COMEX Gold - Bearish Bias Extending

rhboskres

Publish date: Mon, 09 Dec 2019, 05:42 PM

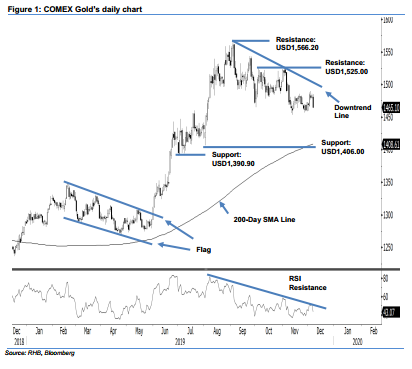

Still trading in a correction phase; maintain short positions. The COMEX Gold formed a black candle to end the latest session lower by USD18 at USD1,465.10. Trading ranged between USD1,463.30 and USD1,485.30. The negative session reinforced our view that the commodity is on the path of extending its multi-month correction phase, which started from the high of USD1,566.20 recorded on 14 Sep. Towards the downside, there is a good possibility for this correction phase to retest the 200-day SMA line, which is also located near the immediate support of USD1,406.00. Maintain our negative trading bias.

As the probability is high that the commodity is resuming its retracement phase, we advise traders to stay in short positions. We initiated these at USD1,464.10, or the closing level of 11 Nov. For risk-management purposes, a stop loss can be placed above the USD1,525.00 threshold.

Immediate support is set at the USD1,406.00 mark, ie near the low of 1 Aug. This is followed by USD1,390.90, or the low of 1 Jul. Moving up, the immediate resistance is set at USD1,525.00 – the high of 3 Oct. This is followed by USD1,566.20, which was the high of 4 Sep.

Source: RHB Securities Research - 9 Dec 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024