FKLI - Persistent Selling Momentum

rhboskres

Publish date: Thu, 01 Aug 2019, 04:52 PM

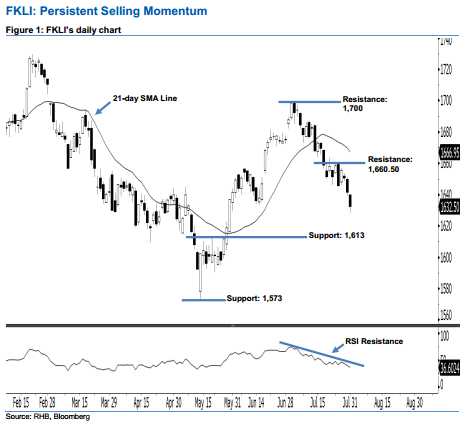

Stay short, with a trailing-stop set above the 1,660.50-pt resistance. Yesterday, the FKLI’s downward momentum continued as expected after it successfully ended lower to form a black candle. It lost 9 pts to close at 1,632.50 pts, off its high of 1,640 pts and low of 1,628.50 pts. As seen in the chart, the downside momentum is likely to continue, as the index has posted a third consecutive black candle and hit its 2-month low. Furthermore, as it has taken out the 1,633.50-pt support mentioned previously, this is an indication that the bearish sentiment should remain intact.

Currently, we are eyeing the immediate resistance level at 1,660.50 pts, the high of 24 Jul’s long black candle. Meanwhile, the next resistance remains at the 1,700-pt psychological mark. Towards the downside, we now anticipate the immediate support level at 1,613 pts, obtained from the high of 21 May. The next support would likely be at 1,573 pts, the previous low of 14 May.

As such, we advise traders to stay short, since we had originally recommended initiating short positions below the 1,668-pt level on 15 Jul. At the same time, a trailing-stop is preferably set above the 1,660.50-pt threshold to lock in part of the profits.

Source: RHB Securities Research - 1 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024