(RICHE HO) Nylex (M) Berhad

RicheHo

Publish date: Tue, 19 Jan 2016, 11:43 AM

Recently, calvintanteng had been recommending NYLEX aggressively in his recent 3 posts. So, I had looked into it and would like to share with others on this.

Nylex (Malaysia) Berhad (“NYLEX”)

NYLEX is a public limited liability company, incorporated and domiciled in Malaysia and listed on the Main Market of Bursa Malaysia in year 1990.

It is principally involved in two main business segments:

- Polymer – Manufacture and marketing of polyurethane and vinyl-coated fabrics, calendered film and sheeting, and other plastic products, including geotextiles and prefabricated sub-soil drainage systems, and rotomoulded plastic products.

- Industrial Chemical - Trading, manufacture and sale of petrochemicals and industrial chemical products.

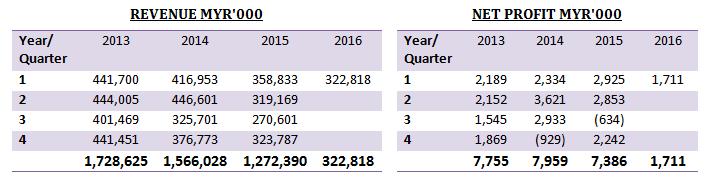

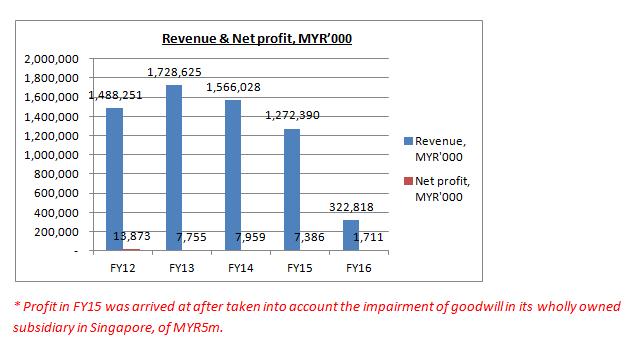

Financial Performance

NYLEX’s 90% revenue contribution is mainly from industrial chemical division whereas 10% is from polymer division.

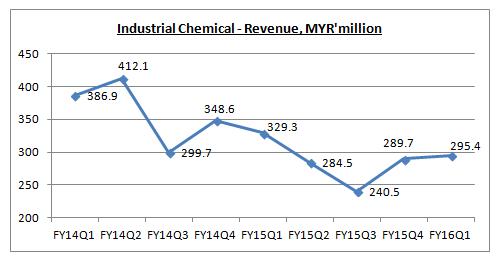

Industrial Chemical

NYLEX industrial chemical products was included phosphoric acid, ethanol, sealants and adhesive products.

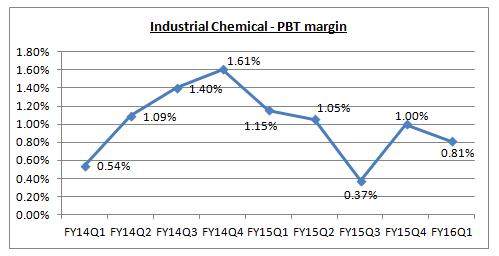

Its revenue had been trending down since FY14 and it was mainly due to lower selling prices for most of its products, following the steep decline in crude oil prices.

In term of net profit, industrial chemical division is only contributed 57%, while polymer division contributed another 43% in FY14. The industrial chemical profit margin is averagely 1.00% only! This business is mainly depends on quantity sold and it is not profitable at all. Once its revenue drops, basically its net profit will drop as well.

Other than that, in Jan 2015, NYLEX had entered into a shipbuilding contract for the construction and purchase of a 6,800 dwt chemical tanker for about MYR60m. The delivery of the vessel is expected to take place in the first half of year 2017.

This acquisition will enable NYLEX to own and operate the vessel and thus reduce dependence on chartering the vessel from third parties, to enhance the business growth plan.

Polymer

NYLEX main business units are films and coated fabrics, geosynthetic drainage products and rotomould.

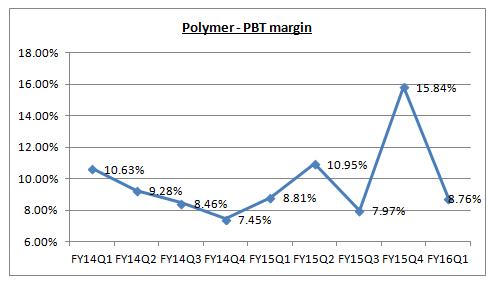

Basically, the profit margin for this division is averagely around 9%. Currently, NYLEX had expanded its market in Indonesia through PT Nylex Indonesia.

Its business in Indonesia had been doing greater with increase in revenue. With the completion of the new Surabaya Plant in 1st quarter of year 2015, NYLEX had established a stronger presence in Indonesia. Its growth was mostly in the secondary automotive sector where it supplies high quality vinyl for car retrims.

Initially, the management is expecting a better return on investment in year 2015, but in fact NYLEX financial performance in FY15 is still average only. It was due to weakening in consumer demand.

It had also met stiffer competition in the PVC sheeting market.

Financial Strength

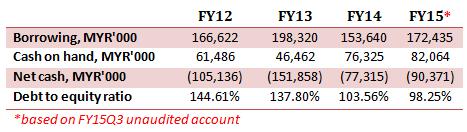

NYLEX debt to equity ratio had dropped for 3 years consecutively, to current 98.25%. It is still above industry standard of 50%. Besides, NYLEX is still in a negative cash position.

Overall, NYLEX’s financial strength is considered below average.

Shares Buy Back

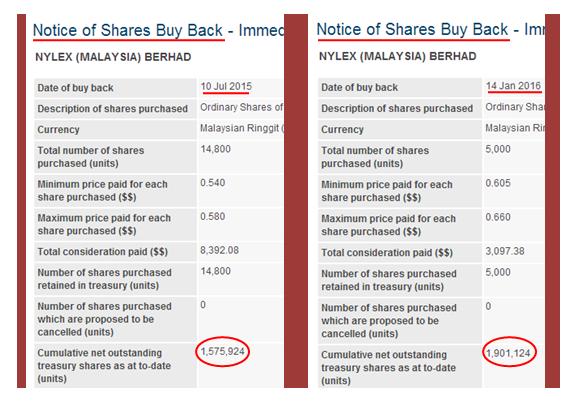

From 10 Jul 2015 to 14 Jan 2016, NYLEX had bought back 325,200 shares from open market, which equivalent to 0.17% of total paid up share capital. It is total of 59 rounds of shares buy back by the Company!

Technical Analysis

Based on technical, NYLEX had surged up in last few days, with a huge increase in volume.

Currently, it had touched its strong resistance line and seems likely to break soon. A breakout above this resistance line will lead NYLEX to test 0.68 followed by 0.72.

Conclusion

NYLEX had net tangible assets (“NTA”) of MYR1.65 per share. With its share price of MYR0.645, NYLEX currently traded 61% below its NTA. In term of net assets, in no doubt, NYLEX is deeply undervalued. NYLEX share price doesn’t reflect the net assets held by the company.

However, in term of earnings power, NYLEX doesn’t seem to be undervalued.

Let’s assume NYLEX is able to deliver MYR10m in a full financial year. With its 192.74m outstanding shares, its earnings per share (“EPS”) will be 5.19 cent. With an estimated PE of 12x, NYLEX is only worth MYR0.62.

A company’s earnings power will be my first consideration, rather than its net asset. A high NTA company doesn’t mean its shares price will move up. One of the good examples is INSAS. But, a high earnings power company will definitely pull up its share price one day.

Overall, NYLEX business profit margin is very low. Even though it had plenty of assets, it doesn’t generate enough profit by using its assets. Many investors had been saying a huge drop in crude oil will benefit NYLEX. In fact, crude oil had been dropped from USD100+/barrel to USD30/barrel over the past 1 and a half year, but NYLEX past 3 quarters financial result doesn’t seems to be benefited.

NYLEX’s FY16Q2 quarter report will be released by end of Jan 2016. I believe it will not have any surprise result.

Having said so, technically NYLEX is still trending up with momentum, with an increase in volume. It is a stock with momentum now.

Whether to put in your money or not, it depends whether you are FA investor or TA investor.

Just for sharing.

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

I will send you one or two samples of my report, for your reference.

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Yes, Warren Buffet said that looking at the past quarter result is like looking into the car's rear view mirror.

You must remember that NYLEX's competitors from China. Sales were weak due to fierce competition.

Now there are 2 factors you MUST SEE AHEAD.

1) RINGGIT HAS CRASHED AGAINST RENMINBI.

So many Chinese Nationals working in Malaysia are planning to leave as Ringgit has Fallen by 20% against Yuan

2) MALAYSIA (NOT CHINA) IS IN TPP

That's a Bonus for NYLEX

2016-01-19 11:52

another company that hit badly by high debt :) high NTA with low earning meaning it has very low ROA and then likely translate to low ROE... not sure if it has the same business like luxchem... If they are in the same model, i believe the latter is ahead of nylex 99 streets :)

2016-01-19 12:40

RicheHo, good and honest opinion of Nylex. That's what we need. Too much of a hard sell raises questions and suspicions? Hissyu2, you hit the nail on the head.

2016-01-19 15:56

Riche Ho vs Calvin..., everything will be known when next quarter earnings released

2016-01-19 19:45

Congrats RicheHo..

U are very lucky to get paperplane2016's compliment.

He seldom praise people one. So far he only praise Calvintaneng and you only. Think this year u will huat very big.

Happy Chinese new year

2016-02-02 13:15

shellhouse

I concur with your honest analysis. Despite plenty forumers promoting, im not convinced with the same reasons mentioned above

2016-01-19 11:46