoint of 18 Jun’s long white candle. To the upside, the near-term resistance level is anticipated at the 27,500-pt round figure. This is followed by the 28,000-pt psychological mark.

Hence, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 25,437-pt level on 7 Jun. Meanwhile, a trailing-stop is preferably set below the 26,657-pt threshold in order to secure part of the profits.

Source: RHB Securities Research - 16 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024