FKLI - Bulls Have More to Prove

rhboskres

Publish date: Fri, 23 Aug 2019, 04:59 PM

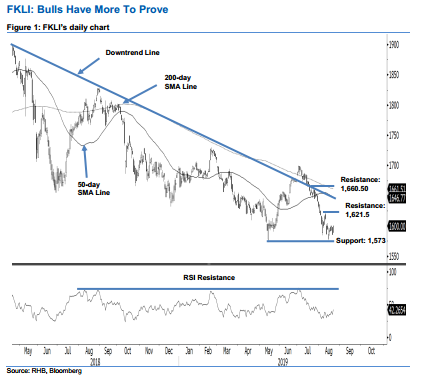

Maintain short positions until signs for a deeper rebound emerges. The FKLI formed a white candle to cease the latest session at the 1,600-pt round figure, indicating a gain of 14.5 pts. The intraday tone was encouraging, as it generally moved higher – the low and high were recorded at 1,588.5 pts and 1,600.5 pts. Based on the daily chart, we are still of the view that the index’s overall weak trend is still firmly in place. We continue to regard the price actions over the past 1-week as a mere minor counter-trend rebound. Towards the upside, for a deeper rebound to develop, the bulls have to cross above the immediate resistance of 1,621.5 pts. For now, we keep to our negative trading bias.

As the daily chart continues to show that the bearish trend is still firmly in place, traders are advised to remain in short positions. We initiated these at 1,668 pts, the closing level of 12 Jul. To manage risks, a stop-loss can now be placed above the 1,621.5-pt mark.

The immediate support is pegged at 1,573 pts, ie the low of 14 May. This is followed by the 1,550-pt mark. Towards the upside, the immediate resistance is pegged at 1,621.5 pts, the high of 9 Aug. This is followed by 1,660.5 pts, the high of 24 Jul.

Source: RHB Securities Research - 23 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024