(RICHE HO) Homeritz - Home ERITZ

RicheHo

Publish date: Mon, 05 Oct 2015, 09:57 PM

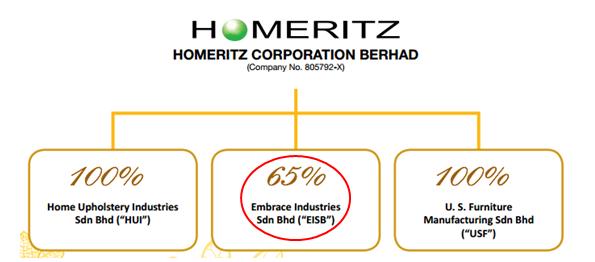

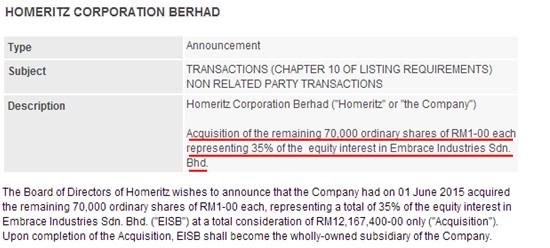

*On June 2015, HOMERIZ had acquired the remaining 35% of EISB and EISB had become HOMERIZ wholly-owned subsidiary

Principal activities

Ø Design, manufacture and sale of upholstery furniture products, comprising leather and fabric-based sofas, dining chairs and bed frames

Ø Has a diverse customer base spanning across more than 40 countries, including Europe, Australia, New Zealand, North and South America, etc.

Ø HOMERIZ own brand of lifestyle furniture series under “Eritz”

Financial Highlights

|

REVENUE RM'000 |

|||||

|

Year/ Quarter |

2011 |

2012 |

2013 |

2014 |

2015 |

|

1 |

24,459 |

26,863 |

25,028 |

35,687 |

33,365 |

|

2 |

19,477 |

24,485 |

23,512 |

28,641 |

37,848 |

|

3 |

20,107 |

23,121 |

28,391 |

29,611 |

37,094 |

|

4 |

25,783 |

28,777 |

35,974 |

33,237 |

|

|

89,826 |

103,246 |

112,905 |

127,176 |

108,307 |

|

|

NET PROFIT RM'000 |

|||||

|

Year/ Quarter |

2011 |

2012 |

2013 |

2014 |

2015 |

|

1 |

3,439 |

3,174 |

2,827 |

5,792 |

4,261 |

|

2 |

1,702 |

2,860 |

2,214 |

4,611 |

6,562 |

|

3 |

1,756 |

2,977 |

3,127 |

4,652 |

6,087 |

|

4 |

3,914 |

5,689 |

6,950 |

5,192 |

|

|

10,811 |

14,700 |

15,118 |

20,247 |

16,910 |

|

From FY11 to FY14, HOMERIZ revenue had a compound annual growth rate (“CAGR”) of 12.29% while its net profit had a CAGR of 23.26%! Based on the FY15 first three quarters, HOMERIZ revenue and net profit are very likely to achieve a new high.

The excellent financial results are probably because of higher sales volume and strengthening of USD.

|

Year |

2011 |

2012 |

2013 |

2014 |

2015* |

|

Net borrowings, RM’000 |

4,565 |

3,021 |

2,672 |

2,306 |

2,008 |

|

Free cash flow, RM |

11,705 |

24,471 |

34,710 |

51,585 |

50,415 |

|

Net cash, RM |

7,140 |

21,450 |

32,038 |

49,280 |

48,407 |

*as at 31 May 2015

HOMERIZ net cash on hand had increased 7 times from 2011 to 2014! It is definitely a cash rich company with almost MYR50m on hand. It totally reflects HOMERIZ financial strength. Cash is king during hard time.

Company Highlight

June 2015

Ø Acquisition of the remaining 35% of equity interest in Embrace Industries Sdn. Bhd. for MYR12.17m

July 2015

Ø Bonus issue 1:2 with free warrants on the basis of 1:4

Ø Acquisition of an agriculture land at Johor for MYR7.68m

Weakening Of MYR

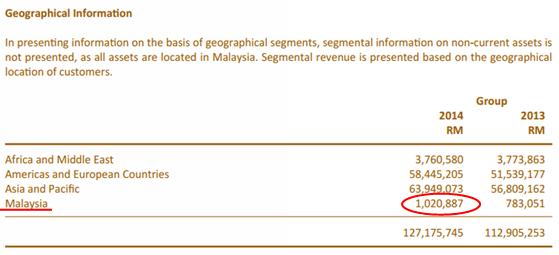

Based on the geographical information, only 0.8% of HOMERIZ revenue is from Malaysia while 99.2% are exported out to other countries!

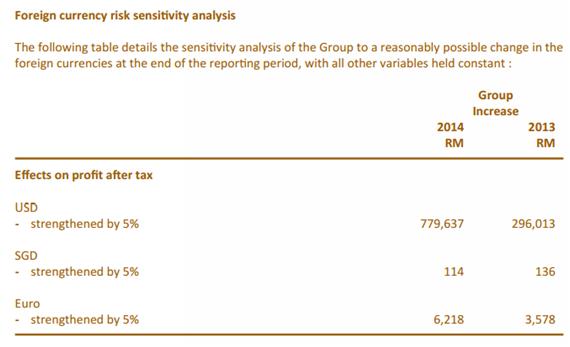

Weakening of MYR against USD, SGD and Euro will benefit HOMERIZ! So far, MYR had depreciated about 22% against USD. That’s mean if other factors remain constant, theoretically HOMERIZ will have extra MYR3m+! That’s a lot!

Expansion Plan

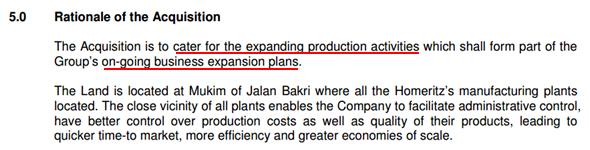

On July 2015, HOMERIZ had acquired a piece of land at Johor for MYR7.68m whereby its existing manufacturing plants are located at the same place too. To expand its business. HOMERITZ had proposed to establish a factory on the land.

Definitely, this will be a good news for HOMERIZ even though it was just the first stage. With almost MYR50m cash on hand, HOMERIZ can easily make internal funding and borrowing for this new factory.

Since the land had been acquired, there should be no obstacle for HOMERIZ to set up the new factory. By the time the factory establishes, HOMERIZ production capacity will also increase.

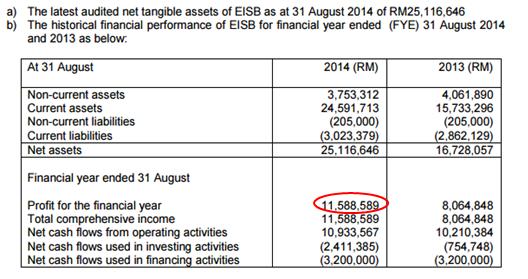

Acquisition of Remaining Interest in EISB

On June 2015, Homeritz had acquired the remaining 35% of the equity interest in Embrace Industries Sdn. Bhd.

That’s mean upon completion, EISB will become wholly-owned companies of HOMERIZ. EISB total net profit will fully contribute to EISB and no longer with 65% only.

On FY14, EISB net profit was MYR11.6m.

Let’s assume EISB net profit for FY15 is MYR13m. An additional 35% profit will contribute additional MYR4.5m to HOMERIZ financial result! It is equivalent to additional MYR1m+ net profit a quarter!

The acquisiton had completed on September. HOMERIZ upcoming quarter result is expected to achieve higher!

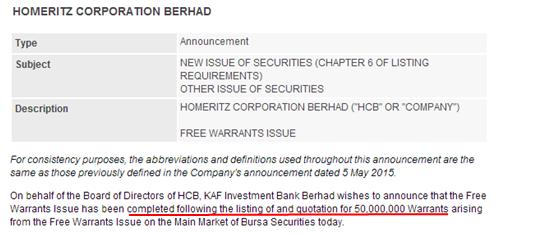

Dilution of Earnings

On July 2015, HOMERIZ had issued 50m warrants,HOMERIZ-WA 2015/2020, to the market.

If the warrant is in-the-money, it is possible that every single warrants will be exercise. If this situation happens, HOMERIZ will need to issue another 50m ordinary shares to the market. By that time, HOMERIZ outstanding shares will be 350m!

In the words, originally a grand prize is shared by 30 person, but now it needs to be share by 35 person! The portion that a person get definitely will be smaller compared to previously.

Price Estimation

HOMERIZ cash flow on year 2013 was MYR18.6m while on year 2014 was MYR29.6m, equivalent to increase of 28%. To recall again, HOMERIZ net profit CAGR for the past three years was 23.26%. For a pessimistic scenario, operating cash flow of MYR30m will be used in year 1 and CAGR of only 5% will be used! Since the Beta for HOMERIZ is 1.26, interest rate of 7% will be used.

Discount Cash Flow (“DCF”) model

|

Interest rate |

7% |

|||||||||

|

Year |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

Est. OCF |

30,000 |

31,500 |

33,075 |

34,729 |

36,465 |

38,288 |

40,203 |

42,213 |

44,324 |

558,478 |

|

0.935 |

0.873 |

0.816 |

0.763 |

0.713 |

0.666 |

0.623 |

0.582 |

0.544 |

0.508 |

|

|

28,037 |

27,513 |

26,999 |

26,494 |

25,999 |

25,513 |

25,036 |

24,568 |

24,109 |

283,902 |

*since we can’t take forever cash flow into account, so assumption of HOMERIZ will only sustain for another 12 years after year 10 will be taken.

|

Total, MYR’000 |

518,172 |

|

(divided) Number of shares, ‘000 |

300,000 |

|

Value per share, MYR |

1.35 |

PE estimation

On next financial year, EISB revenue will 100% contribute to HOMERIZ financial result.

USD will continue to strengthen since FED is likely to hike interest rate soon.

All the factors are positive to HOMERIZ, so its future earnings are estimated as below:

|

Est. net profit, MYR’000 |

|

||

|

Q1 |

6,500 |

|

|

|

Q2 |

7,000 |

|

|

|

Q3 |

7,500 |

|

|

|

Q4 |

8,000 |

|

|

|

29,000 |

|

||

|

|

|||

|

Est. EPS |

0.10 |

|

|

|

Est. PE |

10 |

12 |

15 |

|

Est. Price |

0.97 |

1.16 |

1.45 |

Technical Chart

To make it simplify, only candlesticks and RSI indicator will used. HOMERIZ had a strong resistance line at MYR1.01 and a strong support line at MYR0.90.

Currently, HOMERIZ is moving side way and retests the resistance line. It is an uncertainty whether it will break through or continue moving side way.

However, if HOMERIZ is able to break through the resistance line, the buy in signal will be form. HOMERIZ will move up to another price region.

I will be writing some stock analysis report to earn some pocket money.

I will be writing 5 stock analysis reports and 1 comparison of same industry company report a month for a fee of MYR120/month. It will be a simple, easy to read and understandable report. It had included fundamental and also technical analysis.

For full sample report of HOMERITZ, you may download and have a look, as below:

https://www.dropbox.com/s/8b5nlfg9l5i4fm0/Homeritz%2001%2010%202015.pdf?dl=0

You may also refer some of my articles as below:

1. Export-Oriented Company Not Necessarily Benefit From Weakening Of MYR --> Tongher

http://klse.i3investor.com/blogs/rhinvest/82431.jsp

2. How to Spot Unfavourable Factors of a Company? --> AYS

http://klse.i3investor.com/blogs/rhinvest/81543.jsp

3. Consistently Profit Making Company Not Necessarily Is Good --> London Biscuit

http://klse.i3investor.com/blogs/rhinvest/82368.jsp

4. The Art Of Investing – How To Survive During Market Downturn

http://klse.i3investor.com/blogs/rhinvest/82564.jsp

In addition, you may request to carry out a research on a specific company that you wish to know, for a fee of MYR25/report. For those who subscribe monthly, there will be no extra charges.

For those who are interested, you may contact me at richeho_92@hotmail.com or 016-9392726. Or you may leave your email below, so that I can contact you.

Thanks!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Sifu paperplane, why did you say cycle almost finish? Based on what? Big+old timer gut feeling? :) Appreciate if you could share your reasonings. Tq.

2015-10-06 22:55

Hi RicheHo, just wonder why are you using CFFO instead of FCF in your DCF analysis? I think FCF would be more appropriate coz it is the only real cash going into shareholders' pocket.

And may i know what is your rationale for the discount rate of 7%? To me, 7% is quite optimistic. I would use 9% instead (4% fd + 6% bursa risk - 1% its outstanding earning & balance sheet).

Are you using one stage constant growth model @ growth rate 5%?

Did you consider its cash and debt as well?

Thank you.

2015-10-07 02:31

My DCF is based on FCF. Start from average 6 years FCF (~15mil),

Assume growth rate 6% for 1st 10 years only, then 3% terminal growth after 10 years. (6% calculated from reinvestment rate & ROIC)

Assume discount rate of 9%

Consider its cash @ 50mil & debt @ 2mil

Intrinsic value about RM1.23.

Appreciate your comments.

2015-10-07 02:37

Hi chl1989, yeap you are right. I was wrong in the DCF model. Hahaha.

Regarding the interest rate of 7%, it was because I read a book and it listed down the interest rate that we should used for each BETA.

Btw, can you teach me how to find FCF in this case? How you get 15m? What to do with the cash and debt?

Thanks and appreciate if you willing to share with me hehe.

2015-10-07 08:45

Hi RicheHo and chl1989 could we make a friend? If interested, kindly text me through bosx8989@gmail.com. Nice to meet you guys ya!

2015-10-18 08:35

Hi RicheHo, you can subscribe to kcchongnz online financial course to learn FCF, I can assure you will get more than what you bargain for. He is an unselfish and fantastic teacher.

2015-10-18 09:29

backspacei3

good

2015-10-05 22:21