FKLI - Trend Stays Negative

rhboskres

Publish date: Thu, 22 Aug 2019, 05:15 PM

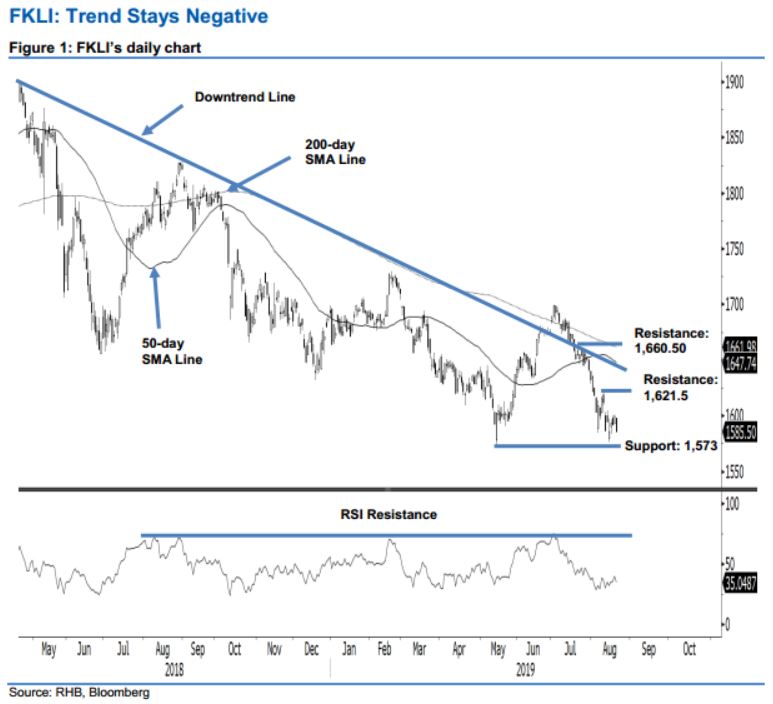

Negative bias stays intact; maintain short positions. The FKLI slid 14 pts to close at 1,585.5 pts. The low and high were recorded at 1,585 pts and 1,598 pts. The session went into negative territory after the index attempted to cross above the 1,600-pt round figure over the prior two sessions – this indicates a possible price rejection from the said level. We maintain that the index’s weak trend that started from early July has not reached an end yet. Further supporting this is the fact that the index is trading firmly below both the 200-day SMA and downtrend lines (as drawn on the chart). Towards the downside, at the minimum, we are expecting the immediate support of 1,573 pts to be tested. We keep to our negative trading bias.

Negative bias stays intact; maintain short positions. The FKLI slid 14 pts to close at 1,585.5 pts. The low and high were recorded at 1,585 pts and 1,598 pts. The session went into negative territory after the index attempted to cross above the 1,600-pt round figure over the prior two sessions – this indicates a possible price rejection from the said level. We maintain that the index’s weak trend that started from early July has not reached an end yet. Further supporting this is the fact that the index is trading firmly below both the 200-day SMA and downtrend lines (as drawn on the chart). Towards the downside, at the minimum, we are expecting the immediate support of 1,573 pts to be tested. We keep to our negative trading bias.

As the bulls are still having difficulty to wrest control from the bears, traders are advised to remain in short positions. We initiated these at 1,668 pts, the closing level of 12 Jul. To manage risks, a stop-loss can now be placed above the 1,621.5-pt mark.

We are keeping the immediate support target at 1,573 pts, ie the low of 14 May. Breaking this may see the market test the 1,550-pt mark. Towards the upside, the immediate resistance is pegged at 1,621.5 pts, the high of 9 Aug. This is followed by 1,660.5 pts, the high of 24 Jul.

Source: RHB Securities Research - 22 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024