E-mini Dow Futures - Eyeing Resistance at 26,000

rhboskres

Publish date: Thu, 08 Aug 2019, 05:13 PM

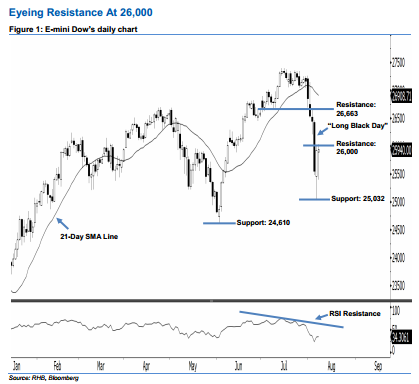

Stay short, provided that the 26,000-pt resistance is not violated at closing. The E-mini Dow formed another positive candle last night. It rose 16 pts to close at 25,940 pts, off its low of 25,392 pts. Yet, we maintain our negative sentiment, as the index failed to close above the 26,000-pt resistance mentioned previously. As the Emini Dow failed to recoup more than 50% of losses created by 5 Aug’s “Long Black Day” candle, this shows that buying momentum is considered weak. Overall, we remain bearish on the index’s outlook.

As seen in the chart, the immediate resistance is anticipated at the 26,000-pt psychological spot, also set near the midpoint of 5 Aug’s “Long Black Day” candle. If a decisive breakout arises, the next resistance is seen at 26,663 pts, ie 2 Aug’s high. On the other hand, we maintain the near-term support at 25,032 pts, which was the 6 Aug’s low. This is followed by 24,610 pts, ie the previous low of 3 Jun.

Thus, we advise traders to maintain short positions, since we had originally recommended initiating short below the 26,663-pt level on 5 Aug. A trailing-stop can be set above the 26,000-pt threshold in order to secure part of the profits.

Source: RHB Securities Research - 8 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024