Road to Success

KLSE Index-Linked Stocks

RicheHo

Publish date: Mon, 17 Aug 2015, 10:46 PM

Today (17th August 2015), KLCI dropped another 24.28 points to 1,572.54, the lowest since July 2012. 149 gainers and 836 losers

August was a terrific month for all the investors! Within 11 working days in August, KLCI index had dropped 150.60 points from 1,723.14 to 1,572.54, which is equivalent to 8.74%! That was a disaster! Our market took 2 years to up from 1,600 (July 2012) to 1,895 (July 2014), 295 points, while it took only half month to drop 150 points! So, where will be the bottom for this crisis? I don’t know.

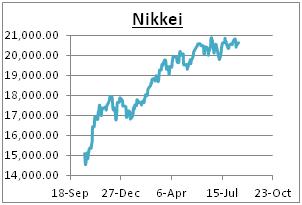

Have a look with the difference between Japan market (Nikkei) and Malaysia market (KLSE). Nikkei was in a super bull trend since Sept 2014 while Malaysia was in a bear trend. The chart tells everything. It was not easy to earn money in Malaysia market!

Since KLSE was so low now, a crisis might be an opportunity for investors to collect too. Imagine one day KLSE index back to the level of 1,800 or higher, what will be the potential stocks to earn a great return? One of the counters will be KLSE index linked stocks.

As we know that the market sentiment is bad, banking sector and O&G sector was oversold. The top 5 losers within this month were SKPETRO, ASTRO, TENAGA, HLFG and GENTING. SKPETRO was O&G counter, but drop of 30% is really very terrific! TENAGA was involved in 1MDB issues. HLFG belong to banking sector. GENTING Singapore subsidiary quarter report was bad, heavy drop in revenue and hence it affected GENTING.

However, MISC was surprisingly strong. It was the only stock that went against the market. It gained 2.44% due to the good quarter result.

I heard many people want to start collecting GENTING. It might be a good time too as next year is the completion of FOX century theme park. There won’t always have MEGA sales in stocks market. So, every investor should take this opportunity to collect cheap good fundamental counter. Once you miss this opportunity, I guess you need to wait at least another 5 years.

But, the question is do you have extra bullet to collect during this hard time?

|

Stocks

|

Sector

|

17-Aug

|

31-Jul

|

Changes

|

|

|

1

|

SKPETRO

|

Trading Services

|

1.71

|

2.45

|

-30.20%

|

|

2

|

ASTRO

|

Trading Services

|

2.86

|

3.37

|

-15.13%

|

|

3

|

TENAGA

|

Trading Services

|

10.40

|

12.20

|

-14.75%

|

|

4

|

HLFG

|

Finance

|

13.82

|

15.86

|

-12.86%

|

|

5

|

GENTING

|

Trading Services

|

7.14

|

8.14

|

-12.29%

|

|

6

|

AMBANK

|

Finance

|

4.93

|

5.59

|

-11.81%

|

|

7

|

RHBCAP

|

Finance

|

6.58

|

7.43

|

-11.44%

|

|

8

|

BAT

|

Consumer Products

|

59.86

|

67.50

|

-11.32%

|

|

9

|

MAYBANK

|

Finance

|

8.19

|

9.20

|

-10.98%

|

|

10

|

UMW

|

Consumer Products

|

8.99

|

10.00

|

-10.10%

|

|

11

|

AXIATA

|

Trading Services

|

5.73

|

6.37

|

-10.05%

|

|

12

|

SIME

|

Trading Services

|

7.90

|

8.72

|

-9.40%

|

|

13

|

CIMB

|

Finance

|

4.90

|

5.38

|

-8.92%

|

|

14

|

PCHEM

|

Industrial Products

|

5.84

|

6.41

|

-8.89%

|

|

15

|

DIGI

|

IPC

|

4.93

|

5.40

|

-8.70%

|

|

16

|

GENM

|

Trading Services

|

3.94

|

4.27

|

-7.73%

|

|

17

|

KLK

|

Plantation

|

20.42

|

22.00

|

-7.18%

|

|

18

|

IOICORP

|

Plantation

|

3.94

|

4.24

|

-7.08%

|

|

19

|

YTL

|

Trading Services

|

1.47

|

1.58

|

-6.96%

|

|

20

|

HLBANK

|

Finance

|

12.80

|

13.58

|

-5.74%

|

|

21

|

TM

|

Trading Services

|

6.18

|

6.55

|

-5.65%

|

|

22

|

PBBANK

|

Finance

|

17.98

|

19.00

|

-5.37%

|

|

23

|

IHH

|

Trading Services

|

5.69

|

6.01

|

-5.32%

|

|

24

|

PPB

|

Consumer Products

|

14.66

|

15.44

|

-5.05%

|

|

25

|

PETDAG

|

Trading Services

|

20.06

|

21.08

|

-4.84%

|

|

26

|

MAXIS

|

Trading Services

|

6.35

|

6.67

|

-4.80%

|

|

27

|

PETGAS

|

Industrial Products

|

21.06

|

22.08

|

-4.62%

|

|

28

|

KLCC

|

REITs

|

6.90

|

7.09

|

-2.68%

|

|

29

|

WPRTS

|

Trading Services

|

3.95

|

4.01

|

-1.50%

|

|

30

|

MISC

|

Trading Services

|

7.99

|

7.80

|

2.44%

|

Just for sharing.

http://rhinvest.blogspot.com/2015/08/klse-index-linked-stocks.html

More articles on Road to Success

(RICHE HO ) Y.S.P. Southeast Asia - Boring Counter with Strong Track Record

Created by RicheHo | Mar 18, 2017

(RICHE HO) Latitude Tree Holdings Berhad - Earnings Recovery in FY17

Created by RicheHo | Feb 19, 2017

(RICHE HO) Ajiya Berhad - Green IBS Provider, Benefited from PR1MA project

Created by RicheHo | Feb 16, 2017

(RICHE HO) Benalec Holdings Berhad - Strong Earnings from Tanjung Piai & Pengerang MIP

Created by RicheHo | Jan 08, 2017

Hiu Chee Keong

any index link product that trade on BSKL ?

2015-08-18 08:07