E-mini Dow Futures - Taking a Pause

rhboskres

Publish date: Wed, 17 Jul 2019, 05:49 PM

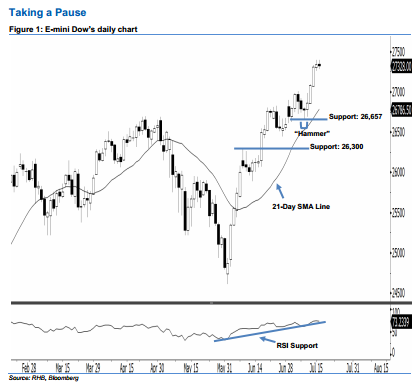

Stay long. The E-mini Dow formed a negative candle last night. It slipped 14 pts to close at 27,328 pts, off its high of 27,396 pts and low of 27,280 pts. However, the bullish sentiment stays unchanged. This is as yesterday’s negative candle can only be viewed as the buyers probably taking a pause after the recent surge. Given that the E-mini Dow is still trading above the rising 21-day SMA line, this implies that the rebound, which began from 9 Jul’s “Hammer” pattern, may carry on. Overall, we remain upbeat in our outlook.

As shown in the chart, the immediate support is seen at 26,657 pts, which was the low of 9 Jul’s “Hammer” pattern. If this level is taken out, look to 26,300 pts – near the midpoint of 18 Jun’s long white candle – as the next support. Towards the upside, we maintain the near-term resistance at the 27,500-pt round figure. This is followed by the 28,000-pt psychological spot.

Consequently, we advise traders to maintain long positions, since we originally recommended initiating long above the 25,437-pt level on 7 Jun. In the meantime, a trailing-stop can be set below the 26,657-pt mark to lock in part of the profits.

Source: RHB Securities Research - 17 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024