Stock Pick Challenge - [DAIMAN] by kcchongnz

Tan KW

Publish date: Thu, 29 Aug 2013, 07:19 PM

Daiman Development Berhad and Graham Net-Net Investment Strategy

In 1932 at the bottom of the Great Crash, Ben Graham wrote an article on Forbes about the cheapness of the market and how companies are being quoted in the market for much less than their liquidating value, as if they were all destined to be doomed. He called these types of stocks, "net nets", companies that sell for less than its net current asset value, or net net working capital. Graham used the following formula to compute the liquidation value of a company.

Net Net Working Capital = Cash and short-term investments + (0.75 * accounts receivable) + (0.5 * inventory) – total liabilities

It's the lowest form of valuation you could possibly do because it ignores everything about the business and just focuses on tangible assets. The formula states that;

- cash and short term investments are worth 100% of its value

- accounts receivables should be taken at 75% of its stated value because some might not be collectible

- take 50% off inventories, due to discounting if close outs occur

The business

Daiman Development Berhad is in property development and investment holding. The Company operates in five business segments: property development, which is engaged in the development of residential, commercial and industrial properties; property investment, which is engaged in management and operation of buildings; non-property investment, which is engaged in overseas investment; trading, which is engaged in the sale of building materials, and leisure and recreation, which is engaged in the operation of sports, golf and recreation clubs, and bowling center.

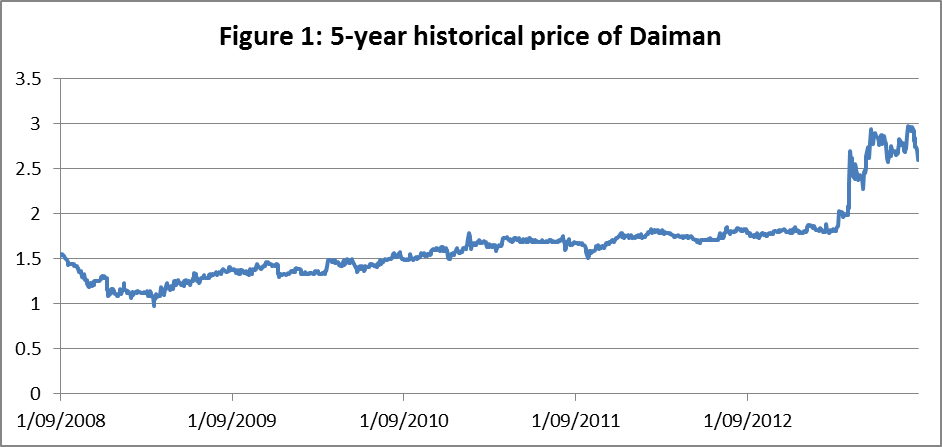

The 5-year share price performance of Daiman

Figure 1 below shows the share price performance of Daiman from 2008 to to-date.

The share price of Daiman has been hovering between RM1.5 to RM2.00 for at least four years before it started to break out at the middle of March this year. It briefly touched the high of RM3.00 intraday and closed at RM2.60 on 28 August 2013. It reported its final year 2013 results ended 30 June 2013 a day ago.

Daiman and Graham net-net

Referring to Daiman’s latest balance sheet as at 30 June 2013, the liquidation value of Daiman is computed using the net net working capital formula above. Besides cash, the land and properties it owns are also taken as 100% of the value. This is a fair assessment as it is believed that these assets are likely to worth more than their book value than otherwise. Note that the value of its property, plant and equipment and other assets of 120m are taken as worth nothing. Table 1 below shows the detail of the assets, their weight used in the net-net assessment and per share value.

Table 1: Graham net-net valuation of Daiman

|

Graham net-net |

BS value |

Wt |

Liq value |

Per share |

|

Cash and cash equivalent |

261313 |

100% |

261313 |

1.23 |

|

Property development costs |

82182 |

100% |

82182 |

0.39 |

|

Land held for development |

389780 |

100% |

389780 |

1.84 |

|

Investment Properties |

279880 |

100% |

279880 |

1.32 |

|

Inventories |

4045 |

50% |

2023 |

0.01 |

|

Trade Account Receivables |

54862 |

75% |

41147 |

0.19 |

|

Property, plant and equipment |

194040 |

0% |

0 |

0.00 |

|

Other assets |

22917 |

0% |

0 |

0.00 |

|

Total assets |

1289019 |

1056324 |

4.98 |

|

|

Total liabilities |

258875 |

100% |

258875 |

1.22 |

|

Total equity |

1030144 |

797449 |

|

|

|

Number of shares |

212192 |

212192 |

|

|

|

Net tangible asset per share |

4.85 |

|

3.76 |

3.76 |

The table above shows that the net tangible asset (NTA) of Daiman is RM4.85. At this morning’s closing price of RM2.60, it is traded at a huge discount of 46% to its NTA. The net-net valuation of Daiman is shown to be RM3.76, which is still a substantial 45% higher than its price.

Isn’t Daiman a deeply undervalued stock as shown above? Wait until we check if the company is a cash burner. If a company is a cash burner, whatever assets it has can be burned away before shareholders can enjoy them.

3 Basic Checks to Perform for a Net Net

For a net net to be investable, it should have

- a solid balance sheet, preferably more cash than inventories and receivables.

- is not bleeding cash. At least breaking even or positive in net profit.

- positive EBITDA

The first check shows that Daiman has most of its net-net assets in high quality assets in cash and cash equivalent (RM1.23 per share), investment properties (RM1.32), and Land held for property development (RM1.84). The poorer quality net-net asset of inventories and receivables amount to just 20 sen. Hence we can safely confirm that the quality of the assets is excellent. Next to check is “Is it bleeding cash”?

The latest annual financial results ended 30 June 2013 shows Daiman’s revenue and net profit increased by 12% and 78% respectively to 190m and 69m respectively, or a EPS of 32.5 sen per share. At RM2.60, the PE is only 8.0. Cash flow from operations amounts to 61.6m with free cash flow of 43.7m. This FCF is a high of 23% (>10%) of revenue. I don’t remember Daiman has even a single year of losses since listing. It has positive CFFO all the time. In fact, Daiman also easily qualified as a value stock standing on its own on financial performance.

Conclusions

Daiman qualifies as Graham net net investment strategy with a wide margin of safety. It can also stand on its own as a value investment stock as a going concern with stable earnings, healthy balance sheet and cash flow. For this I have added Daiman as another stock in my new portfolio.

Katsenelson’s absolute PE

The Katsenelson approach assigns a company with PE "points" and then calculates the fair value by multiplying it with a final multiple factor. This is an absolute approach to remove the effects of market dependency and competitor bias.

The model derives the intrinsic value of the stock based on the following five conditions.

1. Earnings growth rate

2. Dividend yield

3. Business risk

4. Financial risk

5. and earnings visibility

Fair Value PE =Basic PE x [1 + (1 - Business Risk)] x [1 + (1 - Financial Risk)] x [1 + (1 – Earnings Visibility)],

where the Basic PE is the starting PE from a table which takes into consideration of the growth rate and the dividend yield. The table starts with 0% growth for stocks with a PE of 8. For every percentage of earnings growth from 0% to16%, the PE increases by 0.65 points. Once the growth rate reaches a certain level, in this case 17%, the PE value increases by 0.5 points and maxes out at 25% growth. So any stock with a PE higher than 21.9 is capped to a 25% growth rate.

Dividends are tangible to the investor whereas earnings are not. Dividends provide you with a hard return whereas you may never get to see earnings. Every dividend yield percentage receives an equivalent PE point. If the dividend yield is below 1%, give a bonus of 0.5 points.

Katsenelson’s absolute PE for Daiman

Basic PE for Daiman with a growth of 5% and a dividend yield for last year of 4.6%,

Basic PE = 8 + 0.65*5 + 4.6 = 12.9

Business risk: Daiman’s business has low efficiencies with low return of assets of just 5.3% and return of capital of 6.5%. Cash return (FCF/IC) is also not that great at 5%. Hence the management may not be capable and there may not be much moat in its business. An arbitrary 15% discount is applied to its business risk.

Financial risk: Daiman has a very healthy balance sheet with no debt. Hence a premium of 10% is applied.

Earnings visibility: Daiman has quite stable operating profit margins of more than 30%. Its cash flow from operations is also stable though they are slightly below the net income. No premium nor discount is applied.

Hence the absolute PE for Daiman is:

Abs PE = 12.9* [1+(1-115%)] *[1+(1-90%)] * [1+(1-100%)] = 12.0

Fair value of Daiman = 12.0*0.325 = RM3.90

Comment by kcchongnz at Sep 7, 2013 04:44 PM

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Stock Pick Challenge 2013 2H

Created by Tan KW | Jan 02, 2014

Created by Tan KW | Nov 08, 2013

Created by Tan KW | Sep 06, 2013

Discussions

what a great analysis, but again, my concern is one should look more at the business itself rather than focus too much in valuation or financial accounting coz the market might not just simply agree to your valuation. just my worthless 2 cents

2013-08-29 22:00

Everyone has his own criteria for trading, some use FA, some TA, some hear rumors, some use gut feeling. At the end it's the individual who makes the final decision. KC Chong is only giving his take on the counter and in no way making a recommendation to anyone to buy. IT;s very generous of him to share his knowledge with others. Even If I do not buy into this company, it is a very educational lesson for me.

2013-08-29 22:23

Well, i dont mean anything, i am grateful in fact for the true sharing from Kcchong, i am just sharing my view. nothing more.

2013-08-29 22:39

when the market crash, what makes you so confident to hold on the shares is your understanding of the business, the business prospect in which you confident that earning will be increasing, rather than past performance or valuation. Again, jz my worthless 2 cents

2013-08-29 22:41

Very healthy discussion. I support both sides especially ipomember.

When I were younger, many elders gave an advice not to limit oneself into one perspective even though it was then a highly believed truth or principle as truth and principle changes along with time. Now I realize that was a priceless advice. Take one backward step to see thing from another angle.

Just my 2 cents opinion. Thank you.

2013-08-30 07:10

kc, interesting method of valuation, whats your thought on dormant companies KLUANG or SBAGAN ?

2013-08-30 07:35

I cannot remember how many times I have said that I prefer to hear opposite views rather than agreeing with me. It is an excellent way to curb my over-confidence in my stock selection. As one knows well, over-confidence will not be good for somebody's investing experience. So let us continue with this discussion.

Posted by ipomember > Aug 29, 2013 10:00 PM | Report Abuse

what a great analysis, but again, my concern is one should look more at the business itself rather than focus too much in valuation or financial accounting coz the market might not just simply agree to your valuation. just my worthless 2 cents

I TALKED ABOUT GRAHAM NET NET VALUATION FOR DAIMAN. IT IS ONE OF THE STRATEGIES OF INVESTING. I DID TOUCH ON DAIMAN'S BUSINESS AND ITS PERFORMANCE. THAT IS ONE OF MY WAYS OF LOOKING AT IF A COMPANY IS WORTH INVESTING IN. AS YOU KNOW I HAVE MANY WAYS FOR DETERMINING IF A STOCK IS WORTH INVESTING OR NOT.

YOUR COMMENT IS GOOD BUT I WOULD LIKE TO HEAR YOUR VIEW AND PROCESS OF "look more at the business itself rather than focus too much in valuation or financial accounting" IN SELECTING A STOCK TO INVEST.

SURE, MARKET SELDOM AGREE WITH ANYBODY'S VALUATION, NOT ONLY THE VIEW OF A NON-PROFESSIONAL LIKE ME, EVEN ANALYSTS AND INVESTMENT BANKERS. GO CHECK THE FAIR VALUES OF STOCKS GIVEN BY THEM AND SEE IF THE MARKET AGREE WITH THEM, THE PROFESSIONALS OR NOT. THE QUESTION IS WHAT IS YOUR PROCESS AND HOW DO YOU SELECT A STOCK TO INVEST IN? PLEASE SHARE.

Posted by ipomember > Aug 29, 2013 10:41 PM | Report Abuse

when the market crash, what makes you so confident to hold on the shares is your understanding of the business, the business prospect in which you confident that earning will be increasing, rather than past performance or valuation. Again, jz my worthless 2 cents

IF YOU READ THROUGH MY WRITEUP YOU WOULD GET THE MESSAGE THAT I WOULD BE CONFIDENT TO HOLD THE SHARE BASED ON THE QUALITY OF ITS ASSETS; ITS HUGE HOLDING IN CASH, INVESTMENT PROPERTIES AND LAND HELD FOR PROPERTY DEVELOPMENT EVEN AT ITS BOOK VALUE. TO ME THESE PROPERTIES AND LAND COULD BE WELL ABOVE THE MARKET VALUE AND THEY GENERALLY DO NOT DEPRECIATE. EVEN AFTER IGNORING THE VALUE OF ITS OTHER ASSETS, ITS NTA IS STILL 40%+ ABOVE ITS MARKET PRICE NOW.

I PICK IT NOT BECAUSE "confident that earning will be increasing, rather than past performance or valuation" AS STATED BY YOU IF YOU RAD THROUGH MY WRITEUP. HOWEVER I DID TALK BRIEFLY ABOUT ITS BUSINESS PERFORMANCE AND CASH FLOWS. DO YOU SEE ANY PROBLEMS WITH DAIMAN'S BUSINESS.

ONCE AGAIN APPRECIATE YOUR SHARING, AND IN FACT ANYBODY'S SHARING. TELL YOU WHAT, THERE ARE PLENTY OF THINGS I DON'T KNOW ABOUT DAIMAN AND THE PROPERTY MARKET. i LIKE TO LEARN TOO. BUT JUST WISH THAT YOU COME OUT WITH YOUR SPECIFIC CONCERNS, NOT JUST A STATEMENT. THAT IS THE RIGHT WAY OF DISCUSSION, ISN'T IT?

2013-08-30 07:53

Posted by houseofordos > Aug 30, 2013 07:35 AM | Report Abuse

kc, interesting method of valuation, whats your thought on dormant companies KLUANG or SBAGAN ?

house, I know nothing about these companies. But if I get interested in them (will I?), these are the questions I would want to ask:

1) Is the company to be liquidated and assets returned to shareholders? If so is it much more than the price? One way to do is to use the net net valuation.

2) Any potential somebody take over and build a viable business?

3) Is it giving good dividends?

4) Is there available cash to do (3) above for many more years?

5) Is it burning cash?

6) etc etc

2013-08-30 08:28

I opine with with kc's request to ipohmember asking for more specifics. Whilst ipohmember's statement is correct no one can tell the direction of the market to know the timing of buy, sell, buy back again etc. If there is such a person, then we do not need the likes of warren buffet, george soros etc. Say if think you want to sell Daiman at 2,80 today, when do you want to go in again - 2.50, 2.20, 2.00 or 1.70.

2013-08-30 09:36

I TALKED ABOUT GRAHAM NET NET VALUATION FOR DAIMAN. IT IS ONE OF THE STRATEGIES OF INVESTING. I DID TOUCH ON DAIMAN'S BUSINESS AND ITS PERFORMANCE. THAT IS ONE OF MY WAYS OF LOOKING AT IF A COMPANY IS WORTH INVESTING IN. AS YOU KNOW I HAVE MANY WAYS FOR DETERMINING IF A STOCK IS WORTH INVESTING OR NOT.

.

.

.

No comment on this as i fully agree with you.

YOUR COMMENT IS GOOD BUT I WOULD LIKE TO HEAR YOUR VIEW AND PROCESS OF "look more at the business itself rather than focus too much in valuation or financial accounting" IN SELECTING A STOCK TO INVEST.

.

.

.

When i first learnt to analyse a company, i look more on financial accounting, formulate my own spreadsheet and putting all the figure inside and analyse. However, when our market reached a new high this year, my stock is not performing! How come this will happen? Even a stock w/o net profit can perform better!I started to realise that i am living into a fantasy of how good the stock is without knowing too much about the company and its business. Then it urges me to change my philosophy. When it comes to the business, i would like to pick those business that is simple for me to understand and figure out what is the future planning of the company, competitors, is it operatiing in a niche market,if the product is same how does a company outshined the others? so and so...

SURE, MARKET SELDOM AGREE WITH ANYBODY'S VALUATION, NOT ONLY THE VIEW OF A NON-PROFESSIONAL LIKE ME, EVEN ANALYSTS AND INVESTMENT BANKERS. GO CHECK THE FAIR VALUES OF STOCKS GIVEN BY THEM AND SEE IF THE MARKET AGREE WITH THEM, THE PROFESSIONALS OR NOT. THE QUESTION IS WHAT IS YOUR PROCESS AND HOW DO YOU SELECT A STOCK TO INVEST IN? PLEASE SHARE.

There is nothing to talk about on the analyst TP/FV, as they change it very frequent so it can urges people to trade. My method in stock picking is more on bottom up approach, No matter how good the business i think i will always look at their past performance first. The little changes from now and before is i dont focus too much on it, i have been more compromised instead and i look more on the business nature and its prospect as i think we are buying for the future of the company. I ll be very happy if i can come out with a story which shows that i know the company very well.

IF YOU READ THROUGH MY WRITEUP YOU WOULD GET THE MESSAGE THAT I WOULD BE CONFIDENT TO HOLD THE SHARE BASED ON THE QUALITY OF ITS ASSETS; ITS HUGE HOLDING IN CASH, INVESTMENT PROPERTIES AND LAND HELD FOR PROPERTY DEVELOPMENT EVEN AT ITS BOOK VALUE. TO ME THESE PROPERTIES AND LAND COULD BE WELL ABOVE THE MARKET VALUE AND THEY GENERALLY DO NOT DEPRECIATE. EVEN AFTER IGNORING THE VALUE OF ITS OTHER ASSETS, ITS NTA IS STILL 40%+ ABOVE ITS MARKET PRICE NOW.

.

.

.

You are right, but let me share my view on this. When the property price in ISKANDAR area is rising due to various factors, the share price of related stocks have doubled up because people are optimistic on the company. However, little do they know that there are some companies holding the huge landbank without doing anything for more than a decade(at least i read it from theedge weekly)! If a company is holding at lot of huge landbank but do not develop it, it creates no value for the shareholders i think. OF course theoritically you are holding something valuable, but i don't think the value will be realised(unless there is any catalyst). Thats why knowing the company future planning is important.

I PICK IT NOT BECAUSE "confident that earning will be increasing, rather than past performance or valuation" AS STATED BY YOU IF YOU RAD THROUGH MY WRITEUP. HOWEVER I DID TALK BRIEFLY ABOUT ITS BUSINESS PERFORMANCE AND CASH FLOWS. DO YOU SEE ANY PROBLEMS WITH DAIMAN'S BUSINESS.

.

.

.

I have to confess that i don know property stock well, thats why i hold nil property stock in my portfolio

Afterall i am not disagree with you and i might be wrong too.

2013-08-30 10:00

I know. what I mean is that if i feel the market is going down i sell off the share but then when is the right time to buy back. Thus is I am a long term investor I do not need to bother. This is what I mean. Thank you.

2013-08-30 10:04

ipomember

"When it comes to the business, i would like to pick those business that is simple for me to understand and figure out what is the future planning of the company, competitors, is it operatiing in a niche market,if the product is same how does a company outshined the others? so and so..."

MY POST WAS ABOUT GRAHAM NET NET VALUATION ON DAIMAN. SO I PRESUME YOU ARE NOT TALKING ABOUT THAT ISSUE. IF YOU ARE TALKING ABOUT THE COMPANY'S BUSINESS AND IF IT IS WORTHY OF INVESTING, YOU ARE RIGHT. GO TALK TO THE MANAGEMENT AND ITS STAFF, SUPPLIERS, CONTRACTORS AND SUBCONTRACTORS ETC ABOUT THEIR NICHE, COMPETITIVE ADVANTAGE AND FUTURE PLANNING. DO RESEARCH ON THE INDUSTRY, THEIR COMPETITORS, AND HOW THEY CAN DO BETTER THAN THE COMPETITORS ETC. CLASSIC PHILIP FISHER SCUTTLE BUTTING. VERY GOOD.

"My method in stock picking is more on bottom up approach, No matter how good the business i think i will always look at their past performance first. The little changes from now and before is i dont focus too much on it, i have been more compromised instead and i look more on the business nature and its prospect as i think we are buying for the future of the company. I ll be very happy if i can come out with a story which shows that i know the company very well."

GOOD BOTTOM UP APPROACH. I FOLLOW THAT TOO. BUT DON'T YOU THINK THAT YOU MAY END UP WITH THE SAME PREDICAMENT AS YOU SAID BELOW:

"When i first learnt to analyse a company, i look more on financial accounting, formulate my own spreadsheet and putting all the figure inside and analyse. However, when our market reached a new high this year, my stock is not performing! How come this will happen? Even a stock w/o net profit can perform better!I started to realise that i am living into a fantasy of how good the stock is without knowing too much about the company and its business."

SO HOW? YEAH FOLLOW YOUR SCUTTLE BUTTING APPROACH BELOW THEN?

"instead and i look more on the business nature and its prospect as i think we are buying for the future of the company. I ll be very happy if i can come out with a story which shows that i know the company very well."

YEAH WE BUY THE FUTURE, NOT THE PAST. LOOK MORE ON THE BUSINESS NATURE AND ITS PROSPECT. A LITTLE VAGUE ISN'T IT? HOW TO LOOK? FORECASTING? PREDICTING? AND HOW TO TRANSLATE THESE PREDICTIONS INTO $$$$? A STORY? A STORY FOR TRADING? THEN IT IS A DIFFERENT STORY ALREADY, ISN'T IT?

"However, little do they know that there are some companies holding the huge landbank without doing anything for more than a decade(at least i read it from theedge weekly)! If a company is holding at lot of huge landbank but do not develop it, it creates no value for the shareholders i think. OF course theoritically you are holding something valuable, but i don't think the value will be realised(unless there is any catalyst). Thats why knowing the company future planning is important. "

YEAH AGREE. HUGE LAND BANK BUT NO DEVELOPING PLAN NO USE. BUT IS DAIMAN JUST SITS ON THESE ASSETS? IT APPEARS TO ME DAIMAN IS USING ITS CASH TO BUY INVESTMENT PROPERTIES AND SECURITIES. THESE INVESTMENT PROPERTIES AND SECURITIES ARE YIELDING RETURNS. IT IS DEVELOPING ITS LAND BANK, ALBEIT NOT AT TOO FAST APACE. THIS CAN BE SEEN FROM ITS GROWTH IN REVENUE AND OPERATING PROFIT AT A CAGR OF 12% AND 38% RESPECTIVELY. NO???

DAIMAN ALSO JUST DECLARED A DIVIDEND OF 12 SEN, OR A DIVIDEND YIELD OF 4.6%, HIGHER THAN FD RATE.

CATALYST? ISN'T CHEAPNESS THE BEST CATALYST?

OK OK MUST KNOW FUTURE PLANNING. SO GO SCUTTLE BUTTING.

2013-08-30 10:53

Thank you for the healthy discussion. I am now busy with office work and have no time to write more. I give more vote to ipomember. TQ

2013-08-30 11:07

hahaha, i never said im right or you are wrong. i just sharing my view which is a bit different from yours, so maybe we can learn from each other? I think i have bringing up the messages that i want to say.. afterall i am not an experience ones. Good to hear from your replies. Thanks.

2013-08-30 11:14

I hope I don't give the impression to others that I do not like opposite views. As I have said many times, it is not good for my investing experience.

Just that I often find general statements are made. I really appreciate if others can be specific, best come with some numbers to justify. Notice I use numbers a lot because if not, I don't know how to justify my views. It is difficult to discuss on general statements.

Well any comment is appreciated.

2013-08-30 11:35

i think ipomember is introducing another dimension of consideration for us as an investor to ponder.

too focused in the financial / accounting part of the business could tell you how well they were doing, but does not tell you the strategy of the company in dealing with future threats / changes in business.

the half life of a company gets shorter and shorter, and innovation is the key to stay competitive in the market. perhaps that's more relevant to competitive economy. malaysia has very 'traditional' business and protected economy, so i guess it's not too bad.

however, big businesses are often trying to protect their legacy business rather than innovate and do not worried of being cannibalized by new products. maybe a lot of businesses do not have transparency in terms of the 'future', and sometimes hard for the investor to imagine the vision.

one way out is really keep up to date to relevant / indirect competitors or disruptors to the company of which we are vested into. and dump it while it's still healthy.

so to sum it up in short, the dimension that ipomember added MIGHT be: a cheap valuation is a good value investment, but when new competitors/disruptors get into the space, don't hold the stock just because it's under-valuation, because perhaps before it gets the proper valuation, the new competitor/disruptor has wiped the company out.

e.g., JCY - HDD manufacturer.

(again, i suspect this is more relevant to technology sector, but something to take note of for other industry)

2013-08-30 13:02

maybe another example: POS malaysia. was mainly snailmail business, then email came, luckily ecommerce picked up. assuming POS malaysia did not innovate (and without any sort of protection), did not invest enough into logistic courier business, they may be in deep trouble...

telco, sms/voice revenue dropped. whatsapp came in and disrupted their good chunk of revenue. they needed to innovate to ensure business stays relevant with other products.

just my 2cents to add to ipomember's comment.

2013-08-30 13:04

Agree.It is best not to be overconcentrate on financials..it is a picture of the health of the company at a given time.It does not have any feel of the strategy going forward.Pos Malaysia will face a daunting task when users of checking accounts will be charged 50 sen per cheque effective April 2014 as Bank Negara is encouraging customers to use interbank transfers at 10 sen per transaction.

That will have some impact on Pos Malaysia earnings as mails now are shrinking in volume due to technological changes in communication.

Now is the result reporting season and one can notice some companies are announcing higher dividends, treasury shares or warrants for minority shareholders to cling onto the shares on a long term basis.

Is it worth it? With ringgit weakening against the us dollar and the prospect of inflation emerging the stock will have to perform well in the current cycle to give either capital growth or higher dividends going forward.Sometimes watching a stock trend is equally important whether the stock is ready to mount the challenge in the current bearish environment.

My 2 sen comments.

2013-08-30 13:36

KC Chong : Only your post attracts many quality comments. This must be attributed by your generosity, openness and professionalism. Good on you. Keep up the great job. I follow most of your posts. TQ

2013-08-30 19:38

I think WM83 is bringing up the message in a clearer form(with proof and example). I learnt from my lesson by not too focusing on financial accounting is because investment is not a true science otherwise the accountant will be the m/billionaire(I learnt this through Kcchong by reading his post). Just an eaxmple, recently i am trying to look and re-look at Padini. The coming of foreign brand to Malaysia market might seriously give a strike to a local brand like Padini. We can see that Padini was once a fast growing company, but now it turns to be a medium/slow growth company, the profit is decreased due to margin erosion. However, i still think Padini can do well in a longer term for its brand value(look, this is the intangible asset/goodwill which one cannot find it on financial statement), management expertise(see how they develop their own outlet like Padini concept store/Brand outlet),their expansion plan(one good thing is, if you can do well in one place, probably you can redeploy your strategies to somewhere else), their management confidence(you might refer to the latest quarter report on company's prospect view). All these is valuable i think.

2013-08-30 20:04

Another thing is, i have noticed that the stand-alone-store for VINCCI is doing extremely good. If not mistaken, VINCCI contributes the highest revenue for PADINI group. How do i know it? I walk by VINCCI store every weekdays as long as i go to work, i can see that the store is crowded, be it at Ferenheit or KLCC. Thats another way to look at its business.(Of course in Daiman case i dont know how, thats why i dont hold any property stock).

2013-08-30 20:12

i guess you should look for a job where it's nearby sales office of the property company then :P

2013-08-30 20:31

Posted by ipomember > Aug 30, 2013 08:12 PM | Report Abuse

Another thing is, i have noticed that the stand-alone-store for VINCCI is doing extremely good. If not mistaken, VINCCI contributes the highest revenue for PADINI group. How do i know it? I walk by VINCCI store every weekdays as long as i go to work, i can see that the store is crowded, be it at Ferenheit or KLCC. Thats another way to look at its business.(Of course in Daiman case i dont know how, thats why i dont hold any property stock).

GOOD POINT. ANOTHER CLASSIC PETER LYNCH STRATEGY OF INVESTING. I AGREE FULLY THIS NON FINANCIAL INFORMATION IS VERY IMPORTANT WHEN DECIDING IF TO INVEST IN THAT COMPANY OR NOT. NO ARGUMENT.

SO SUPPOSING THAT VINCCI STORE IS SO CROWDED AND SO MUST BE MAKING A LOT OF MONEY FOR PADINI. NO NEED TO LOOK AT THE MARKET VALUATION ALSO, JUST BUY?

BUT LET ME ASK YOU A FEW QUESTIONS.

1) ARE OTHER VINCCI STORES IN OTHER PLACES ALSO VERY CROWDED AND WITH EXPLOSIVE SALES?

2) DO THE SALES TRANSLATE INTO GOOD BOTTOM LINE? WHAT KIND OF MARGINS? GOOD RETURN ON CAPITALS?

3) CAN GOOD SALES LEADS TO LOSSES INSTEAD? WHY NOT?

3) WHAT ABOUT OTHER STORES OR PRODUCTS OF PADINI? NOT AS WELL? SO HOW DO THEY AFFECT PADINI'S BOTTOM LINE?

4) ASSUMING EVERYTHING IS GOOD. GOOD SALES, GOOD PROFITS ETC. WOULD YOU BUY ITS STOCK IF IT IS SELLING AT RM10 A PIECE? NO? THEN WHAT PRICE WOULD YOU WILLING TO PAY? HOW DO YOU COME TO YOUR CONCLUSIONS?

2013-08-31 13:39

Very pertinent questions indeed put up by kcchongnz. Perhaps bsngpg and ipohmember can provide the answers. Much appreciate.

2013-08-31 13:42

wm83, your last 2 posts talked about business trends and prospects.

In the context of Malaysia scenario, which industry or businesses would you see in next 5-10 years.

2013-08-31 14:28

Well, actually my purpose of posting is not to argue how good Padini is, i just want to give an example that its better to focus on both business and financial accounting in doing our investment analyst. However i think i might be able to answer you.

SO SUPPOSING THAT VINCCI STORE IS SO CROWDED AND SO MUST BE MAKING A LOT OF MONEY FOR PADINI. NO NEED TO LOOK AT THE MARKET VALUATION ALSO, JUST BUY?

.

.

.

Of course buying into a excessive high PE company can be a disaster, you are actually buying into the so called "futuristic fundamental", betting the company can generate higher and higher earnings year on year to sustain the price/expectation.

1) ARE OTHER VINCCI STORES IN OTHER PLACES ALSO VERY CROWDED AND WITH EXPLOSIVE SALES?

As for VINCCI,other than stand-alone-store, there are store-within-store, (which we can see it inside Padini Concept Store), and franchise store(yes,if my memory serves me well). For sure i wouldn't able to go for every stores and other than Klang Valley ones, i went to Malacca one, which is doing quite well too because there is less competition there. Like what i said - "one good thing is, if you can do well in one place, probably you can redeploy your strategies to somewhere else". How can i gauge it? look at the revenue grow then we can know. The inventory level and receivable is managing well too(you can see it from the just released result).

2) DO THE SALES TRANSLATE INTO GOOD BOTTOM LINE? WHAT KIND OF MARGINS? GOOD RETURN ON CAPITALS?

.

.

.

The margin is above 10 and its gradually increase except for the FY13 result, due higher OPEX as more store open. However, the debt level has dropped and the cash holding increase, which makes me believe the expansion plan is sustainable. I don know about the ROC, but for ROE, at least it stay above 20% consistently from 2008 to current, which is awesomely good.

3) CAN GOOD SALES LEADS TO LOSSES INSTEAD? WHY NOT?

.

.

.

can be specified? Thanks

3) WHAT ABOUT OTHER STORES OR PRODUCTS OF PADINI? NOT AS WELL? SO HOW DO THEY AFFECT PADINI'S BOTTOM LINE?

Like i said, Padini Concept Store and Brand Outlet is doing good, especially for PCS. Inside PCS, there are VINCCI, VINCCI accessory, SEED, PDI, P&CO etc. Well, i couldn't tell you which brand did better than which brand, but as i noticed PCS attracted crowds too.

4) ASSUMING EVERYTHING IS GOOD. GOOD SALES, GOOD PROFITS ETC. WOULD YOU BUY ITS STOCK IF IT IS SELLING AT RM10 A PIECE? NO? THEN WHAT PRICE WOULD YOU WILLING TO PAY? HOW DO YOU COME TO YOUR CONCLUSIONS?

.

.

.

RM10 a piece? In what valuation? i think needless i say u know it better than i when it comes to valuation. For the current PE of 13-14, i think its not too expensive or too cheap( i dono, i think so). However if we calculate PEG, its lesser than 1 as the 5 years CAGR is 15%, but wait! Investment is not science, and it is not about finding all answer for your questions? Assume its PE is more than the current one, but if ones is bullish on the company prospect, its still worth to buy. (of course if the PE is too excessive, its different story).

2013-08-31 14:51

Posted by wm83 > Aug 30, 2013 08:31 PM | Report Abuse

i guess you should look for a job where it's nearby sales office of the property company then :P

haha,maybe i try to buy one property then i can know better? haha, just kidding.. :p

2013-08-31 15:03

Posted by ipomember > Aug 31, 2013 02:51 PM | Report Abuse

Well, actually my purpose of posting is not to argue how good Padini is, i just want to give an example that its better to focus on both business and financial accounting in doing our investment analyst. However i think i might be able to answer you.

MY QUESTIONS WERE GENERAL IN NATURE, NOT INTENDING TO TALK ABOUT PADINI, BUT JUST USED IT AS AN EXAMPLE.

ANYWAY, I FIND YOUR REASONING ON PADINI VERY GOOD. SO YOU DO LOOK AT THE FINANCIALS, DON'T YOU? IN FACT YOU LOOKED DEEPER THAN ME IN A COMPANY'S FINANCIALS. YOU EVEN TALKED ABOUT ITS INVENTORIES AND RECEIVABLES. YOU LOOKED INTO ITS NON FINANCIAL ASPECTS, VERY GOOD. JUST THAT NOT EVERYBODY HAS THE LUXURY TO DO THAT.

YEAH, YOU ALSO CONSIDER WHETHER IT IS A GOOD BUY. WELL DONE. SO I HAVE NO QUESTION THAT YOU HAVE A PROPER PROCESS OF INVESTING.

Posted by ipomember > Aug 29, 2013 10:00 PM | Report Abuse

what a great analysis, but again, my concern is one should look more at the business itself rather than focus too much in valuation or financial accounting coz the market might not just simply agree to your valuation. just my worthless 2 cents

2013-08-31 15:15

As for Padini i think inventory and receivable is important, if ones is looking at MYEG, inventory could means nothing since its providing services? Ya i admit not everyone got the chance to pass by the store and see hows the store doing, but somehow this is my edge, likewise if someone is involving into property industry, steel industry, or whatsoever, they have their edge too because they know the industry better than others do..

2013-08-31 15:41

@hk wong

I dont look at Bonia, but i can tell you seldom i see people inside BONIA store @ Pavillion, but of course it doesn't mean that its not doing well as there are other brands too like sembonia, braun buffel and etc. I think you can look at this guy's blog(http://www.intellecpoint.com/), he talks about bonia.. to be true i also learning by reading his blog...

2013-08-31 16:00

Graham Net-Net Investment Strategy and some property companies

In 1932 at the bottom of the Great Crash, Ben Graham wrote an article on Forbes about the cheapness of the market and how companies are being quoted in the market for much less than their liquidating value, as if they were all destined to be doomed. He called these types of stocks, "net nets", companies that sell for less than its net current asset value, or net net working capital. Graham used the following formula to compute the liquidation value of a company.

Net Net Working Capital = Cash and short-term investments + (0.75 * accounts receivable) + (0.5 * inventory) – total liabilities

It's the lowest form of valuation you could possibly do because it ignores everything about the business and just focuses on tangible assets. The formula states that;

• cash and short term investments are worth 100% of its value

• accounts receivables should be taken at 75% of its stated value because some might not be collectible

• take 50% off inventories, due to discounting if close outs occur

Net net comparison of some property companies

Three companies from Bursa; Daiman, Plenitude and KSL’s latest balance sheets were used to compute their net tangible asset and Graham net net values. Besides cash, the net net values of land, development costs and investment properties owned are also taken as 100% of the book value. This is a fair assessment as it is believed that these assets are likely to worth more than their book value than otherwise. Note that tax assets, property, plant and equipment, Goodwill and “other assets” are taken as worth nothing.

Table 1 below shows the prevailing share prices of the three property companies at the close in the morning on 6 September 2013, their net tangible assets and Graham net net per share.

Table 1: Graham net-net valuation of Daiman

Company Price NTA Net-net Discount

Daiman 2.63 4.85 3.76 -30%

KSL 2.02 3.13 2.47 -18%

Plenitude 2.10 3.35 3.04 -31%

The table shows that Plenitude, with a share price of RM2.10, is trading at the highest discount of 31% to its Graham net net value of RM3.04. Daiman at RM2.63, follows closely at a discount of 30%. It is noted that both Plenitude and Daiman has no debts at all while KSL has a debt to equity of 0.21. Plenitude also has its highest holding in cash at RM1.44, or 37% of the total assets. Daiman’s cash holding is RM1.23 per share, or 20% of total assets. KSL on the other hand has most of its value in land held for development of 36% of total assets. KSL’s net cash is only 47m, or less than 3% of the total assets.

Earnings based comparison

Table 2 below shows the market valuation based on earnings at the latest year end results.

Table 2: Market valuation based on earnings

Company Price PER EV/Ebit EV/Sales

Daiman 2.63 8.0 4.5 1.7

KSL 2.02 6.1 5.2 2.4

Plenitude 2.10 7.4 2.0 0.9

KSL’s PE ratio of 6.1 appears to be the lowest valuation while there is not much difference between Plenitude and Daiman with PE between 7.4 and 8.0. However based on enterprise value, Plenitude has the best value with its market enterprise value (EV) only twice the earnings before interest and tax (Ebit). EV is even less than sales at 0.9 times.

Enterprise Value = Market Capitalization + Minority interest + Total Debt - Cash

KSL is the most expensive when enterprise value is taken into consideration. Its EV is 5.2 times Ebit, basically because it is the only one utilizing a fair bit of debts.

Conclusions

All three property companies above show that they are trading at steep discounts to their net tangible assets. They are even traded at substantial discounts to their Graham net net asset values, ranging from 18% to 31%. Of the three, Plenitude appears to be a better bargain with a Graham net net discount of 31% and enterprise value only twice its Ebit and less than its annual sales.

2013-09-06 13:55

TanKW, Thanks for pointing out the mistake (again). I had the right absolute value formula as below:

Fair Value PE =Basic PE x [1 + (1 - Business Risk)] x [1 + (1 - Financial Risk)] x [1 + (1 – Earnings Visibility)],

But copied wrongly when i substitute the values. It should be:

Abs PE = 12.9 * [1+(1-115%)] *[1+(1-90%)] * [1+(1-100%)] = 12.0

So fair value of Daiman = 12*0.325 = RM3.90

Thanks again.

2013-09-07 16:39

Katsenelson’s absolute PE

The Katsenelson approach assigns a company with PE "points" and then calculates the fair value by multiplying it with a final multiple factor. This is an absolute approach to remove the effects of market dependency and competitor bias.

The model derives the intrinsic value of the stock based on the following five conditions.

1. Earnings growth rate

2. Dividend yield

3. Business risk

4. Financial risk

5. and earnings visibility

Fair Value PE =Basic PE x [1 + (1 - Business Risk)] x [1 + (1 - Financial Risk)] x [1 + (1 – Earnings Visibility)],

where the Basic PE is the starting PE from a table which takes into consideration of the growth rate and the dividend yield. The table starts with 0% growth for stocks with a PE of 8. For every percentage of earnings growth from 0% to16%, the PE increases by 0.65 points. Once the growth rate reaches a certain level, in this case 17%, the PE value increases by 0.5 points and maxes out at 25% growth. So any stock with a PE higher than 21.9 is capped to a 25% growth rate.

Dividends are tangible to the investor whereas earnings are not. Dividends provide you with a hard return whereas you may never get to see earnings. Every dividend yield percentage receives an equivalent PE point. If the dividend yield is below 1%, give a bonus of 0.5 points.

Katsenelson’s absolute PE for Daiman

Basic PE for Daiman with a growth of 5% and a dividend yield for last year of 4.6%,

Basic PE = 8 + 0.65*5 + 4.6 = 12.9

Business risk: Daiman’s business has low efficiencies with low return of assets of just 5.3% and return o f capital of 6.5%. Cash return (FCF/IC) is also not that great at 5%. Hence the management may not be capable and there may not be much moat in its business. An arbitrary 15% discount is applied to its business risk.

Financial risk: Daiman has a very healthy balance sheet with no debt. Hence a premium of 10% is applied.

Earnings visibility: Daiman has quite stable operating profit margins of more than 30%. Its cash flow from operations is also stable though they are slightly below the net income. No premium nor discount is applied.

Hence the absolute PE for Daiman is:

Abs PE = 12.9* [1+(1-115%)] *[1+(1-90%)] * [1+(1-100%)] = 12.0

Fair value of Daiman = 12.0*0.325 = RM3.90

2013-09-07 16:44

my friend kcchongnz will u buy knm share if SMA 250 IS BELOW SMA 10.uptrend mode.

2013-09-07 16:58

kc, realistically, would you always use a basic P/E of 8 ? Typically I would say the basic P/E should we the average P/E of the industry and its peers ?

2013-09-08 08:37

house, then you are talking about comparative valuation now, not absolute PE valuation.

Why then PE 8 as the basic PE? To me this is related to what is my required return investing in stock. Flip the PE over you have an earnings yield of about 12%, and that is my required return, or a risk premium of 8% over the long term MGS rate. This I think is more than adequate.

I don't fancy too much about comparative valuation though I agree it has its advantages and benefits. Reasons are shown in my questions:

1) Would two companies in the similar industry be accorded the same PE valuation if they have different capital structures; one with huge excess cash, and the other heavy debt?

2) Ditto if they have vast different in operation efficiencies?

3) ditto they have different expected growth rate?

4) Ditto if their quality of earnings are different; say one with part of the earnings from some non operating investments, or one has to spend considerably more money in working capital etc?

5) ditto one pays regular and increasing dividends while the other spend a lot of money invest this and that but with return way below than the cost of capital?

6) etc etc

2013-09-08 09:39

Posted by yungshen1 > Sep 7, 2013 04:58 PM | Report Abuse

my friend kcchongnz will u buy knm share if SMA 250 IS BELOW SMA 10.uptrend mode.

MY FRIEND YUNGSHEN1, YOU ASKED THE WRONG PERSON. BUT LET ME ASK YOU BACK. WHY SMA 250 BELOW SMA10 IS AN UPTREND MODE? WHY NOT SMA 300, 280, 230, OR 200 INSTEAD OF SMA 250? AND WHY NOT SMA 5, 12, 15, 20 INSTEAD OF SMA 10?

AGAIN I CAN'T REMEMBER HOW MANY TIMES YOU HAVE ASKED ME TO BUY KNM AND I HAVE ANSWERED WITH NUMBERS, FACTS AND FIGURES? YOU JUST WANT OT ASK FOR FUN, AREN'T YOU?

Posted by yungshen1 > Sep 8, 2013 10:03 AM | Report Abuse

that y i buy knm.i believe one day it will reach to 2.000 again.

BUYING A STOCK TO ME IS INVEST IN PART OF THE COMPANY'S BUSINESS. ONLY WHEN I BELIEVE IT IS WORTHWHILE TOO INVEST THEN ONLY I DO. TO MAKE MYSELF BELIEVE IF THE COMPANY, OR THE STOCK WILL GIVE ME GOOD RETURN, I HAVE TO LOOK AT AND STUDY ITS BUSINESS IN DETAILS. IT IS NOT JUST BLINDLY BELIEVE. BELIEVE BASING ON WHAT?

AGAIN DON'T TELL ME YOU BELIEVE GENERAL LEE WILL GORENG THE SHARE UP TO 2.00 SOON SO THAT YOU CAN SELL FOR A PROFIT. I RATHER BELIEVE THAT PIG CAN FLY.

2013-09-08 11:01

Haha, pigs can fly - good one. Nevertheless a lot of people who believe in KNM are having the same thinking that they can make money from China stocks listed here.

2013-09-08 11:34

I like "Pig can fly" too. In this forum, I see many choose to believe pig can fly and 敢死队. I broke out in cold sweat for their hard earn money.

2013-09-08 12:16

Conclusion is.....

Daiman is undervalued

Is time to hold for long investment

2013-09-08 21:50

inwest88

Good choice and good write-up. As of now both you and otb have already selected 10 stocks. Hopefully it can help enlighten investors to make their final decision. But no blame game please.

2013-08-29 20:29