FKLI - Trend Stays Negative

rhboskres

Publish date: Tue, 13 Aug 2019, 10:12 AM

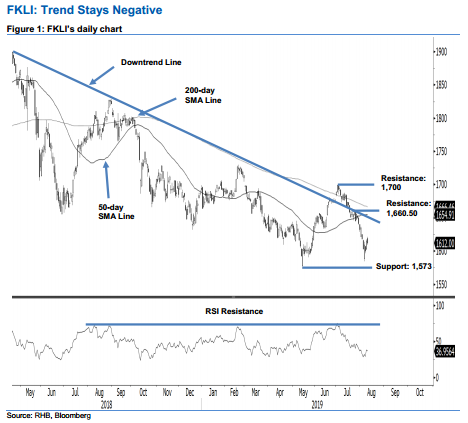

Maintain short positions, as the bears are still in control. The FKLI ended its latest session 3 pts lower at 1,612 pts. The intraday tone was negative, as the index generally trended lower for the whole session – the high and low were posted at 1,621.5 pts and 1,609.5 pts. Overall, the FKLI’s negative trend remains firmly in place, as the index’s recent sessions’ rebounds can only be seen as signs of a minor consolidation. Once this consolidation is over, we are expecting the negative price trend to resume – at the minimum – to retest the 1,573-pt immediate support. Consequently, we keep to our negative trading bias.

On expectation that the negative trend may still be able to extend further, we continue to recommend traders remain in short positions. We initiated these at 1,668 pts, or the closing level of 12 Jul. To manage risks, a stop-loss can be placed above the 1,660.5-pt mark.

Towards the downside, immediate support is set at 1,573 pts, ie the low of 14 May. This is followed by the 1,550-pt mark. On the other hand, the immediate resistance is set at 1,660.5 pts, which was the high of 24 Jul. This is followed by 1,700 pts, a round figure.

Source: RHB Securities Research - 13 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024