Insider Asia’s Stock Of The Day: ULICORP (14/08/2015)

Tan KW

Publish date: Fri, 14 Aug 2015, 10:54 AM

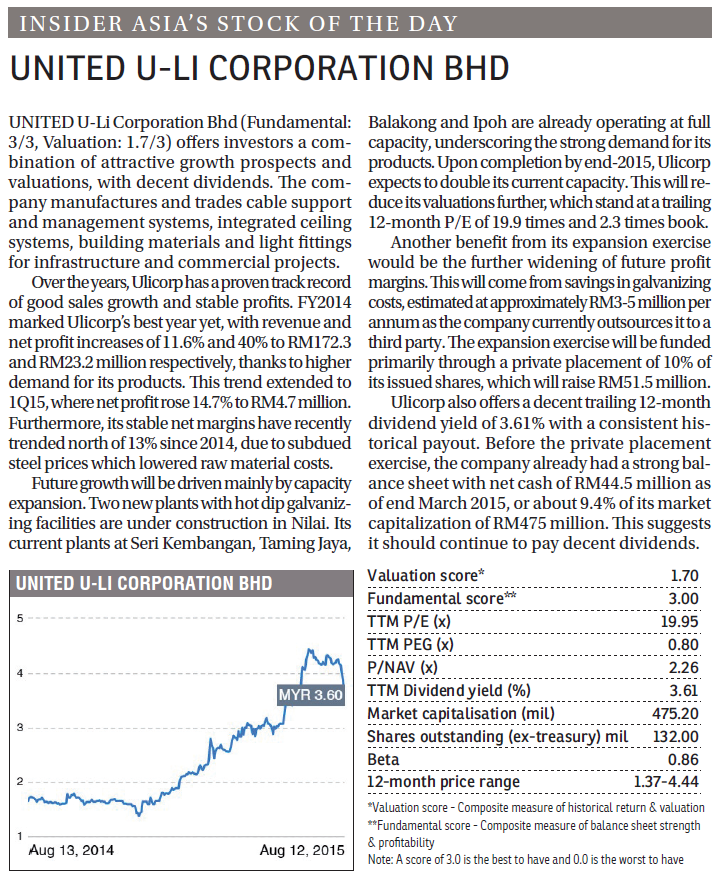

United U-Li Corporation Bhd (Fundamental: 3/3, Valuation: 1.7/3) offers investors a combination of attractive growth prospects and valuations, with decent dividends. The company manufactures and trades cable support and management systems, integrated ceiling systems, building materials and light fittings for infrastructure and commercial projects.

Over the years, Ulicorp has a proven track record of good sales growth and stable profits. FY2014 marked Ulicorp’s best year yet, with revenue and net profit increases of 11.6% and 40% to RM172.3 and RM23.2 million respectively, thanks to higher demand for its products. This trend extended to 1Q15, where net profit rose 14.7% to RM4.7 million. Furthermore, its stable net margins have recently trended north of 13% since 2014, due to subdued steel prices which lowered raw material costs.

Future growth will be driven mainly by capacity expansion. Two new plants with hot dip galvanizing facilities are under construction in Nilai. Its current plants at Seri Kembangan, Taming Jaya, Balakong and Ipoh are already operating at full capacity, underscoring the strong demand for its products. Upon completion by end-2015, Ulicorp expects to double its current capacity. This will reduce its valuations further, which stand at a trailing 12-month P/E of 19.9 times and 2.3 times book.

Another benefit from its expansion exercise would be the further widening of future profit margins. This will come from savings in galvanizing costs, estimated at approximately RM3-5 million per annum as the company currently outsources it to a third party. The expansion exercise will be funded primarily through a private placement of 10% of its issued shares, which will raise RM51.5 million.

Ulicorp also offers a decent trailing 12-month dividend yield of 3.61% with a consistent historical payout. Before the private placement exercise, the company already had a strong balance sheet with net cash of RM44.5 million as of end March 2015, or about 9.4% of its market capitalization of RM475 million. This suggests it should continue to pay decent dividends.

This article first appeared in digitaledge Daily, on August 14, 2015.

Insider Asia’s Stock Of The Day: ULICORP (14/08/2015)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Edge - Insider Asia’s Stock Of The Day

Discussions

hei calvintaneng, you mention SIFU Boneschthe, who is that , is he share expert? pls provide

2015-08-14 11:25

Grace Ly

Bonescythe gave recommendation from time to time.

I once bought Ipmuda at 70 cents and recommended. And to my surprise Bonescythe wrote a glowing article on Ipmuda. IPMUDA WENT LIMIT UP!

Then even Star newspapers mentioned about Bonescythe the blogger from I3 Forum.

Well Bonescythe has written over 300 articles. Some good and some lousy.

Ulicorp was very "chun" at Rm1.20

Go to Ulicorp Forum

Scroll back to February 2014 and you will read Bonescythe's article on Ulicorp in i3

2015-08-14 11:53

calvintaneng

WHOA!

THIS STOCK WAS RECOMMENDED BY SIFU BONESCYTHE AT RM1.20 ONLY

NOW ALREADY UP BY MORE THAN 200%

BE CAREFUL NOW AS IT MOVES FROM INVESTING TO GAMBLING ZONE.

IS IT IN BUBBLE TERRITORY?

REMEMBER THIS IMPORTANT RULE

"HE THAT IS LOW NEEDS FEAR NO FALL"

BETTER SELL INTO STRENGTH AND CASH OUT

2015-08-14 11:09