THIS STOCK HIGHLY CHANCES FOR BONUS ISSUES & SKY'S LIMIT!

sparta

Publish date: Tue, 12 May 2020, 01:52 AM

Target Price : TP1: RM4.30 - TP2 RM5.50

WHAT KIM SAID ABOUT SUPERMX?

- 2.93 & 2.98 as a piled and supported.

Supermax produces various types of natural rubber and nitrile latex gloves to over 165 countries such as the USA, European Union, Middle East, Asia and South Pacific countries. The company is also involved in trading of latex gloves, generation of biomass energy, trading and marketing of healthcare products, medical devices and property holdings activities.

As Malaysia’s very first home-grown contact lens manufacturing company, It has obtained the necessary license and approvals to export its products to over 60 markets globally, including the USA and Japan markets which are two of the largest contact lens market presently. The contact lens brand, namely AVEO is distributed via its own global distribution network located in 8 countries, through joint ventures and appointment of authorized dealers in over 50 other countries as well as via e-commerce online sites available in three countries such as USA, Malaysia and UK. The brands owned by Supermax such as Supermax, Aurelia and Maxter are trusted and recognized by laboratories, hospitals, pharmacists, doctors and surgeons around the world. As we knew all of those countries are affected by COVID-19.

From my perspective and prediction there is a big-boom sales from this country alone (USA). So we dont need to figure out the other sales from other countries llike Europe.

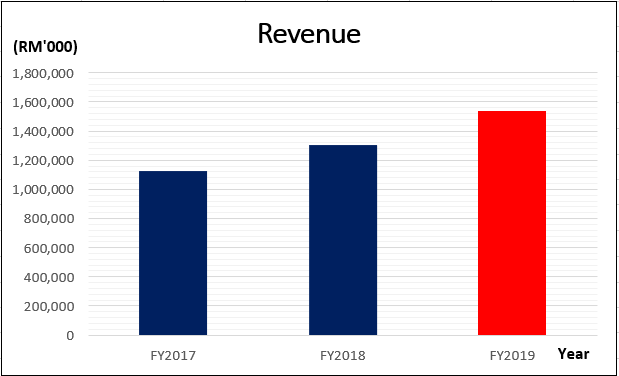

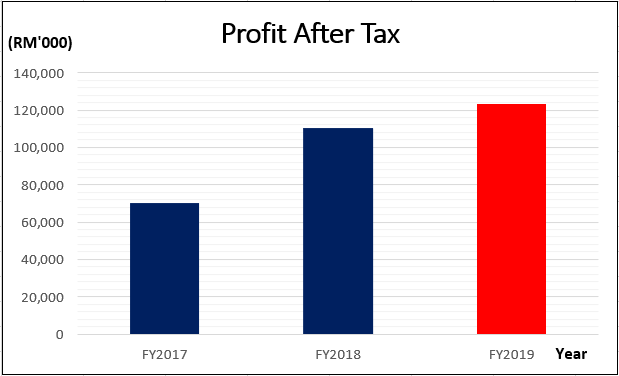

FINANCIAL REVIEW

Supermax has achieved a revenue growth of 17.92% from RM1.304 million in FY2018 to RM1.538 million in FY2019. Based on 3 years of CAGR basis, SUPERMX has a revenue growth of 14.19%.

The increase in revenue was attributed on the back of increased of volume production arising from its ongoing rebuilding and replacement program as well as the ongoing efforts to fine-tuning and boost operational efficiency and production capacity.

The commendable performance was achieved in the face of challenges such as uncertainties caused by the on-going US-China trade war and Brexit, high volatility in raw material costs and increased competition in the global marketplace. Nevertheless, the company is committed to continue working towards maximizing the company’s performance and stakeholders’ interest and values.

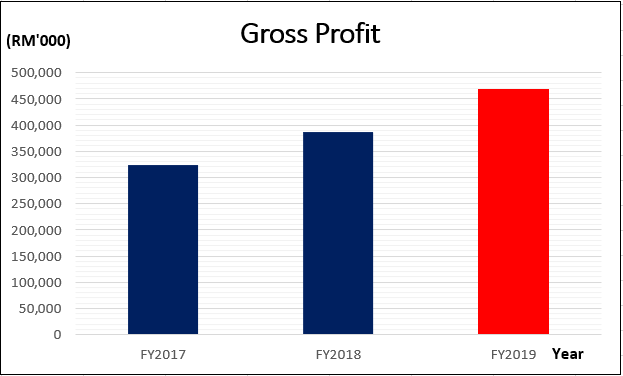

The rise in gross profit was due to the increased output from newly commissioned lines at the company’s Perak plant under its rebuilding and replacement program, higher average selling prices (ASP) in response to higher raw material prices, a stronger dollar over the course of the year and resilient global demand for the medical gloves.

Towards end of 2019, the company has completed the acquisition of land in Meru, Klang on which it plans to build Plant #13, #14 and #15 that will contribute another 13.2 billion pieces of gloves to the group’s installed capacity over the next five years up to year 2024.

For the contact lens business, the revenue is on the rise as Supermax continues to spend on advertising and promotions and managed its costs well. Even though this venture on the whole is not quite contributing to the company’s performance yet, it is becoming less of a strain on its performance which is positive for the company. Supermax will continue to work to obtain all the necessary licenses and approvals in order to export the products to more countries across the world. The company has spent over RM100 million to-date on this venture and remains optimistic and confident that over the medium to long term, it is building a business that will be value enhancing to all stakeholders.

27 Apr 2020 : 2.34 - 2.45 = 1,672,100

23 Apr 2020 : 2.24 - 2.30 = 1,791,323

22 Apr 2020 : 2.08 - 2.14 = 2,660,600

21 Apr 2020 : 1.95 - 2.00 = 5,000,000

15 Apr 2020 : 1.76 - 1.85 = 8,888,000

So, my positive thinking and view as follows :.

1. Share buyback refer to a company repurchasing its own shares.

2. Share buyback boost share prices by reducing the number of outstanding shares in the market.

3.Share buyback can benefit shareholders if they tick certain boxes. The best use of cash, if there is not another good use for it in business, if the stock is underpriced is a repurchase.

4. Share buyback should also be most beneficial when shares are bought back below their true value.

So, in simple terms.. share buyback means repurchase of shares by the company. It can happen in three ways.. :

1. Either the company purchases its own shares in open market

2. Issue a tender offer and lastly

3. Negotiate a private buyback

Also, for me there a some reason companies go for share buyback such as :

1. Attempt to boost earnings per share (EPS)

2. Reward shareholders

3. Undervalued shares

4. Lack of growth opportunities

5. Tax advantage

For this SUPERMX case, I had chose no. 3 (Undervalued shares) When the company feels the shares are undervalued, a share buyback is used to pump up the stock price, which acts like a support or new base for the stock.

There could be a number of reasons why shares of a particular company are trading lower despite stable fundamentals. A buyback reassures investors that the company has confidence in itself and is determined to work towards creating value for shareholders.

So, this is the time company protect their value of price. Of course its among the best Glove Counter which is still 3rd liner lower P/E 38.76 now from the lowest P/E 25 on Feb-Mar 20. My target P/E is 70-80

Currenty Big 4 (Four) P/E now :

Harta = 60.77

Topglov = 49.09

Supermx = 38.76

Kossan = 33.28

I just want to focus my fav Supermax. As we know this company is spending RM1.1 billion to increase the production capacity from the current 24 billion pieces per annum to 27.4 billion pieces by 2020 and 44.1 billion pieces per annum by 2024. I noticed the last pevious announcement that company bought a 5-acre piece of industrial land in Meru, Klang Selangor for RM20 million for future expansion of its manufacturing capacity. This is a simple reason that we can see how much the confidence level from management.

The plan is to construct a new manufacturing plant No. 16 over the next few years, which will increase the group's production capacity by about 4.5 billion pieces of gloves per year. This acquisition is in the best interest of the group as it enables the group to expand and grow their business to ultimately accrue long term benefits to the shareholders.

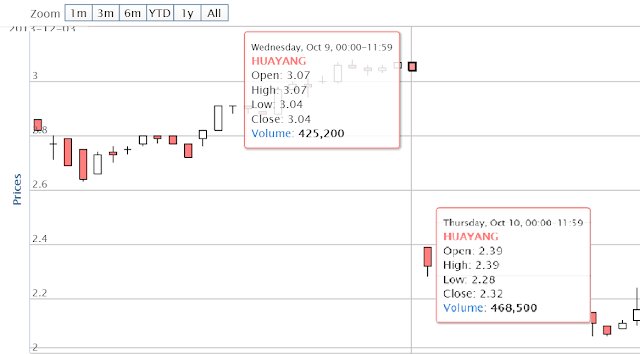

So, from RM1.29 till current price. The movement has been done approx 130%. With the available cash company, I am strongly believe the bonus issue will happen again this year when significant prices has reach. My estimation at RM5-RM6. If this happen, its good? or bad sign?

To illustrate this, let us assume a bonus issue on different ratios – 1:1, 3:1 and 5:1

Shareholder X has 6000 existing shares on hand.

6000 shares entitle for: 6000*2/3 = 4000 bonus shares

Total shares after completion of bonus issue= 6000 + 4000 = 10,000 shares

Firstly - bonus shares are normally paid using the company’s retained earnings. This means that the available cash reserve for the company will reduce, which could possibly lead to lower dividend in future.

Secondly - bonus issue is sometimes considered as a substitution to dividend, in the form of non-cash repayment.

Thirdly - when the number of shares increases, the market normally balances the share price. It’s hard to explain this without a real scenario. Thus, let’s ignore this for a while and come back to this statement after going through the case study later. At this point of time, you just need to be aware that after bonus issue, the share price will normally decrease accordingly.

Fourth - Bonus issue is in fact a way to encourage retail investors’ participation in buying a stock. In the third point, we have discussed that the share price will drop. Now, when the share price is lower, more investors could afford to chip in.

Fifth - Issuing bonus shares increases the issued share capitals (outstanding shares to be specific). This could create a delusion that the company is larger than it really is.

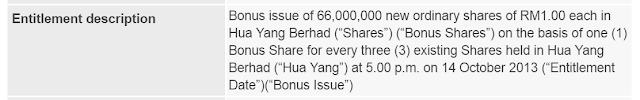

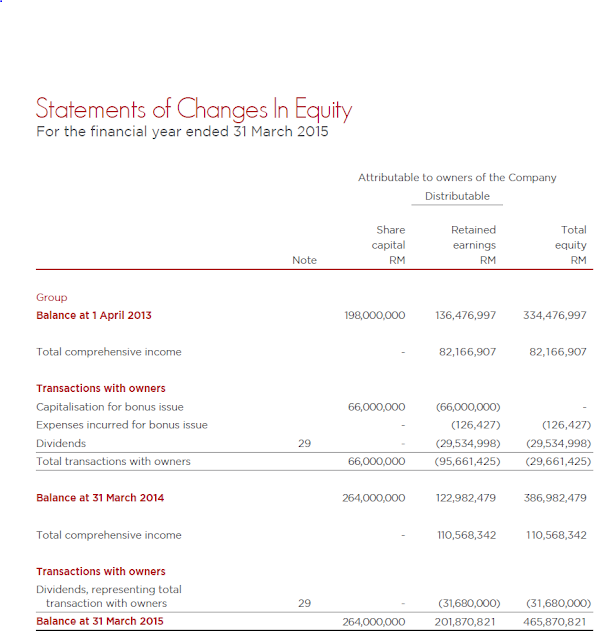

After understanding the concept, let’s have a look at a real case study. The selected stock is Hua Yang, a property counter. Back in 2013, the company announced bonus issue on the basis of 1:3. So, for every 3 existing shares, the shareholder will get 1 bonus share. From the notice, we can see that the company issued 66,000,000 of new bonus share. At the par value of RM1, therefore, the total share capital is increased by RM66 million. At the same time, RM66 million was deducted from its 2013 retained earnings, as the bonus issue was funded by the company’s retained earnings.

Issue of bonus shares facilitates a company to conserve cash which can be further reinvested for carrying out different operational and functional activities. At times when a company is not in a position to pay dividends in the form of cash then the only means to satisfy shareholder’s desire for dividend is giving them some extra shares in the form of a bonus. Helps in building a better market image and attract more number of small investors.

2. From investors point of view

Investors get tax benefits as no tax is levied on additional bonus shares issued to them. Long term investors are benefited to large extent with these shares as they are willing to expand their investment in that company and believe in long term story of the company. In future when the company will pay a dividend in the form of cash, investors will receive more as they will be holding more number of shares.

Disadvantages of bonus shares

1. From company’s point of view

With this additional issue of shares, the company does not receive any cash which reduces the company’s ability to raise its capital. Issue of bonus increases the number of outstanding shares which will decrease future EPS (Earning Per Share).

2. From investors point of view

Not all investors are happy with the bonus shares. As they may be interested in cash to fulfill their other objectives for which they have made this investment. It does not give any extra wealth to shareholders as share price drops to some proportionate amount to maintain the market capital of the company same as before.

These are some of the advantages and disadvantages of bonus shares. They can be issued after twelve months from the issue of shares for consideration and only out of reserves which are created from profit realized in cash that is a company must have a significant amount of undistributed profit. Also this proposal made by the board of directors is first approved by existing shareholders in a general meeting.

Bonus shares do not directly affect a company’s performance. Bonus issue has following major effects.

1. Share capital gets increased according to the bonus issue ratio.

2. Liquidity in the stock increases.

3. Effective Earnings per share, Book Value and other per share values stand reduced.

4. Markets take the action usually as a favorable act.

5. Accumulated profits get reduced.

6. A bonus issue is taken as a sign of the good health of the company.

WHAT KIM SAY?

Only the rubber sectors will have a big jump and bright prospect for now!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Follow Kim's Stockwatch!

Created by sparta | May 08, 2024

Created by sparta | May 07, 2024