E-mini Dow Futures - Third Consecutive White Candle

rhboskres

Publish date: Tue, 20 Aug 2019, 09:52 AM

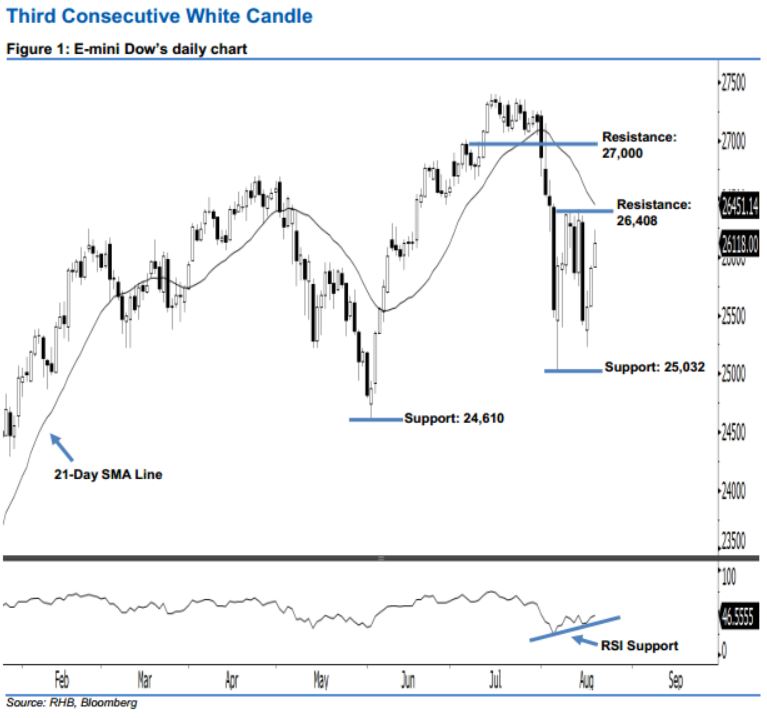

Upside move is not over yet; stay long. Buying momentum in the E-mini Dow continued as expected, as another white candle was formed last night. It gained 211 pts to close at 26,118 pts, after oscillating between a high of 26,237 pts and low of 25,912 pts. Technically speaking, the index has marked a higher close vis-à-vis the previous sessions since 15 Aug. This indicates that the rebound, which started from 6 Aug’s white candle, may continue. Furthermore, the index has posted a third consecutive white candle, this has enhanced the positive sentiment as well. Overall, we stay positive on the E-mini Dow’s outlook.

As seen in the chart, we are eyeing the immediate support level at 25,032 pts, which was the previous low of 6 Aug. If a breakdown arises, the next support is maintained at 24,610 pts, ie the low of 3 Jun. Towards the upside, we maintain the immediate resistance level at 26,408 pts, determined from the high of 13 Aug. Meanwhile, the next resistance is seen at the 27,000-pt psychological spot.

Therefore, we advise traders to maintain long positions, following our recommendation of initiating long above the 26,035-pt level on 9 Aug. In the meantime, a stop-loss can be set below the 25,032-pt threshold in order to minimise the downside risk.

Source: RHB Securities Research - 20 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024