FCPO - Upward Move Resumes

rhboskres

Publish date: Fri, 23 Aug 2019, 05:00 PM

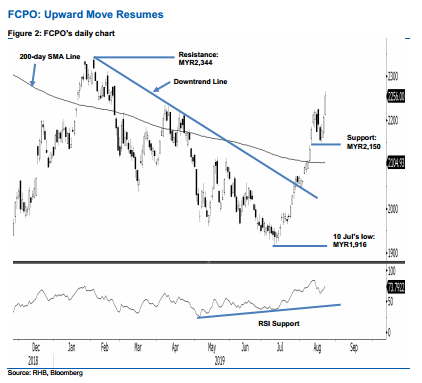

Initiate long positions as the correction phase was shorter than expected. The FCPO performed positively in the latest session. At the closing, it advanced MYR48 to close at MYR2,256. The low and high were recorded at MYR2,211 and MYR2,265. The strong performance saw the commodity cross above the previous immediate resistance of MYR2,235 – suggesting that the correction phase we previously envisaged was narrower and shorter than expected. As such, chances are now higher that the commodity is ready to extend its upward move, that started from the low of MYR1,916 on 10 Jul. Switch to positive trading bias.

Our previous short positions, initiated at MYR2,156 – the closing level of 19 Aug, were closed out at MYR2,235. As the commodity is likely resuming its upward move, we initiate long positions at the latest closing. For risk management purposes, a stop-loss can be placed below the MYR2,150 level.

The immediate support is revised to MYR2,150, the low of 20 Aug. This is followed by MYR2,100, near the 200-day SMA line. Conversely, the immediate resistance is now pegged at MYR2,344, the high of 7 Feb. This is followed by MYR2,400, the next round figure.

Source: RHB Securities Research - 23 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024