(RICHE HO) Pantech Group Holdings Berhad

RicheHo

Publish date: Tue, 26 Jan 2016, 02:33 PM

After reading an article post by "fast" on PANTECH (http://klse.i3investor.com/blogs/sharebuyback/90351.jsp), I would like to share my research and point of view on this company.

Pantech Group Holdings Berhad (“PANTECH”)

PANTECH initially started business as a partnership in year 1987 under the name Pantech Hardware and Machinery Trading, supplying industrial hardware and machinery in the southern region of Peninsular Malaysia. In year 1988, the partnership was converted to a private limited company.

In early 1990s, PANTECH grew rapidly supplying pipes, fittings, flanges, valves and other pipe-related components such as gaskets and fasteners. In year 1998, PANTECH changed its name to Pantech Corporation Sdn Bhd to better reflect the company's business and its evolution time. In Feb 2007, it was successfully listed main market of Bursa Malaysia as Pantech Group Holdings Berhad.

Currently, PANTECH is a leading One-Stop Centre for piping products in Malaysia.

PANTECH’s business can be divided into two segments:

- Trading, supply and stocking of specialized steel pipes and related products

- Manufacturing and supply of butt-welded carbon steel fittings and related products

Financial Performance

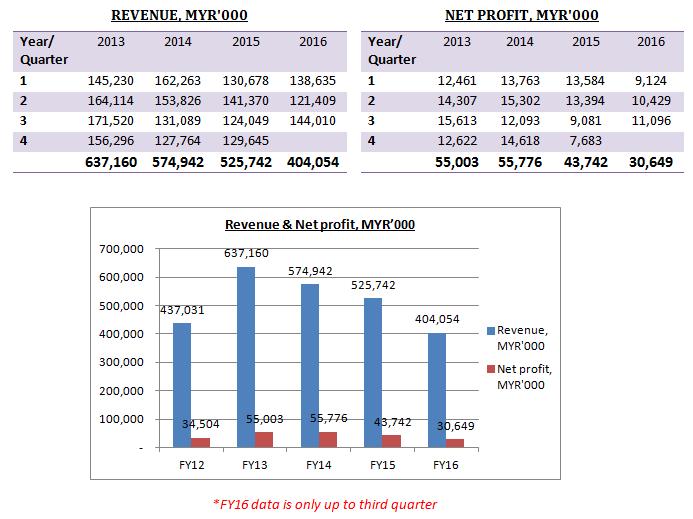

As we can seen from above, PANTECH’s revenue and net profit had been in a declining form since FY13 and it had dropped for 3 years consecutively.

Under a haze of economic uncertainties, the crude oil price had fell sharply in year 2014 and 2015 with prices falling from USD114/barrel on June 2014 to USD30 per barrel on Jan 2016. With a sharp decline of almost 74% in price, investment in oil and gas projects decelerated. This in turn, led to a weaker local sales demand, especially from the local oil and gas sector and affected PANTECH business.

Besides, the dropped in financial performance was also due to lower export sales of stainless steel pipes.

PANTECH profit margin was squeezed lower by higher cost of doing business where operating costs rose and a more competitive business environment.

FYI, revenue contribution from the trading and manufacturing divisions was 57:43 in year 2015.

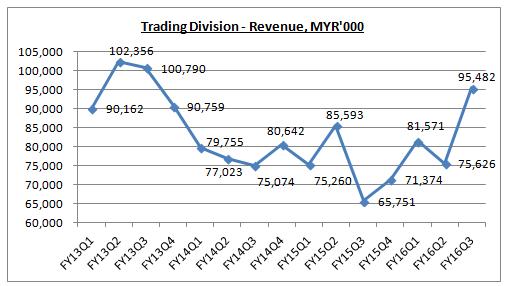

PANTECH revenue from trading division had shown recovery in FY16, contributed by an increase demand in downstream oil and gas projects, namely RAPID.

The project in the Refinery and Petrochemical Integrated Development (“RAPID”) in Pengerang is an USD5m initial take-off order for PANTECH. In order to support this project and future wins, PANTECH had acquired a four-acre land near Sungai Rengit, which is located just next to RAPID, for MYR3m. This new site will enable PANTECH to capitalize on urgent orders and accommodate the demanding turnaround time.

PANTECH is working hard to secure further contracts within the RAPID project, and is upbeat on the opportunities available. This project had now become its main focus.

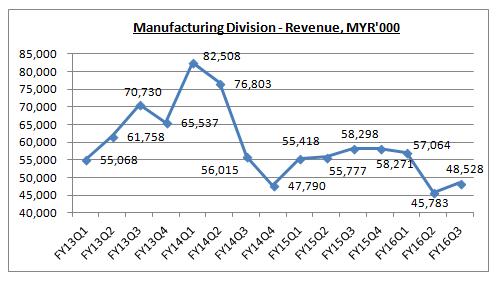

In manufacturing division, its revenue contributed from this division was getting weaker. In the latest two quarters, PANTECH delivered less than MYR50m revenue from this division. It was due to decrease in global sales demand.

FYI, the revenue contribution from PANTECH manufacturing entities in Malaysia and the United Kingdom was 80% and 20% respectively.

All three manufacturing plants of PANTECH have maintained their capacity at 21,000, 14,400 and 800 metric tonnes with output optimized at 88%, 80% and 75% respectively, in FY15.

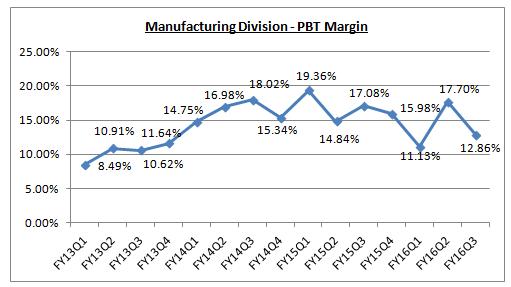

Besides, its profit before tax margin from manufacturing division had been weakening in the latest quarter, due to higher operational cost.

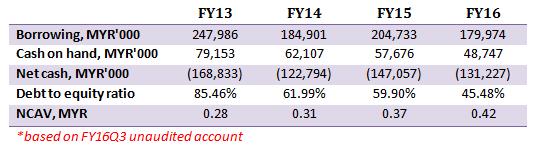

Financial Strength

In term of financial strength, PANTECH debt to equity ratio had been reduced from 85% in FY13 to 45% in FY16. Its NCAV was increasing from year to year as well, to current MYR0.42 per share.

The positive NCAV means that PANTECH is liquid enough and able to clear all its liabilities by using its current assets. It is because PANTECH inventory is very high, which is up to MYR265m!

Having said so, PANTECH borrowings are higher than its cash on hand. It had a net borrowing of MYR131m!

Joint Venture Agreement

On Sep 2015, PANTECH had entered into a joint venture agreement with Euromech Machinery Sdn. Bhd. (“EMSB”) with the intention to incorporate a new joint venture company named “Pantech Galvanising Sdn Bhd” (“PGSB”) to carry on the business of provision of hot-dip galvanising, and other business.

PGSB will be a 51% subsidiary of PANTECH, while EMSB will hold another 49%.

EMSB is a company incorporated in Malaysia and is involved in the business of manufacturing and fabrication work for conveyor system and other related services in Johor.

On Nov 2015, the new company PGSB had entered into the lease purchase agreement with EMSB to purchase the 60 years lease free land at Mukim Sungai Tiram, District Johor Bahru, measuring approximately 4.357 acres in the industrial area known as Tanjung Langsat Industrial Complex for the shares consideration of 7,212,055 ordinary shares of MYR1.00 each per share in PGSB.

By using this land, PGSB intends to construct a plant, to carry on the business of provision of hotdip galvanising.

On Dec 2015, PGSB entered into the related party transaction for the purchase and installation of galvanising machines and furnace for an estimated cash consideration of MYR3.71m from Kubota Kasui Malaysia Sdn. Bhd. The machineries are the necessity capital expenditure in PGSB for carrying out its principal activities.

The joint venture is anticipated to commence business by Dec 2016.

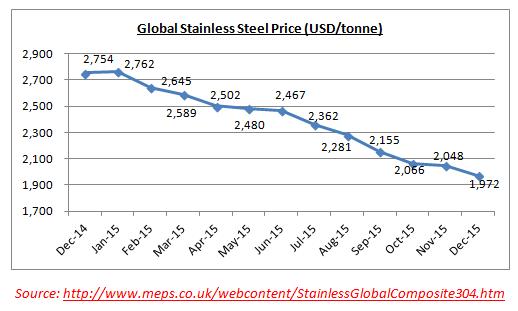

Stainless Steel Price

Stainless steel is the main raw materials to manufacture stainless steel pipe. The global stainless steel price was in a down trend since year 2014. Up to Dec 2015, it had dropped for 28% compared to previous year.

Supposing, PANTECH shall benefited from the drop of stainless steel price. However, the fact is the stainless steel price is not directly proportional to PANTECH profit margin. It was not reflected in PANTECH financial report.

This is because as the stainless steel price drop, PANTECH will adjust its stainless steel pipe price accordingly as well. So, this is one of the main reasons why PANTECH revenue from manufacturing division dropped.

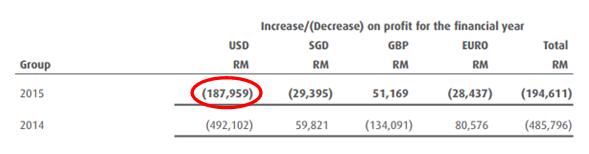

Currency Risk

Malaysia is the main market for PANTECH as it accounted 52% of its total revenue in FY15.

Currently, PANTECH had been focused on the contribution from local RAPID projects. So, it is not affected significantly by currency risk.

The below is the currency sensitivity analysis which extracted from PANTECH annual report 2015. If the RM had strengthened against the USD, SGD, GBP and EURO by 4% respectively, this would have the following impact:-

The effect is less than MYR200k only.

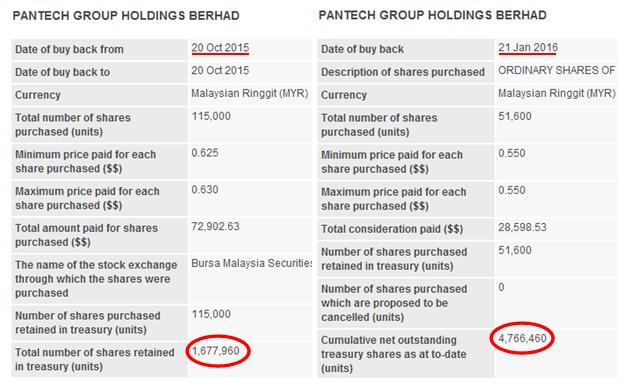

Shares buyback

PANTECH had been buying back its shares aggressively recently. Up to 21th Jan, there are total 32 rounds of shares buyback since 20th Oct, according to Bursa!

It had bought back 3.09m shares from open market within this period.

So, what’s the intention of this aggressive shares buyback?

After refer to its chart above, PANTECH was in a falling trend since 21th Oct.

I strongly believe PANTECH management wanted to buy back its shares in a cheaper price. So, when the price keeps dropping, they will continue to buy back.

In other words, perhaps PANTECH management is optimistic with the Group’s future performance.

Technical Analysis

In term of technical, last week PANTECH had dropped below its support line MYR0.57. So far, there is no sign of turning up and it is not looking good.

I believe PANTECH will drop further down and the next support line can be found at 0.54.

Conclusion

Overall, PANTECH is slowly improving its financial performance after secured an order from RAPID. Currently, its main focus is on this project too and anticipates receiving more order from RAPID in the future.

Regarding its new joint venture company, it is anticipated to commence hot-dip galvanising only by Dec 2016. So, within the whole 2016, there will be no contribution from this business.

Let’s assume PANTECH will be able to deliver MYR42m net profit in a full financial year. With its number of shares of 616.47m, its earnings per share will be 6.81cent. With an estimated PE of 10x, PANTECH will worth around MYR0.68.

Compared to its current price MYR0.56, it still has 21.43% space to improve.

However, currently there is no other catalyst for PANTECH as drop in stainless steel price and weakening of MYR does not affect the Group much.

Technically, PANTECH is still on a downtrend. I believe it is still not the bottom yet. Perhaps, investors can buy on weakness?

Having said so, my point of view is different with the one from investment bank.

Just for sharing.

Hey guys, I am writing stock analysis report to earn some pocket money and to build up my capital base. For those who are busy with their work and no time to carry out their own analysis, you may outsource some analysis work for me based on your criteria. I promise my analysis will be honest and unbiased.

For more information, you may email me at richeho_92@hotmail.com. I will send you one or two samples of my report, for your reference. You may refer some of my background on

http://klse.i3investor.com/blogs/rhinvest/83398.jsp

Happy 2016 chinese new year in advance! Huat ah! :)

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

subscribe would be more appropriate word than outsource.analyst spent 90% time or more on fact finding.ready made template is available for analysis which is the easiest process.key driver to excellent analyst report is dig and drill info.3 key facts

retail investor buy stock to made money.

earnings drives share price not cash flow, asset or any stupid jargons.quarter report also widely known earning report.media only reports earning increase or decrease in news.

analyis to support fact not opposite.

richie,start with industry outlook.spend time dig and drill on industry prospect,trend,current situation,factors,sentiments such as poultry.then move to companies in apple to apple comparison and use industry outlook average growth or degrowth to project 1 year earning.work out eps details for each company.dig and drill deeper into each company with comparison analysis using industry outlook not by company financial metrics.concluding paragraph of analysis report shows potential earning for each company after industry outlook taken into consideration.higher earning equal to good news coverage in media and high share price/high profit to retail investor.

2016-01-26 21:11

Congrats RicheHo..

U are very lucky to get paperplane2016's compliment.

He seldom praise people one. So far he only praise Calvintaneng and you only. Think this year u will huat very big.

Happy Chinese new year.

2016-02-02 13:15

johnkhoo

interesting.i do not even know analysis report can be outsourced.then ur role must b like an advisor. bear in mind, you might liable to what you suggest to your client.

2016-01-26 19:02