Hang Seng Index Futures - Sentiment Remains Bearish

rhboskres

Publish date: Wed, 07 Aug 2019, 09:34 AM

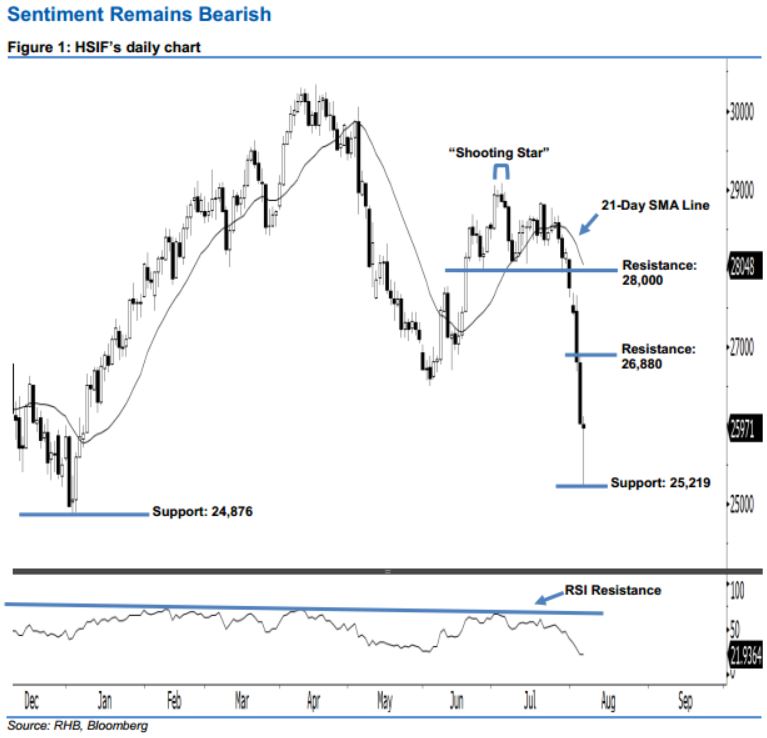

Maintain short positions. After posting four black candles in a row, the HSIF formed a “Doji” candle yesterday. It settled at 25,971 pts after oscillating between a high of 26,118 pts and low of 25,219 pts. However, it is not surprising that the sellers may be taking a pause following the recent losses. From a technical perspective, we think the bears may continue to control the market, as long as the HSIF does not recoup the losses from 5 Aug’s long black candle. As the index is trading below the 21-day SMA line, this suggests that the market downside swing – which started off 4 Jul’s “Shooting Star” pattern – may persist.

For now, we maintain the immediate resistance at 26,880 pts, which was the high of 5 Aug’s long black candle. The next resistance is seen at 28,000 pts, ie near 26 Jun’s low. On the other hand, we are eyeing the immediate support at 25,219 pts, which was determined from 6 Aug’s low. If a breakdown occurs, the next support is anticipated at 24,876 pts, or the previous low of 3 Jan.

Hence, we advise traders to stay short, in line with our initial recommendation to have short positions below the 28,109-pt level on 1 Aug. A trailing-stop can be set above the 26,880-pt mark to secure part of the profits.

Source: RHB Securities Research - 7 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024