FCPO - Counter-trend Rebound Extending

rhboskres

Publish date: Tue, 06 Aug 2019, 10:04 AM

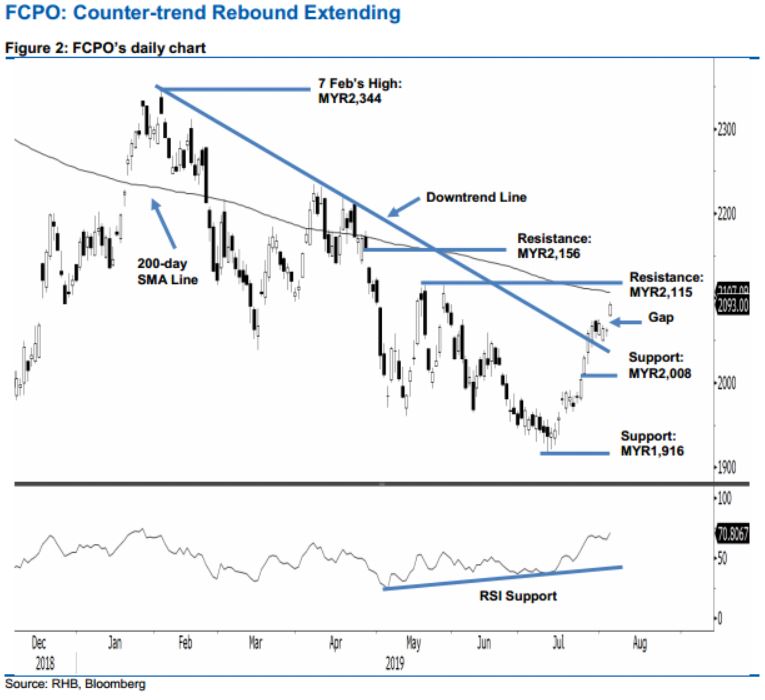

Maintain long positions as the commodity is pushing beyond the downtrend line. The FCPO formed an “Upside Gap” yesterday, breaking from its multi-day minor consolidation. This placed the commodity above the downtrend line (as drawn in the chart). At the closing, it settled near to the session’s high at MYR2,093, implying a gain of MYR31. Overall, the counter-trend rebound that started from the low of MYR1,916 on 10 Jul is still in progress. Towards the upside, the rebound may be extended towards the MYR2,115 immediate resistance mark – which is also located around the 200-day SMA line. Hence, we keep to our positive trading bias.

As the bulls are still showing signs of control over the rebound, traders are advised to remain in long positions. We initiated these at MYR2,029, the closing level of 24 Jul. For risk management purposes, a stop-loss can now be placed at the breakeven level.

Immediate support should be at MYR2,008, 23 Jul’s high. This is followed by MYR1,916, the low of 10 Jul. On the other hand, the immediate resistance is set at MYR2,115, the high of 29 May. This is followed by MYR2,156, the low of 26 Apr.

Source: RHB Securities Research - 6 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024