E-mini Dow Futures - Downside Swing Stays Intact

rhboskres

Publish date: Wed, 07 Aug 2019, 09:23 AM

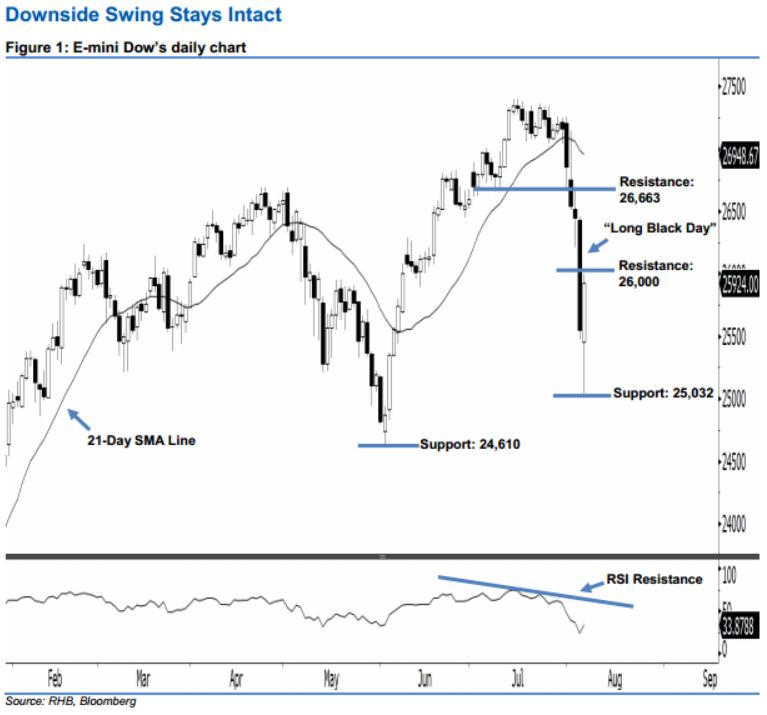

Stay short while setting a trailing-stop above the 26,000-pt resistance. Following five consecutive sessions of market declines, the E-mini Dow ended higher to form a white candle last night. It gained 374 pts to close at 25,924 pts, off the session’s low of 25,032 pts. Unsurprisingly, yesterday’s white candle should be view merely as a technical rebound following the recent plunge. Technically, market sentiment remains bearish, as the index failed to recover more than 50% of the losses created by 5 Aug’s “Long Black Day” candle. Overall, we keep our bearish view on the E-mini Dow’s outlook.

Presently, we anticipate the immediate resistance at the 26,000-pt round figure, set near the midpoint of 5 Aug’s “Long Black Day” candle as well. If the price climbs above this level, look to 26,663 pts – which was the high of 2 Aug – as the next resistance. Towards the downside, we are now eyeing the immediate support at 25,032 pts, ie 6 Aug’s low. The next support is maintained at 24,610 pts, which was the low of 3 Jun.

Therefore, we advise traders to maintain short positions, following our recommendation of initiating short below the 26,663-pt level on 5 Aug. Meanwhile, a trailing-stop set above the 26,000-pt threshold is preferable to lock in part of the gains.

Source: RHB Securities Research - 7 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024