FCPO - Persistent Upward Momentum

rhboskres

Publish date: Mon, 29 Jul 2019, 11:55 AM

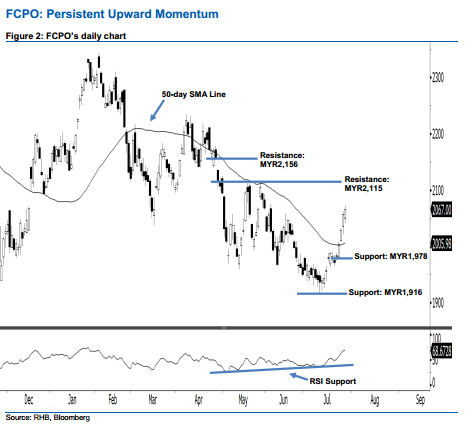

Maintain long positions. The FCPO’s upside strength continued as expected, as a fourth consecutive white candle was formed last Friday. This indicated persistent buying momentum. It rose MYR7 to settle at MYR2,067, after oscillating between a high of MYR2,073 and low of MYR2,041. In view of last Friday’s closing, the FCPO has taken out the previously-indicated MYR2,059 resistance, implying that the bullish sentiment is still intact. On a technical basis, the latest white candle can be viewed as a continuation of the bulls extending the rebound from 11 Jul’s white candle. As such, we think the bulls are still in control of the market.

Based on the daily chart, the immediate support level is seen at MYR1,978, defined from the low of 23 Jul. If this level is taken out, look to MYR1,916 – ie the previous low of 10 Jul – as the next support. Towards the upside, we anticipate the immediate resistance level at MYR2,115, obtained from the high of 29 May. The next resistance would likely be at MYR2,156, ie the downside gap resistance of 26 Apr.

Therefore, we advise traders to maintain long positions, since we had originally recommended initiating long above the MYR2,029 level on 25 Jul. At the same time, a stop-loss is preferably set below the MYR1,978 threshold in order to minimise the downside risk.

Source: RHB Securities Research - 29 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024