WTI Crude Futures - Continues to Weaken; Stay Short

rhboskres

Publish date: Wed, 07 Aug 2019, 09:37 AM

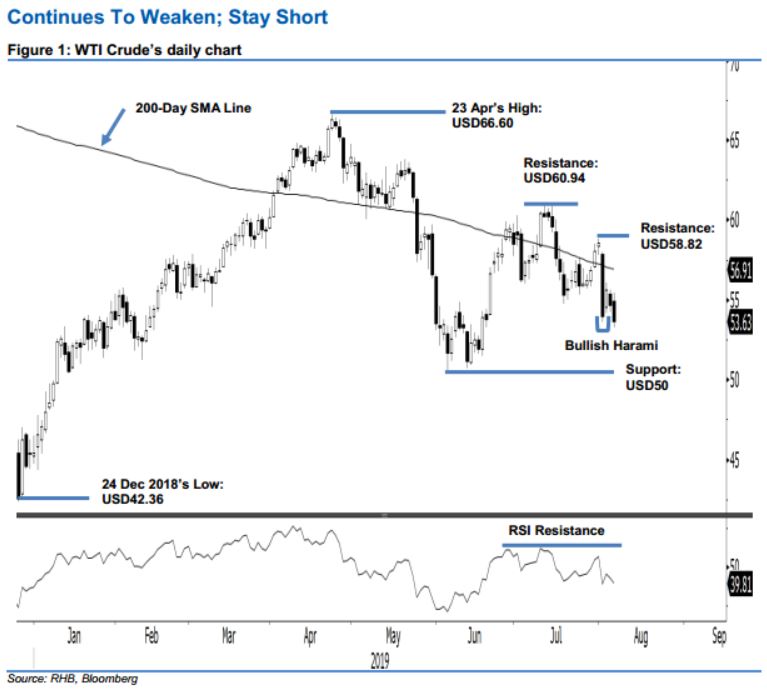

Bears are still in firm control; maintain short positions. The black gold failed to sustain its earlier session’s positive tone. At the closing it settled USD1.06 weaker at USD53.63 – the session’s low and high were posted at USD53.29 and USD55.42. The session also negated 1 Aug’s “Bullish Harami” formation, thus dampening the outlook for the commodity – at the minimum, it reached an interim low for a counter-trend rebound to develop. Hence, we keep to our negative trading bias.

In the absence of technical evidence to suggest an interim low has been reached, we continue to recommend that traders stay in short positions. We initiated these at USD55.30, which was the closing level of 19 Jul. For risk management purposes, a stop-loss can now be placed above the USD58.82 mark.

Immediate support is set at USD50, a round figure. This is followed by USD45. On the other hand, the immediate resistance is eyed at USD58.82, which was the high of 31 Jul. Breaking this could see the market test the USD60.94 mark, high of 1 Jul.

Source: RHB Securities Research - 7 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024