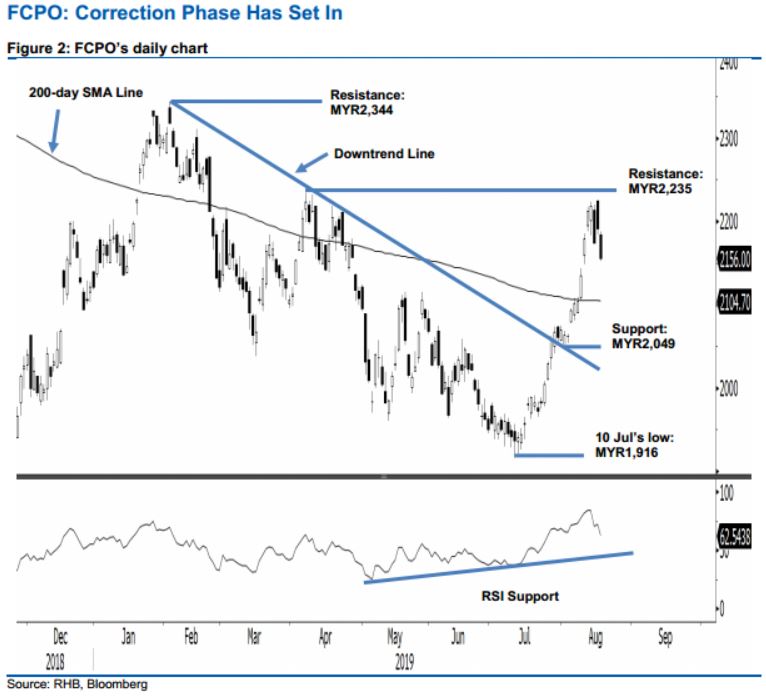

FCPO - Correction Phase Has Set In

rhboskres

Publish date: Tue, 20 Aug 2019, 09:30 AM

Initiate short positions as the possibility for a correction phase to develop is high. The FCPO formed a black candle to close MYR36 weaker at MYR2,156. The intraday tone was negative as it generally scaled lower for the whole session – the high and low were recorded at MYR2,188 and MYR2,152. The weak session also crossed the MYR2,173 mark (the stop-loss for the previous long positions). This, in our view, suggests that the commodity has likely entered a correction phase. This correction phase was triggered after the rally that started from mid-July, flashed out an overbought RSI reading recently. Towards the downside, we are expecting the 200-day SMA line to be retested. Switch to negative trading bias.

Our previous long positions, initiated at MYR2,029 – the closing level of 24 Jul was closed out at MYR2,173. On the expectation that a correction phase is developing, we initiate short positions at the latest closing. For risk management purposes, a stop-loss can be placed above the MYR2,235 level.

The immediate support is eyed at MYR2,100, near the 200-day SMA line. This is followed by MYR2,049, the low of 31 Jul. On the other hand, the immediate resistance is set at MYR2,235, the high of 5 Apr. This is followed by MYR2,344, the high of 7 Feb.

Source: RHB Securities Research - 20 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024