WTI Crude Futures - Tightening Up Stop-Loss

rhboskres

Publish date: Thu, 08 Aug 2019, 05:23 PM

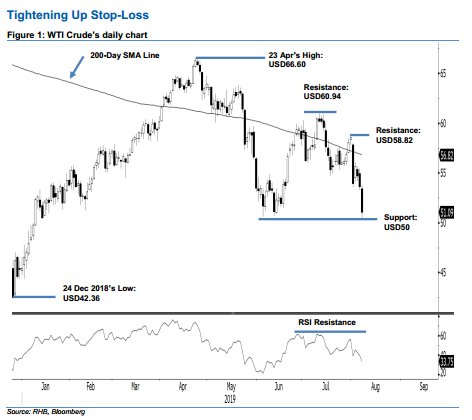

Nearing the USD50 support mark again; Maintain short positions. The black gold formed a black candle in the latest trade. At one point, it came near to test the immediate support of USD50 with an intraday low of USD50.52. This was before it rebounded towards the end of the session to settle at USD51.09, a decline of USD2.54. While the commodity was able to rebound from the said immediate support, further positive price actions in the coming sessions are required to confirm that a low is in place. Until this happens, we keep to our negative trading bias.

As the bears still have an upper hand over the price trend, we continue to recommend that traders stay in short positions. We initiated these at USD55.30, which was the closing level of 19 Jul. For risk management purposes, a stop-loss can now be placed at the breakeven level.

Immediate support is set at USD50, a round figure. The second support is eyed at USD45. Meanwhile, the immediate resistance is pegged at USD58.82, which was the high of 31 Jul. This is followed by the USD60.94 mark, high of 1 Jul.

Source: RHB Securities Research - 8 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024