WTI Crude Futures - the Retracement Is Extending

rhboskres

Publish date: Fri, 19 Jul 2019, 04:33 PM

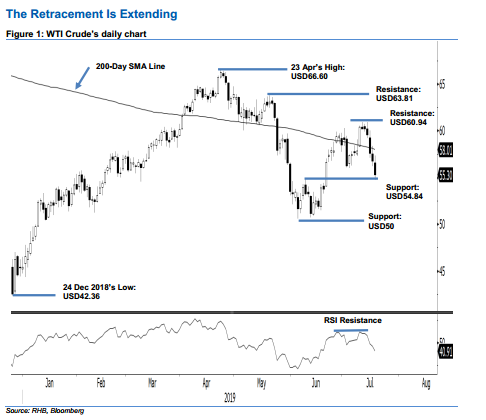

Initiate short positions, as the retracement is deeper than expected. The WTI Crude extended its retracement leg into the latest session – it settled at USD55.30 at the close after declining USD1.48, breaching below the previous immediate support of USD56.04. The weak session also places the commodity further below the 200-day SMA line – suggesting a possible price rejection. Also, our previous long positions’ stop-loss was also triggered. As a result, we switch our trading bias to negative.

Our previous long positions were initiated at USD60.43, or the closing level of 11 Jul – it closed out at USD55.04 yesterday. As the WTI Crude is extending its retracement leg, we initiate short positions at the latest close. For riskmanagement purposes, a stop-loss can be placed above the USD60.94 mark.

We revised the immediate support to USD54.84, which was the high of 10 Jun. This is followed by USD50. Meanwhile, the immediate resistance is now pegged at USD60.94, which was the high of 1 Jul. This is followed by USD63.81, or the high of 20 May.

Source: RHB Securities Research - 19 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024