FCPO - Still Negative

rhboskres

Publish date: Fri, 19 Jul 2019, 04:26 PM

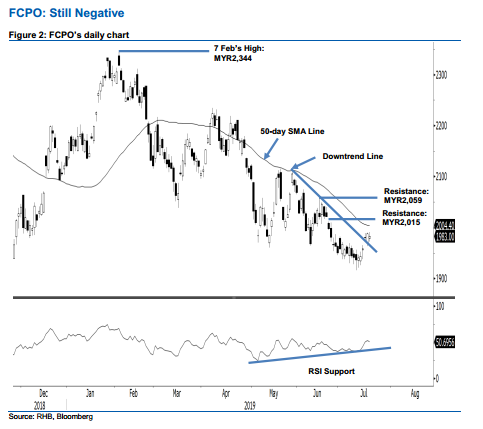

Maintain short positions as the negative trend is still not nullified. The FCPO traded in a relatively narrow band of MYR1,972 and MYR1,991, before closing MYR5 softer at MYR1,983. While the commodity has managed to stage a minor rebound recently and crossed above the downtrend line (as drawn in the chart), there are still no firm price signals to suggest that a deeper rebound is on the cards. For now, for a deeper rebound to likely develop, the commodity has to cross above the 50-day SMA line – a trend line that the commodity has struggled to overcome YTD. For now, we stay with our negative trading bias.

Until signs for a deeper rebound show up, we continue to recommend that traders stay in short positions. These were initiated at MYR1,951, the closing level of 28 Jun. We revise the stop-loss to above MYR2,015.

Towards the downside, the immediate support is set at the MYR1,900 threshold. This is followed by MYR1,863, the low of 25 Aug 2015. Moving up, the immediate resistance is revised to MYR2,015, near the high of 24 Jun. This is followed by the MYR2,059 threshold, the high of 18 Jun.

Source: RHB Securities Research - 19 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024