(RICHE HO) Bright Packaging Industry Berhad - Turnaround Soon?

RicheHo

Publish date: Mon, 29 Aug 2016, 03:18 PM

Bright Packaging Industry Berhad (“BRIGHT”)

Background

BRIGHT was incorporated in year 1988 and subsequently listed on Bursa Malaysia in year 1996. It was one of the Asia Pacific’s largest aluminium foil converting businesses, with a solid reputation of outstanding performance and quality. It’s products include aluminium foil and metalized film laminate to tissue/wood free/board and inner frame, and they are exported to countries all over the world, such as China, Thailand, Australia, UAE, Germany, etc.

BRIGHT extensively caters pharmaceutical, confectionery, liquor and cigarette packaging, such as the products below:

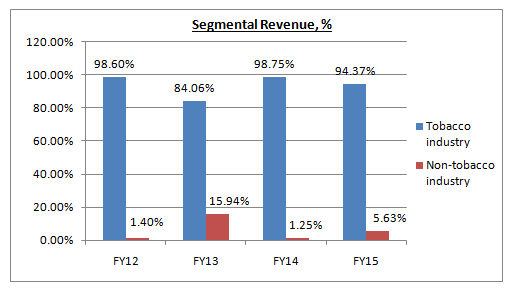

Tobacco Contribution

Basically, tobacco industry contributed significantly for BRIGHT in term of revenue. It contributed averagely 95% of the Group’s revenue.

BRIGHT had been focusing to provide the aluminium foil packaging materials for the tobacco industry in the past 10 years as the profit margin generated from the tobacco industry is higher as compared to other industries. Besides, the demand for its products from the tobacco industry is more stable and consistent as compared to the demand from other industries with the increasing number of smokers.

As at today, BRIGHT’s major customer is Philip Morris and its affiliates companies. Its contribution accounted 73% of the Group’s revenue in FY15.

BRIGHT had been established a long term relationship established with Philip Morris since more than 10 years ago and it had the ability to provide them with value added services such as customizing specific printing requirement for the cigarette boxes.

FYI, the leading tobacco company worldwide is Philip Morris International, generating around USD29.7b revenue in year 2015. It controls an estimated 15% of the international cigarette market and is the most profitable tobacco company in the world. Philip Morris operates in more than 180 countries, and sells 6 of the top 15 brands, including Marlboro.

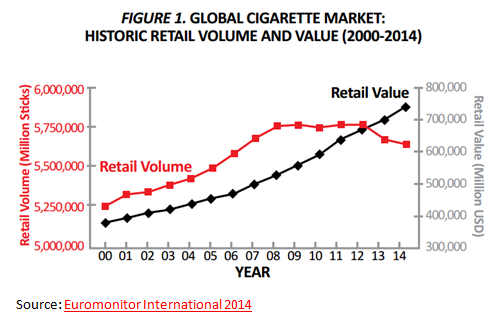

Cigarette Industry - Prospect

Based on market research, between 2000 and 2014, global cigarette volume sales increased by 8% while retail values increased by 121%.

Industry analysts predict that over the next 5 years (2015-2019) the global cigarette industry will continue to grow; volumes are predicted to increase by 0.9% and values by 29%. The cigarette sales and consequently tobacco packaging sales are expected to remain strong over the short to medium term.

Future Prospect/Expansion

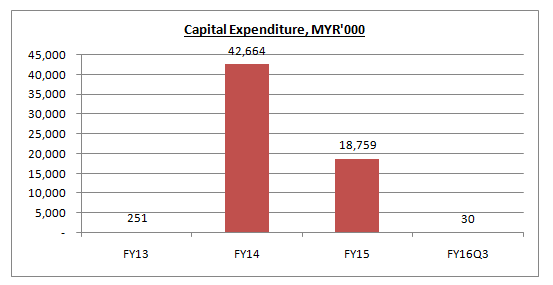

Previously, BRIGHT’s production had been running at full capacity and its clients anticipated stronger demand in the coming years. So, the management had decided to invest in new production capacity, which will allows it to capture a larger market share.

As a result, BRIGHT had expanded its production floor to cater for larger warehouses and new ancillary equipment in FY15. 2 new production lines had started operation in Apr 2015.

BRIGHT had spent MYR43m and MYR19m capital expenditure in FY14 and FY15 respectively. It had started to bear fruit with its revenue increased significantly in FY15 and FY16.

BRIGHT was expected to continue deliver good revenue in the upcoming quarters.

Financial Highlight

BRIGHT’s revenue had been increasing steadily since FY15. The higher turnover was due to increase in customers’ order from tobacco industry.

FYI, in Jan 2015, BRIGHT had secured a contract from Zao Philip Morris Izhora, a MNC tobacco manufacturing company in Russia, to supply aluminium foil at a total estimated value of USD15m. This was the main contribution for its improving revenue in these two years.

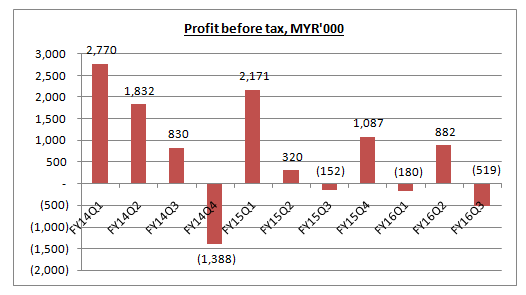

However, despite its excellent result in revenue, BRIGHT’s profit before tax was not good.

According to the management, the temporary dip in FY15 and FY16’s profit were mainly due to the business strategy of gaining market share with more competitive pricing and the impact of depreciation from the new production lines investments.

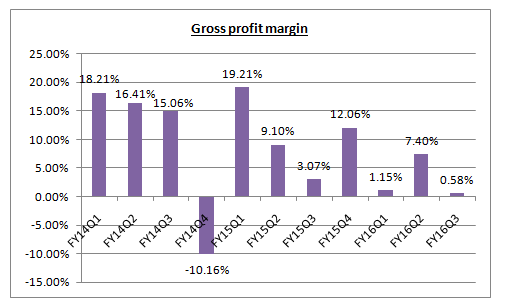

Besides, in FY16, BRIGHT was heavily impacted by the fluctuation of material cost. Its gross profit margin had dropped significantly in recent quarters as compared to FY14. The management did not explain too much on this. The main materials should be aluminium foil, paper lamination wraps and seals.

The gross profit margin for FY13, FY14 and FY15 was 19%, 11% and 11% respectively. But, the margin for FY16 so far was only 3%.

Peers Analysis

Technical Chart

As at 26th Aug 2016, BRIGHT closed at MYR0.33.

BRIGHT had been on a huge downtrend since year 2014, whereby its share price had dropped by more than 50% in two years plus. However, it seems that BRIGHT had found its bottom at around 0.29 and it was able to stand strong above this support level.

Have a clearer view on its year 2016 chart. BRIGHT had successfully breakout from its huge downtrend line, supported by a huge buying volume. It also indicated that its huge downtrend had come to an end.

Currently, BRIGHT is in a small bull run and it is expected to go further up in short term. Its support level can be found at MYR0.29.

Conclusion

So far, BRIGHT’s revenue had been doing well with its strong order books from Philip Morris. Its operating expenses had reduced as well after the completion of two new production lines.

The only issue that BRIGHT facing now is the material cost, which directly increases its cost of goods sold. This is the only part where BRIGHT needs to figure it out. Once BRIGHT is able to solve this issue, I strongly believe it will be able to turn profitable again.

Besides, BRIGHT was a net cash company with zero borrowing. With its current cash pile of MYR35.6m, BRIGHT had the ability to search for different opportunities to expand its business. It was considered a defensive counter.

Technically, it had breakout from its huge downtrend. Perhaps, a buy signal had been formed?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

whkwoon

First must look at the Directorship of the company, if the Directors are trustworthly or not

2016-08-29 16:38