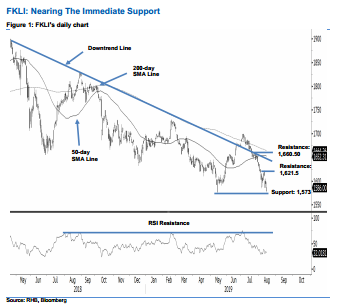

FKLI - Nearing the Immediate Support

rhboskres

Publish date: Fri, 16 Aug 2019, 05:11 PM

Maintain short positions while tightening up risk management. The FKLI came in near to test the immediate support of 1,573 pts with an intraday low of 1,576 pts. This was before it rebounded towards the end of the session, to settle at 1,586 pts, indicating a decline of 9 pts. Overall, the weak trend that started from the failed attempt to cross the 1,700-pt mark on 2 Jul is still firmly in place. This is further supported by the fact that there was no clear price reversal signal from the said immediate support in the latest session. The RSI reading, which has yet to reach an oversold threshold, also implies room for further weakness. Maintain our negative trading bias.

In the absence of clear price reversal signals from the said immediate support, we continue to recommend that traders remain in short positions. We initiated these at 1,668 pts, or the closing level of 12 Jul. To manage risks, a stop-loss can now be placed above the 1,621.5-pt mark.

The immediate support is set at 1,573 pts, ie the low of 14 May. This is followed by the 1,550-pt mark. Meanwhile, we revise the immediate resistance to 1,621.5 pts, which was the high of 9 Aug. This is followed by 1,660.5 pts, the high of 24 Jul.

Source: RHB Securities Research - 16 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024