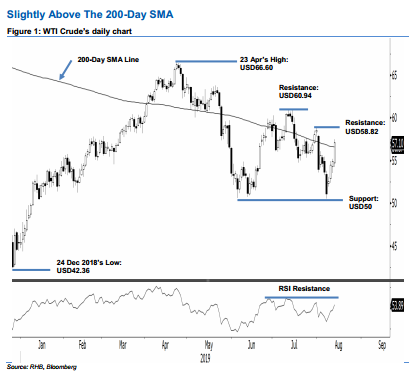

WTI Crude Futures - Slightly Above the 200-Day SMA

rhboskres

Publish date: Wed, 14 Aug 2019, 05:09 PM

Initiate long positions as the bulls are coming back. The WTI Crude formed a white candle, which at the closing marginally crossed the 200-day SMA line. Session’s low and high were posted at USD54.21 and USD57.47, before closing USD2.17 stronger at USD57.10. While the upside breach of the said SMA is still a minor one, the recent rebound suggests a possibility for a stronger rebound to take place. Should the commodity be able to extend itself well above the said SMA line in the coming sessions, this positive bias would be further validated. Switch our trading bias to positive.

Our previous short positions initiated at USD55.30 (the closing level of 19 Jul) were closed out at the breakeven level in the latest session. On the bias that the commodity is in the process of developing a stronger rebound, we initiate long positions at the latest closing level. For risk-management purposes, a stop-loss can now be placed at USD50.

immediate support is set at USD50, a round figure. This is followed by USD45. On the other hand, the immediate resistance is still expected at USD58.82, which was the high of 31 Jul. This is followed by the USD60.94 mark, or the high of 1 Jul.

Source: RHB Securities Research - 14 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024