RHB Retail Research

Hang Seng Index Futures - Hitting a 5-Month High

rhboskres

Publish date: Mon, 30 Dec 2019, 11:37 AM

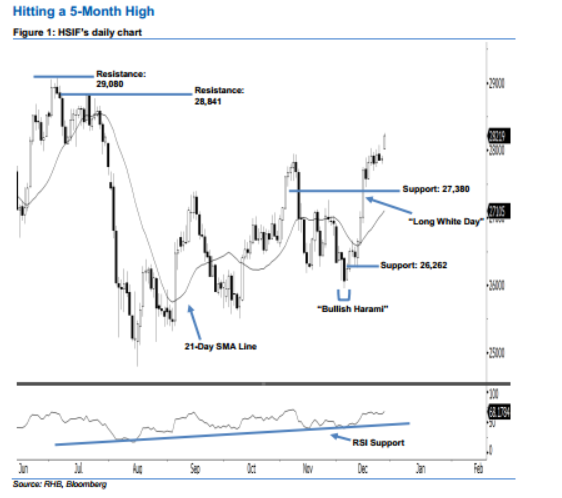

Market hit its 5-month high; maintain long positions. The upward movement of the HSIF continued as expected, as a white candle and an upside gap was formed last Friday. During the intraday session, it rose to a high of 28,258 pts before ending at 28,219 pts for the day. Market sentiment remains bullish, as the index has taken out the previously indicated 28,080-pt resistance and hit its 5-month high. This may also further extend the rebound that started with 5 Dec’s Bullish Harami” pattern. In view that the 21-day SMA line is likely to turn higher, the bullish sentiment has therefore been enhanced.

As seen in the chart, the immediate support level is anticipated at 27,380 pts, ie near the midpoint of 13 Dec’s “Long White Day” candle. Meanwhile, the next support is seen at 26,262 pts, which was the previous low of 11 Dec. To the upside, the immediate resistance level is situated at 28,841 pts, ie the high of 19 Jul. The next resistance would likely be at 29,080 pts, which was the previous high of 4 Jul.

Hence, we advise traders to maintain long positions, given that we initially recommended initiating long above the 26,500-pt level on 12 Dec. A trailing-stop can be set below the 27,380-pt mark in order to secure part of the gains.

Source: RHB Securities Research - 30 Dec 2019

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments