FCPO - Bulls Still In Control

rhboskres

Publish date: Fri, 03 Jan 2020, 05:14 PM

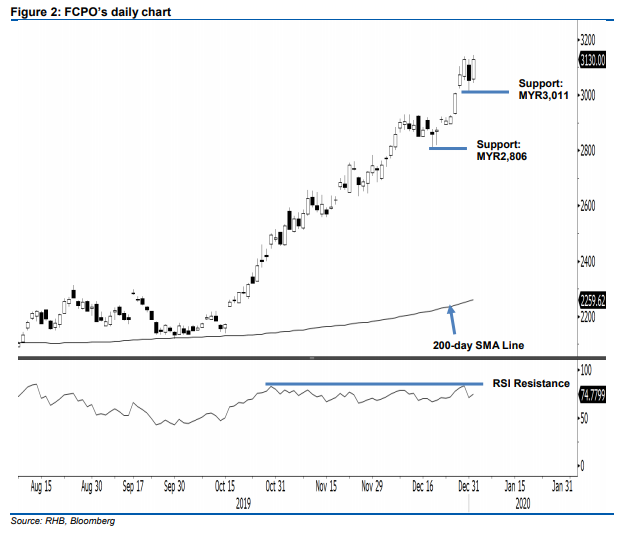

Maintain long positions as there is no negative price reversal signal. The FCPO formed a white candle in the latest session, adding MYR78 to close at MYR3,130. Trading ranged between MYR3,043 and MYR3,144. The positive price action signals no negative price follow-up from the prior session, thus suggesting that the bulls still have firm grip. While the RSI is still in the overbought territory, no price exhaustion price signal has been spotted. The risk for a correction to take place could likely be signalled by the downside breach of the immediate support of MYR3,011. For now, we are keeping our positive trading bias.

As the bulls are still signalling control over the price trend, traders are advised to remain in long positions. These were initiated at MYR2,175, the closing level of 9 Oct. To manage risks, a stop-loss can now be placed below MYR3,011.

The immediate support is set at MYR3,011, the low of 31 Dec 2019. This is followed by MYR2,806, the low of 18 Dec. On the other hand, the immediate resistance level is set at MYR3,202, the high of 19 Dec 2016. This is followed by the psychological level of MYR3,300.

Source: RHB Securities Research - 3 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024