Hang Seng Index Futures - Plunged to 7-Month Low

rhboskres

Publish date: Tue, 06 Aug 2019, 09:53 AM

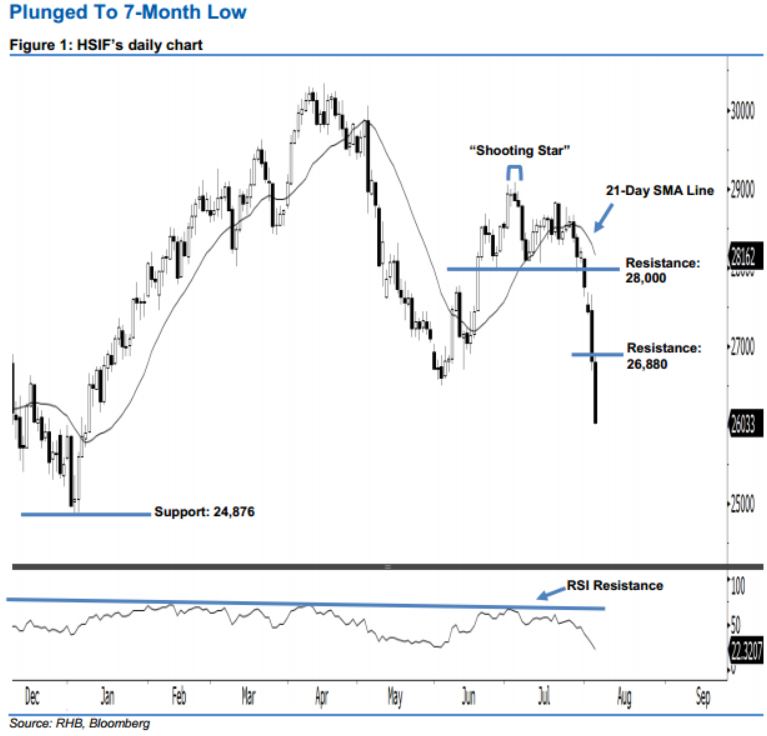

Stay short while setting a new trailing-stop above the 26,880-pt level. Yesterday, the HSIF’s selling momentum continued as expected, after it formed another long black candle. It tumbled 784 pts to close at 26,033 pts. Technically, the market correction would likely continue, as the index has marked lower closes since 31 Jul. Moreover, yesterday’s long black candle has taken out the previously-indicated 26,505-pt support and recorded the lowest close in nearly seven months, which has enhanced the bearish sentiment.

Presently, the immediate resistance is seen at 26,880 pts, ie the high of 5 Aug’s long black candle. The next resistance is maintained at the 28,000-pt round figure, set near 26 Jun’s low as well. To the downside, we are now eyeing the near-term support at the 25,000-pt psychological spot. This is followed by 24,876 pts, determined from the previous low of 3 Jan.

To recap, we initially recommended that traders initiate short positions below the 28,109-pt level on 1 Aug. We continue to advise staying short for now, while setting a new trailing-stop above the 26,880-pt threshold. This is in order to lock in part of the profits.

Source: RHB Securities Research - 6 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024