FKLI - An Intraday Reversal

rhboskres

Publish date: Wed, 07 Aug 2019, 09:52 AM

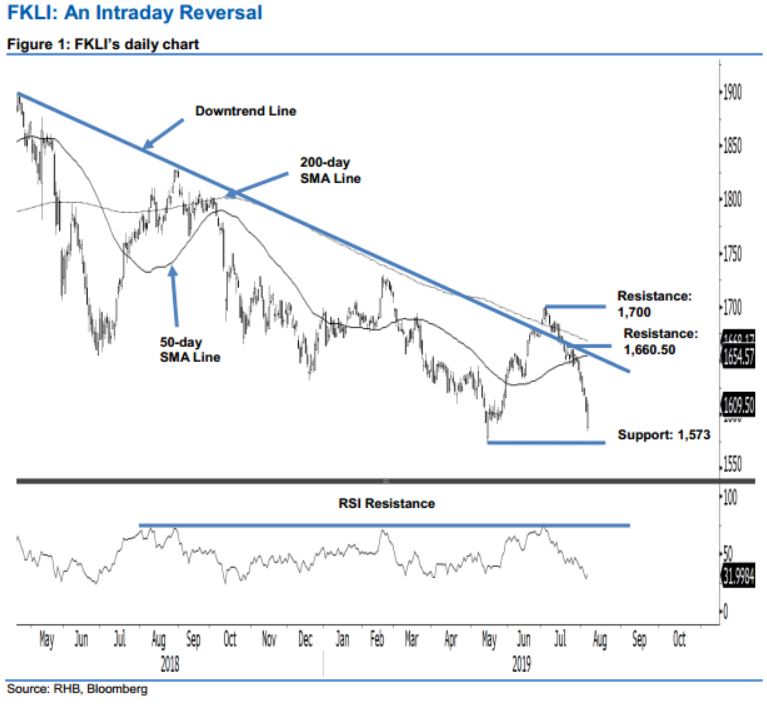

Maintain short positions as it is still unclear whether a low has been formed. The FKLI staged a comeback in the latest session. It reversed from an earlier session’s loss (intraday low: 1,584.5 pts) to settle the day 6 pts higher at 1,609.5 pts. The positive reversal came as the index was approaching the immediate support of 1,573 pts on the back of an oversold Daily RSI reading (as highlighted in our previous report – FKLI: Bears Clawing Fiercely). However, further positive price actions in the coming sessions are needed to confirm that an interim low has been established. Until this happens, we keep to our negative trading bias.

Until the bulls are able to wrest control from the bears, we continue to recommend that traders remain in short positions. We initiated these at 1,668 pts, the closing level of 12 Jul. To manage risks, a stop-loss can be placed above the 1,660.5-pt mark.

We are keeping the immediate support target at 1,573 pts, the low of 14 May. This is followed by 1,550 pts. Moving up, the immediate resistance is set at 1,660.5 pts, the high of 24 Jul, followed by 1,700 pts, a round figure.

Source: RHB Securities Research - 7 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024