Malaysia's Market Outlook

RicheHo

Publish date: Tue, 11 Aug 2015, 08:53 AM

Today (10-08-2015) was another terrible day for Malaysia’s stock market. KLSE index had dropped another 28.28 points to 1,654.37 levels. FYI, last Monday KLSE index was still at the 1,744.19 levels. It means the market had dropped 89.82 points which equivalent to 5.15% in a week time! It had breached the support level of 1,670 and things will get even worse!! Foreign funds are retreating from Malaysia market very quickly and they had net sold for 15 week continuously!

What is happening? I believe all investors have the obligation to know the current outlook for Malaysia market and take it seriously. It is not as optimistic as you think.

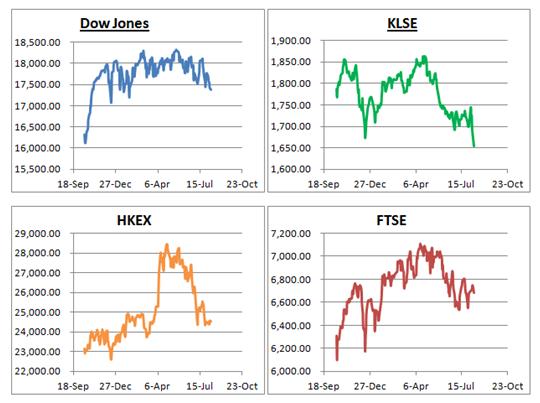

Firstly, let’s have a look at Malaysia and the world major index.

World Indices

Dow Jones had started to move at the opposite direction since it breached 1,800 levels on 21st July. It had dropped 7 days continuously! FTSE and Hang Seng index are also at the down trend. However, they are not as worse as KLSE index.

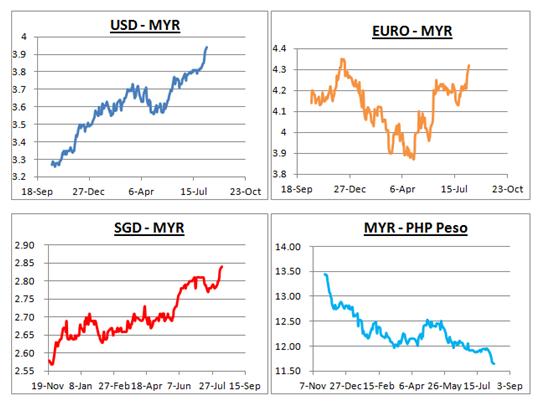

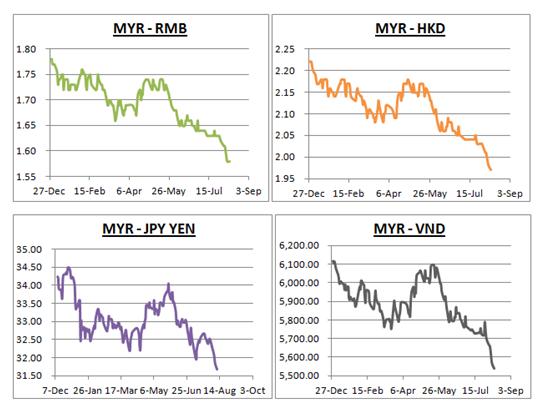

Secondly, let’s look at the Currency chart. Malaysia Ringgit (“MYR”) started to depreciate since a year ago and MYR is the worst currency in South East Asia! Sooner, MYR might be a piece of paper, become valueless. FYI, MYR and SGD are at the same level when Singapore was no longer a part of Malaysia, but until today SGD1.00 dollar equivalent to MYR2.84!

Currency

From the chart above, we can clearly see that MYR is creating new low and it seems like it will still go further down. As at 31st July, USDMYR was still at the level of 3.82 but as at today it had dropped to 3.94! It was only 10 days time! By using MYR as our principal currency, our net worth is decreasing from day to day even though we done nothing! How are we going to go for oversea vacation?

That’s the reason why there is getting more and more people who going to work at oversea especially Singapore. Malaysia foreign currency reserve was left only USD9.67 billion as at 31st July, the lowest among the past 5 years! ! However, our currency is still not the worse yet. US very very likely will hike their interest by end of this year or the latest beginning of next year. Foreign fund will move back to US and subsequently affect Malaysia market. MYR will continue to depreciate to further low by that time.

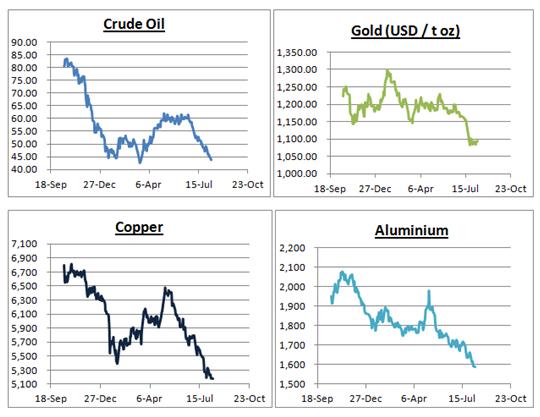

Thirdly is the world commodity price. Crude oil price had once again dropped to the support level of USD43/barrel. Will it continue to drop further? I had no idea.

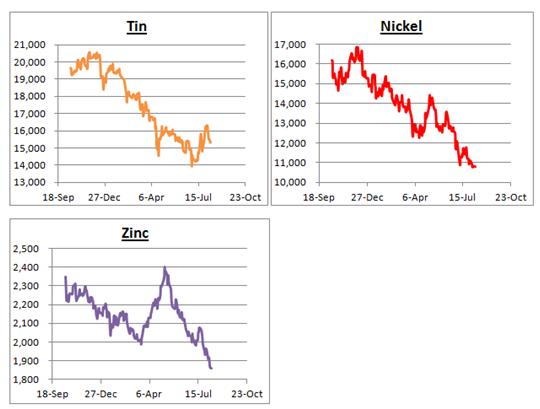

Commodity

As we can see from above, the commodity and metal price are also dropping to a new low. Years ago, most of the people will buy gold to hedge their wealth, but we need to accept the fact that Gold is no longer a secure product today! It was a historical new low for Gold! The commodity price was also dropping like nobody else.

Back to Malaysia, Fitch Rating mentioned that implementation of GST and removal of subsidize of petrol price will increase government earnings every year. This is two of the reasons why they revised our rating from A- rating with negative outlook to stable. Implementation of GST might be good for long term but I totally not agree with the removal of subsidize of petrol price. Government always claimed that our petrol price is much lower compare to other South East Asia countries. However, we need to remember that Malaysia is one the major crude oil extraction country in Asia and the country income is mainly depends on crude oil, while other South East Asia countries are purchasing from other countries. It is non-comparable!

Besides that, Malaysia national debt had already up to MYR680+ billion. FYI, during our former 5th prime minister, Malaysia national debt was only at around MYR350+ billion.

In Malaysia, there are too many negative issues surrounded and we don’t even have a positive catalyst to boast our market up. Malaysia politics and 1MDB issues are also one of the main factors. With all the inner and outer facts above, I believe bear market is already not far from us. To be honest, there might be another economy crisis. The truth is Malaysia economic had started to slow down and moving backward. Do more research by yourself rather than totally believe in those economists and investment bank words. They are being too optimistic. Just my 2 cents opinion

Overall, as a Malaysian, I am truly sad and disappointed.

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Good morning,

Behind every cloud there is a silver lining.

The crash of the ringgit has positive side effects:

1) It makes Malaysian goods cheaper in world markets - thus capturing world market share. The seed for World Class Companies from Malaysia is sown!

2) It makes Malaysia an ideal nation for tourists. When Dragi devalued the Euro Americans made a beeline to Europe for their holidays.

3) The state of Johor will benefit from an influx of Sporean shoppers and tourists. All those Johoreans who worked in Spore will also bring back more cash to Johore with such Strong Sing Dollar. So invest in Johor landed houses.

Plus now is still the best time to buy these houses in Johore as they are still relatively Very Cheap compared to Kl

Eg. A low cost house with freehold title 2 rooms 1 bath sells for rm70k in kota masai, johor. A similar low cost house with leasehold title in tmn bukit anggerik, cheras, kl sells for rm320k - more than 400% higher than Johor.

You can still get a single storey 3 rooms 2 baths hse in Johor at below Rm200k and a 2 storey 4 rooms 3 baths house for less than Rm300k right now in Johor!

So there are oppotunities everywhere in Malaysia if you know where to look.

So investing opportunity is always there. The smart ones always find ways to invest.

Regards,

Calvin Tan Research

Jurong West Singapore

Note: With fallen ringgit Malaysia should step up effort to lure retirees from all over the world to retire in Malaysia by My 2nd Home Program. This will further boost the economy of Malaysia.

Malaysia is already the Top no. 4 for world retiree now. And with the crash of ringgit Malaysia will rise up to be World Champoin no.1

2015-08-12 05:06

One more thing. China just devalued its yuan by 2% against the US Dollar.

People say when US raise interest rates more funds will leave Emerging markets and go back to USA. For what purpose?

A strong US Dollar is detrimental to US exports. They cannot compete.

It is also bad for US multinational companies operating all over the world. Translated to Us currency their profits will be reduced greatly.

So it will be very bad for US Economy.

And Yellen raise interest rate some more? US will just die faster. Imagine someone is drowning and you take the life jacket away? Can you see the picture?

So it is suicidal for Yellen to raise interest rate now.

2015-08-12 05:21

A few month a ago, Malaysia are talking about under-valued Ringgit... but I think it is better to buy over-valued US$... ha ha ha

2015-08-12 11:04

johnny cash

already time for JIBBY to step down

2015-08-11 13:39