SOS Truth and Myth about Long Term Investment in Bursa

sosfinance

Publish date: Mon, 25 Jun 2018, 07:06 PM

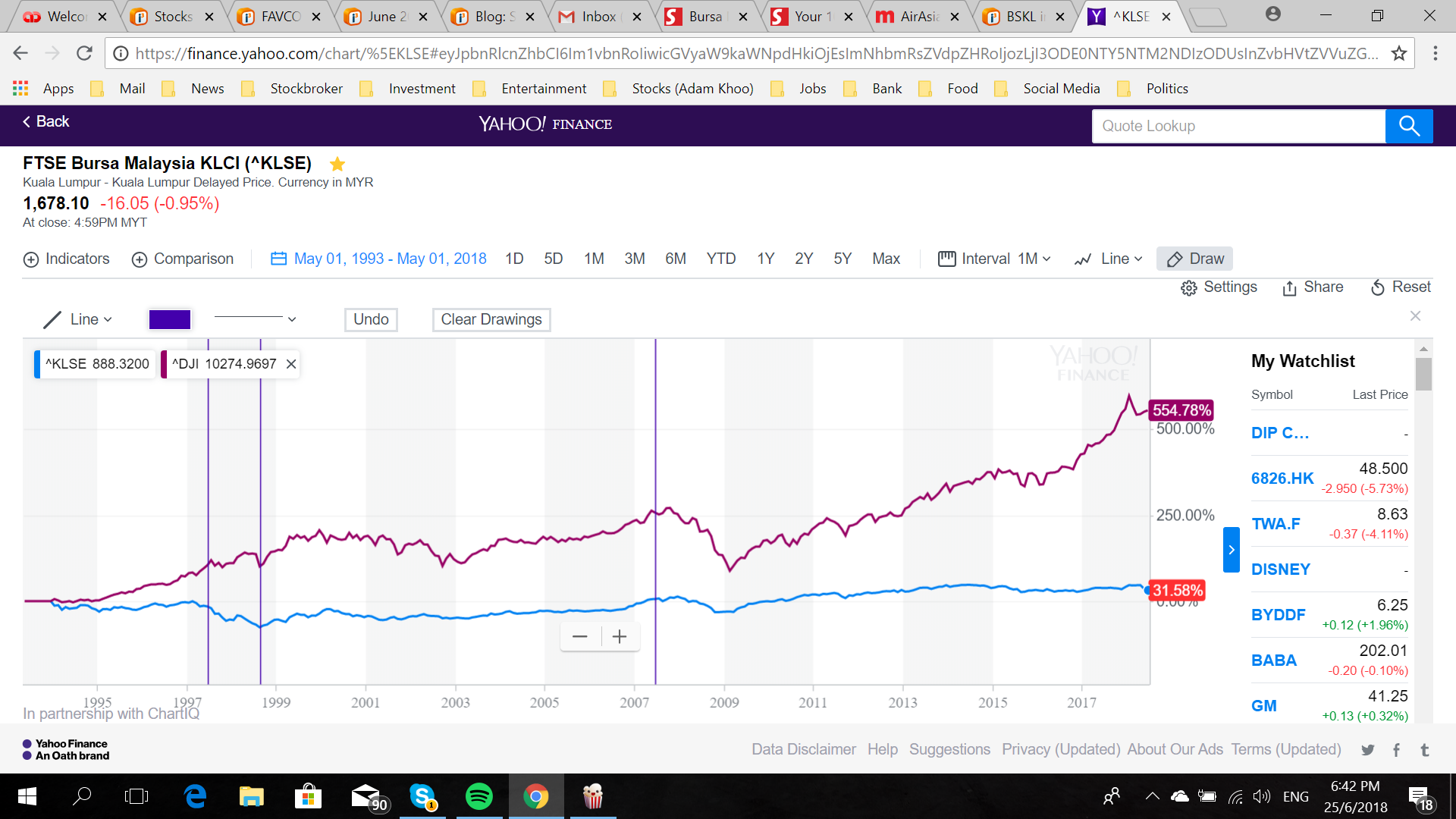

TRUTH AND MYTH ON LONG TERM INVESTMENT OF STOCK INDEX (BURSA MALAYSIA only)

10 years, 20 years, 25 years + Lowest

KLCI - Component Stocks

| Years | Return to 25/6/18 | |

| 1 | 10 (Jul 2007) | 92% |

| 2 | 20 (Jul 1997) | 67% |

| 3 | 25 (Jul 1994) | 65% |

| 4 | Lowest (Aug 1998) 24 yrs | 108% |

VIEW OF KLCI OR INDEX STOCKS OVER LAST 10 - 25 YEARS

Myth - we always hear from the financial advisers/research house/fund managers and especially Stock Investment Trainer said that you can expect about 10% p.a. (compounding return) for buying index stocks (KLCI only).

So, ask your trainers, are you sure? Look at the table.

(No evaluation is been done on Dow Jones).

So, please do not accept blindly what others said. Yes, there are a few occassions we can get 10% p.a., but only a few occassions. If we convert it into USD, you will not even get the return in the table provided. The only consolation is, you may get 3-5% p.a. of dividend.

Some GURUS said only 10% can outperform KLCI in the long run. Really?

WHY THEN SO MUCH IS INVESTED KLCI?

1. Government (via GLICs) owns about 60% of GLCs? (someone please verify)

2. EPF invested how much into Bursa?

3. Unit trusts (local) invested how much in Bursa?

4. Foreign funds invested how much in Bursa?

5. Retailers invested how much in Bursa?

More articles on SOS Read this before you INVEST in Stocks

Created by sosfinance | Jul 14, 2018

Flintstones

Property bought at the right price is the way to go

2018-06-25 19:08