(TapDance) Ethanol theme on an obscure small-cap industry leader

tapdance

Publish date: Tue, 05 May 2020, 04:19 PM

Summary

Market demand for sanitizer will remain elevated in the foreseeable future amidst the virus rampant era.

This company – which supplies ethanol, a key ingredient for manufacturing sanitizer – has recently commissioned its new facility to enhance capacity and productivity.

Given the ferocious sanitizer demand, the new facility’s ramp-up could exceed market expectation in terms of speed and profitability.

The co. is not trading at a premium valuation despite the crazy ethanol theme seen in the market right now (i.e. Hexza and/or Hextar). It is because the co. has recently experienced some lackluster performance which is mainly by-design.

The capacity enhancement program mentioned earlier requires the management to shut-down its existing facility for months affected its profits. Therein, alongside with the trade war impact, it looks uglier than it actually is.

Simply, investors will be able to invest in:

- A sanitizer themed company,

- which product is experiencing significantly elevated demand,

- at a well-timed production enhancement program

- at a discount

- because real potential is masked by identifiable factors

Description

It appears the usage of sanitizer is here to stay and likely would escalate further if taking into consideration of the ‘new norm’ i.e. virus will still be lurking around – even post vaccine launch.

Ethanol is a key ingredient for manufacturing sanitizers. It explains the sudden spike in interest for ethanol players.

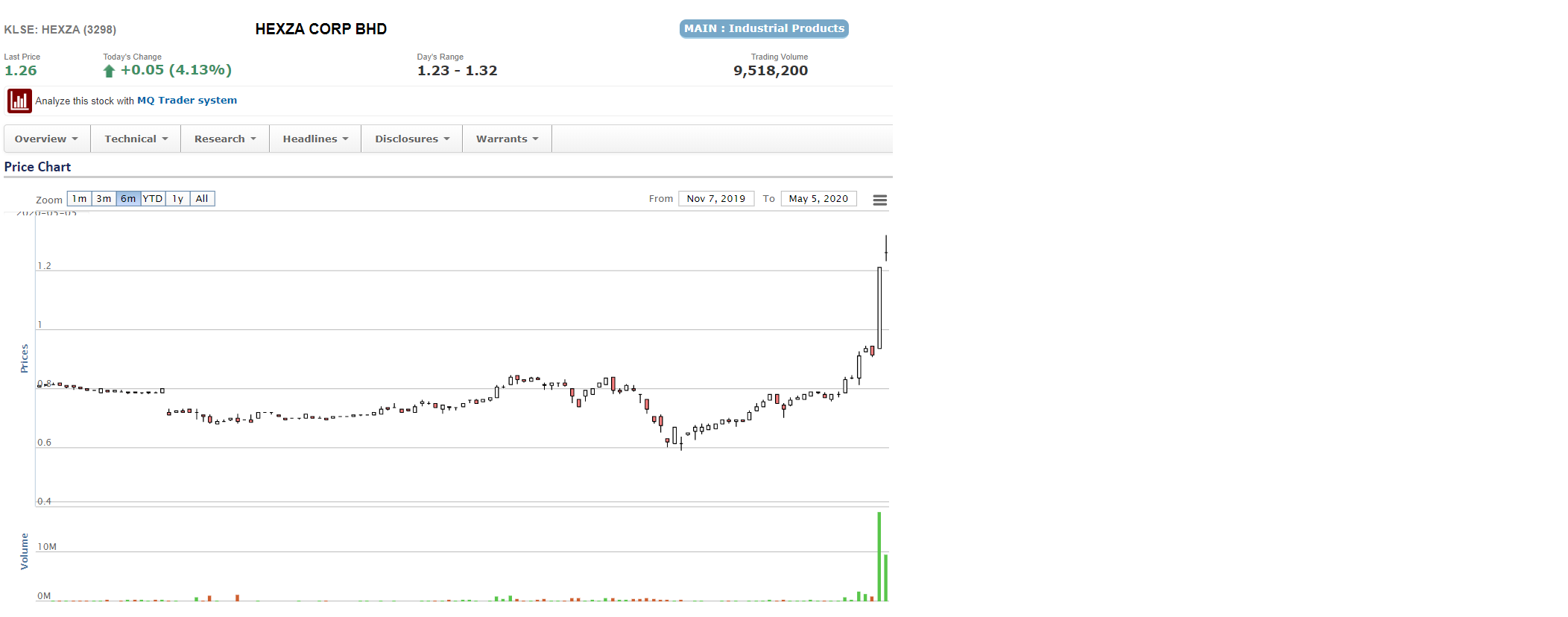

Hexza being one of the more prominent ethanol player saw its share price spiked more than +60% ON TOP of the April market recovery.

The mighty ethanol trend is truly mighty. To truly understand the hype, look no further from Hextar. Yes, mild spelling difference from Hexza.

Hextar or Hexza, one might wonder! Confused? I was. So I’ve decided to look up Hextar and found out that it focuses in agricultural chemical.

Quite misleadingly – especially under the ethanol trend – the website states one of its division is to ‘manufacturing of hygiene disposal product’ of which was referring to its cotton and tissue products. Not entirely surprise that market misunderstood Hextar as Hexza and that it supplies ethanol.

Perhaps Hextar’s run-up is explainable. Still one couldn’t completely neglect the fact that both moved up at the same time and that there’s no spill-over effect at all. Or perhaps they both fuel each other’s price trend.

While market is completely sucked into the two Hex-es, the truly leading ethanol player was ignored.

Hexza generates ~RM100 mn revenue. This true leader (“True Leader”) that I’m going to talk about is valued at ~RM100 mn market cap whilst generating ~RM1,300 – 1,500 mn.

In case you have not gotten it, I’ll spill the bean. It is trading at 1x Hexza’s market cap when it generates 13 – 15x Hexza’s revenue. The below chart proofs that its share price performance is broadly muted.

True Leader used to generate ~RM30 mn pretax. Its recent earning has declined affected by the US/China trade war. Hexza experienced similar treatment.

The big deal is – True Leader allocated more than 2-years’ worth of earnings into capex for capacity expansion AND HAD TO SHUT DOWN ITS EXISTING FACILITIES FOR SEVERAL MONTHS – so to make way to ready the new capacity!

Excerpt from AR is as attached:

It means True Leader experienced double whammy whereby its recent lackluster performance was dragged down by

1) trade war and,

2) some purported anomaly event – not related to its true earning power – and that particular event is making its way to proof its worth.

The best part is –

- the real potential is about to be surface amidst this sanitizer hungry period of time

- while the market punishes it for its recent misery – which is by-design by the management.

******* *******

Enough about (potential) earnings.

True Leader’s balance sheet might look a bit shabby on a quick glance. Its debt level appears slightly high but that is because of its trade facility – namely, in laymen, is for acquiring stocks. Verifiable in the co.’s AR.

The co.’s dividend is nothing to shout about. However, because of its hammered valuation, that paltry dividend payout is now yielding a decent ~4%.

Bear in mind that management increased its dividend payout amidst the weaker performance, and after the recent heavy capex cycle.

So when the business performance recovers, it is also reasonable to expect an even higher dividend.

******* *******

For those impatient punters who couldn’t wait to have the co.’s name, sorry, I WON’T reveal.

I believe there are sufficient hints in my article to discover the co.’s identity. And investors ought to do some work for their own fortune. That is also to excuse myself from any low-class pump and dump accusation.

So, good luck!!

******* *******

Latest update (2.5 hours after the original post):

I certainly did not expect it to be so easy. Kudos to fellow mate Terrchung who has figured out the co.'s identity!

And yes the the company is Nylex.

tapdance

Make ur guesses heard over here!

2020-05-05 16:28