FKLI - Just a Minor Bounce

rhboskres

Publish date: Thu, 15 Aug 2019, 04:59 PM

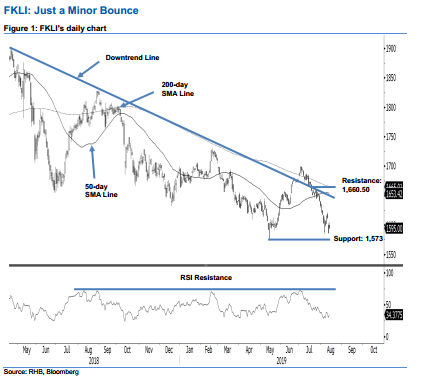

Maintain short positions as the retracement leg is merely taking a pause. The FKLI closed 8.5 pts higher at 1,595 pts, yesterday. The low and high were recorded at 1,593 pts and 1,605 pts. For now, we deem the latest positive performance as just a minor bounce within the downtrend. This is normal, as the weak trend recently flashed out an oversold RSI reading. Once the bounce has run its course, we expect – at minimum – the immediate support of 1,573 pts to be tested. Supporting this is the fact that the index is capped well below both the 50-day/200-day SMA lines and the downtrend line (as drawn in the chart). We maintain our negative trading bias.

As the trend is still weak, we continue to recommend that traders remain in short positions. We initiated these at 1,668 pts, or the closing level of 12 Jul. To manage risks, a stop-loss can be placed above the 1,660.5-pt mark.

Towards the downside, immediate support is set at 1,573 pts, ie the low of 14 May. This is followed by the 1,550-pt mark. On the other hand, the immediate resistance now set at the 1,600-pt mark. This is followed by 1,660.5 pts, the high of 24 Jul.

Source: RHB Securities Research - 15 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024