COMEX Gold - Looking Fine

rhboskres

Publish date: Wed, 14 Aug 2019, 05:05 PM

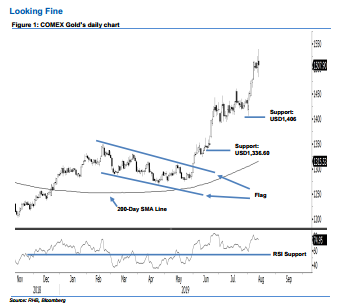

Maintain long positions as the commodity is still hovering around the USD1,500 mark. The COMEX Gold was trading in a wide range during the latest session. Towards the closing, it failed to sustain its earlier sessions’ positive tone – settling USD3 weaker at USD1,507.90. The low and high were recorded at USD1,483 and USD1,539.5. The performance also suggests a possible intraday price reversal, which came on the back of the overbought Daily RSI reading. Price actions over the coming sessions are important, should the commodity continue to show signs of weakness, chances would be high that a deeper consolidation may be developing. Until this happens, we keep to our positive trading bias.

Until there are price actions to indicate a deeper consolidation is taking place, we retain our recommendation for traders to stay in long positions. We opened these positions at USD1,333.60, which was the closing level for 5 Jun. For risk-management purposes, a stop-loss can now be placed below the USD1,406 mark.

We are keeping the immediate support target at USD1,406, or near the low of 1 Aug. This is followed by USD1,336.60, which was the low of 17 Jun. Moving up, the immediate resistance is now set at the USD1,550 level. This is followed by the USD1,600 threshold.

Source: RHB Securities Research - 14 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024