FKLI - Downside Move Continues

rhboskres

Publish date: Wed, 31 Jul 2019, 09:50 AM

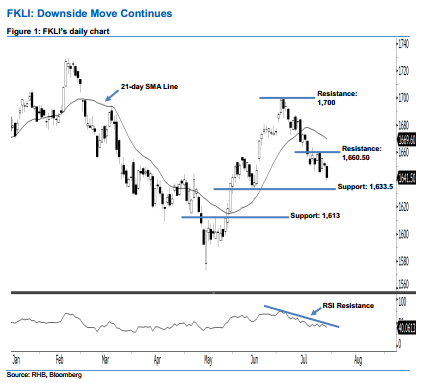

Downside move is likely to persist; stay short. The downward momentum in the FKLI has continued on as expected, as a black candle was formed on Monday. It declined 9 pts to close at 1,641.50 pts, off the session’s high of 1,651 pts and low of 1,639 pts. Market sentiment remains bearish, as the FKLI has posted a second consecutive black candle and marked a lower close below the declining 21-day SMA line. Moreover, the 14-day RSI indicator deteriorated to a weaker reading at 40.06 pts – this indicates that the downside swing that began off in early-July may carry on. Overall, we maintain our bearish view for the FKLI’s outlook.

Based on the daily chart, the immediate resistance level is seen at 1,660.50 pts, ie the high of 24 Jul’s long black candle. If a breakout arises, the next resistance is anticipated at the 1,700-pt psychological spot. On the other hand, we maintain the immediate support level at 1,633.50 pts, ie the low of 17 Jun. The next support is seen at 1,613 pts, determined from the high of 21 May.

Therefore, we advise traders to maintain short positions, following our recommendation of initiating short below the 1,668-pt level on 15 Jul. In the meantime, a trailing-stop can be set above the 1,660.50-pt mark in order to secure part of the gains.

Source: RHB Securities Research - 31 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024