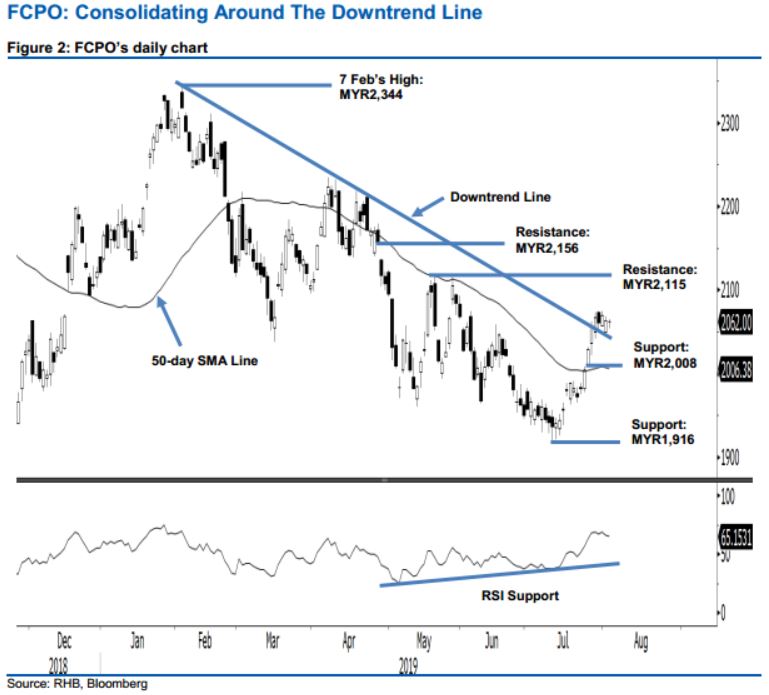

FCPO - Consolidating Around The Downtrend Line

rhboskres

Publish date: Tue, 06 Aug 2019, 10:20 AM

Maintain long positions as there are no price rejection signals from the downtrend line. The FCPO ended the latest session marginally lower by MYR2 to settle at MYR2,062. Trading took place in a relatively narrow range of MYR2,054 and MYR2,065. The latest session’s price action can be seen as part of the commodity’s narrow consolidation phase, around the downtrend line (as drawn in the chart), which has been developing over recent sessions. Towards the upside, a firm breakout from the said consolidation phase could signal an even deeper countertrend rebound. Based on these, we keep to our positive trading bias.

As we are not seeing price rejection signals from the said downtrend line, traders are advised to remain in long positions. We initiated these at MYR2,029, the closing level of 24 Jul. For risk management purposes, a stop-loss can now be placed at the breakeven mark.

Towards the downside, the immediate support is eyed at MYR2,008, which was the 23 Jul’s high. This is followed by MYR1,916, the low of 10 Jul. Meanwhile, the immediate resistance is set at MYR2,115, the high of 29 May. This is followed by MYR2,156, the low of 26 Apr.

Source: RHB Securities Research - 6 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024