Hang Seng Index Futures - Downside Swing

rhboskres

Publish date: Tue, 13 Aug 2019, 10:09 AM

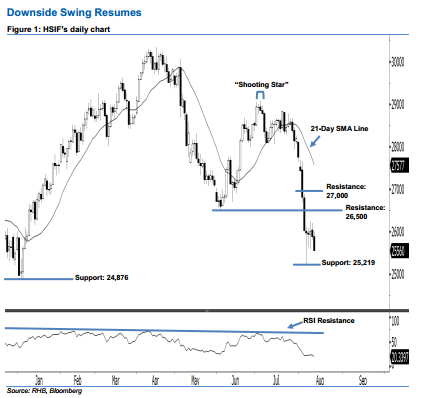

Stay short while setting a new trailing-stop above the 26,500-pt level. The downward movement of the HSIF has continued as expected, as a black candle was formed yesterday. It dropped to a low of 25,550 pts during the intraday session, before ending at 25,560 pts for the day. Market sentiment remains bearish, as the aforementioned black candle was the second one recorded in two consecutive days. This movement may also further extend the downside swing that started with 4 Jul’s “Shooting Star” pattern.

Based on the daily chart, we now anticipate the immediate resistance level at 26,500 pts, situated near the midpoint of 5 Aug’s long black candle. Meanwhile, the next resistance would likely be at the 27,000-pt psychological mark. Towards the downside, the immediate support level is maintained at 25,219 pts, ie the low of 6 Aug. If the price breaks down, the next support is seen at 24,876 pts, which was the previous low of 3 Jan.

To re-cap, on 1 Aug, we initially recommended traders initiate short positions below the 28,109-pt level. We continue to advise them to stay short for now, while setting a new trailing-stop above the 26,500-pt threshold. This is in order to lock in a larger part of the profits.

Source: RHB Securities Research - 13 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024