FCPO - Tightening Up Trailing-Stop

rhboskres

Publish date: Fri, 02 Aug 2019, 05:15 PM

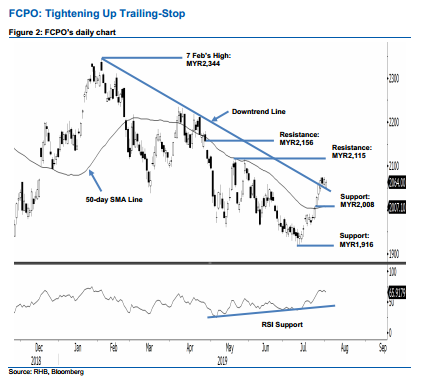

Still consolidating around the downtrend line; maintain long positions. The FCPO ended the latest session MYR6 weaker at MYR2,064. The low and high were posted at MYR2,049 and MYR2,068. The soft commodity has been showing signs of consolidating around the downtrend line (as drawn in the chart) in recent sessions. In the absence of price rejection signals from the said downtrend, the counter-trend rebound – which started from the low of MYR1,916 on 10 Jul – would still be considered intact. Additionally, the commodity is still trading relatively well above the 50-day SMA line. With these data points in mind, we keep to our positive trading bias.

As the counter-trend rebound is still not showing signs of coming to an end, traders should remain in long positions. We initiated these at MYR2,029, the closing level of 24 Jul. For risk management purposes, a stop-loss can now be placed at the breakeven mark.

The immediate support is set at MYR2,008, which was the 23 Jul’s high. This is followed by MYR1,916, the low of 10 Jul. Moving up, the immediate resistance is now pegged at MYR2,115, the high of 29 May. This is followed by MYR2,156, the low of 26 Apr.

Source: RHB Securities Research - 2 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024