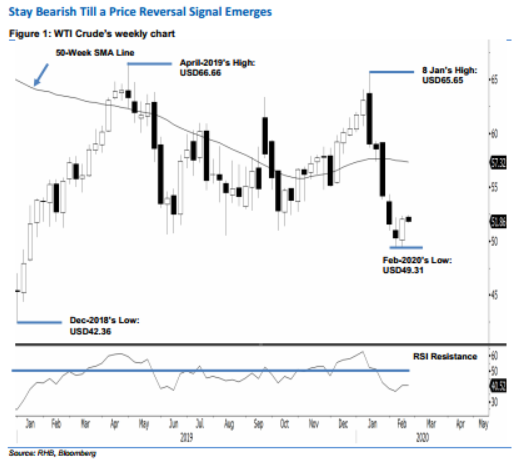

WTI Crude Futures - Stay Bearish Till a Price Reversal Signal Emerges

rhboskres

Publish date: Tue, 18 Feb 2020, 10:55 AM

Maintain short positions until the possible flag formation is confirmed. Today we take a look at the WTI Crude’s weekly chart. After experiencing a multi-month upward move between Dec 2018 and Apr 2019, the black gold has been experiencing a correction phase till now. The price pattern that developed throughout this correction phase now resembles a possible flag formation. The sharp retracement leg – which started from the high of USD65.65 on 8 Jan – reached an extremely oversold RSI reading two weeks ago. This saw prices rebounding. However, to confirm the completion of the possible flag formation, and the commodity’s readiness to stage a rebound – or even a total price reversal – the WTI Crude has to settle above the USD52.29 immediate resistance. Until then, we are holding on to our negative trading bias.

In the absence of the possible flag formation’s confirmation, we advise traders to stay in short positions. These were initiated at USD59.61, or the closing level of 8 Jan. To manage the risk, a stop-loss can now be placed above the USD52.29 level.

The immediate support is set at USD51.30, which was derived from 13 Feb’s candle. This is followed by USD50.30, or 12 Feb’s candle. Conversely, the immediate resistance is set at USD52.29, or 1 Feb’s candle. This is followed by USD53.50, which was derived from 29 Jan’s candle.

Source: RHB Securities Research - 18 Feb 2020

![[MQ Raya Campaign 2022] Guideline of Joining the Campaign | Let's Join Now!!!](https://mqac.i3investor.com/img/video_thumbnail/433/thumbnail.jpg)