(Tradeview 2020) - The Argument For & Against Glove Sector. Pick Your Side. But Choose Wisely.

tradeview

Publish date: Thu, 10 Sep 2020, 12:29 PM

|

|

Against Gloves |

|

Record Earnings For The Next 4 Quarters (Minimum. May Be More than 4Q)

|

Vaccine Approvals / End of Covid-19 Pandemic |

|

Committed & Lock In Orders with Deposit Paid

|

Post Covid-19 Normalisation of ASP |

|

Delivery Lead Time of 20 months

|

Too Expensive Valuation |

|

Huge Cash Hoard / Net Cash position

|

Windfall Tax |

|

Potential Special Dividend / Yield Play

|

Labour Remediation Fees |

|

Further ASP Increase

|

Higher Cost of Raw Materials |

|

Additional Capacity

|

Potential Oversupply from New Entrants Into The Market |

|

Structural Change in Demand & Hygience Practices Post-Covid 19

|

Weaker USD, Stronger MYR |

|

Continuous Stock Piling by Governments

|

US / Local Election |

|

Rerating of Latex Gloves ASP as Nitrile Gloves waiting time far exceeds Latex Gloves

|

End of Loan Moratorium, Retail Investors leave Bursa |

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me at : tradeview101@gmail.com

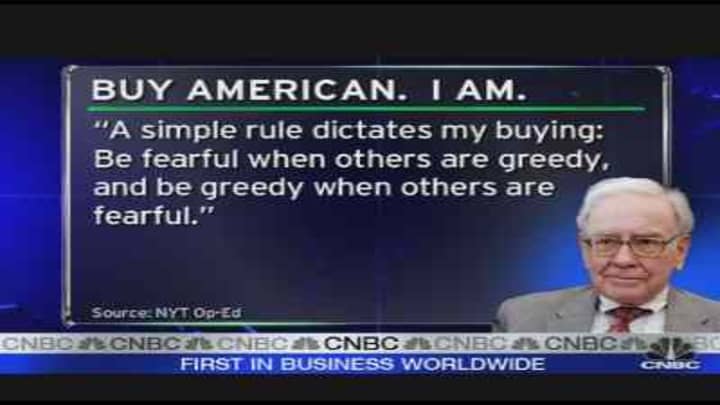

Food for thought:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-08-31

SUPERMX2024-08-30

HARTA2024-08-30

HARTA2024-08-30

HARTA2024-08-30

HARTA2024-08-30

HARTA2024-08-30

KOSSAN2024-08-30

KOSSAN2024-08-30

KOSSAN2024-08-30

SUPERMX2024-08-30

TOPGLOV2024-08-30

TOPGLOV2024-08-29

KOSSAN2024-08-29

SUPERMX2024-08-29

SUPERMX2024-08-29

SUPERMX2024-08-29

SUPERMX2024-08-29

SUPERMX2024-08-29

SUPERMX2024-08-29

TOPGLOV2024-08-28

KOSSAN2024-08-28

SUPERMX2024-08-28

TOPGLOV2024-08-27

TOPGLOV2024-08-26

TOPGLOV2024-08-23

KOSSAN2024-08-23

KOSSAN2024-08-23

KOSSAN2024-08-23

KOSSAN2024-08-23

KOSSAN2024-08-23

KOSSAN2024-08-23

KOSSAN2024-08-23

KOSSAN2024-08-23

KOSSAN2024-08-21

HARTA2024-08-21

HARTA2024-08-21

KOSSAN2024-08-21

KOSSAN2024-08-21

KOSSAN2024-08-21

TOPGLOV2024-08-20

HARTAMore articles on Trading With A View

Created by tradeview | Oct 18, 2021

Created by tradeview | Sep 28, 2021

Created by tradeview | Sep 15, 2021

Created by tradeview | Jun 01, 2021

Created by tradeview | Apr 08, 2021

Created by tradeview | Mar 17, 2021

Discussions

I am not complaining about the current glove sliding "pandemic" bcoz I can buy what I couldn't one month ago. Thanks for the FEAR FACTOR

2020-09-10 20:21

i think 1 have to think beyond current situation.Be logic, It is no doubts that current glove supply market remains tight as orders have been stretched to at least next year. But how about in 2022 and there after when every 1 gets vaccinated? can their ASP remain as high as current and earnings still sustain? that remains a question. Currently many players started to venture in glove making, not only china but local players are ramping up production as well. If their current supernormal profit can still sustain beyond 2022 and grow then the current valuation is justifiable, what if it is an opposite? Would u still pay so high PE of 20 or more to buy a company if their growth cannot sustain? It is similar to a company selling its property to make 1 off supernormal extraordinary gain. Would you take in the gain to calculate the value or exclude it becoz it is 1 off item? Shudn't you also look at the earning for 2022 and 2023 as well when demand supply balance out?

2020-09-11 13:09

tq Tradeview 4 tis impartial writeup. Better den IB report. Always flipflop. Limpek u sound like reasonable person. I answer ur q:

1. 2022 every get vaccine, u sure? Can u confirm 100% will happen? I don't dare 2 confirm. But if u r right, will glove demand reduce? I don dare to confirm.

2. ASP high becos demand high supply low. Good argument. But u think China can ramp up supply 2 fight Msia when Nitrile Glove r innovation product of Msia with raw material available here, not China?

3. Ok la, u compare supernormal profit in 21 to selling property. U sell property no more property. Tts y one off. But glove company still manufacturing, even ASP fall, they catch up with new capacity 2 close demand gap. So not one off.

4. Do u noe how much profit Glove company going 2 make next 1 year?

5. U value stock bcos what might happen 2 years later and ignore next 1 year. Which analyst got crystal ball c 2 years ahead but ignore next year?

2020-09-11 15:16

Ok. Be logic just ask urself these few questions

1) Can the current supernormal ASP be sustained in the long run due to this pandemic? If everything back to normal, what will be the ASP in the future? Can the current earning be sustained forever?

2) Now so many local players are venturing into glov becoz of their lucrative profit.(e.g. Karex, AT, Gets, etc) Will the supply and demand gap be filled up more quickly than our initially thought?

3) A business is for a long term basis and not just for 1 or 2 years. Dun you think valuing a company based on its normalised earnings which can sustain in a long run will be more proper compared to just 1 or 2 year supernormal profit?

I think u know the answer

2020-09-11 16:42

I try 2 answer ur q :

1. I don noe wat happen in future bcos I don noe when pandemic end. If everything go bak 2 normal, I agree ASP go bk 2 normal. But in future is new normal, no old normal. Meaning, possible we r seeing shift in demand and behaviour pattern. Nothing is forever. But pandemic happen every few years. Each time glove price higher than b4. Aids, SARS, H1N1, EBOLA, Covid-19, what is next?

2. Tis one i am not worried. new players have no economies of scale, cost is not competitive, and management not skilled like big boys. All r Small players only announce news 2 push share price. Goreng kaki oni nia....

3. Tis point I agree wit u. Long term not short term. I nvr look short term. I look long term. All these companies have been growing long term not short term. Many years only bcome world champion. Valuation on normalise earnings is ok, but cannot ignore supernormal profit. Otherwise, we shud tell glove company next 1 year no nd open 4 business. Close shop. Open again 2 years later when pandemic over bcos market wont value ur next 1-2 years hardwork.

My last Q 2 u? Y u dont believe in Glove story when u c their results so good? Keep on getting better. Y u want it to die and value cheaply. Any other company can do better than Glove player in next 1-2 years? If got pls tell me, I go 2 buy now.

2020-09-11 17:02

So what do u think the fair value then? 10,12,15? Based on what assumption? If you are businessman, would you pay those prices to buy over the company? why not setting up your own new production line compared to buying over the company?

2020-09-11 17:17

Also u can take an example of the face mask, when the business is so lucrative, everyone venture in. Now look at the price of face mask. Facemask and glove are both PPE. the 1st already show u the results.

2020-09-11 17:23

Limpek, I answer ur Q :

1. Face mask cannot compare 2 Glove at all. One is low barrier 2 entry, 1 is high barrier 2 entry. Glove esp Nitrile Glove nd years of R&D, but mask, esp 3 play face mask u buy 1 machine from china u can do it immediately. Unless N95 mask which oso nd more skills. Msia is pioneer of Nitrile tts y Msia is champion of Gloves.

2. 1 Glove factory takes 9-18 months 2 set up. Do u think new player can easily set up and fight big boys. Big boys take many years 2 achieve economies of scale. New player sure suffer losses. No one can takeover bcos market cap big, but can take placement in shares, don nd set up production line.

3. My FV? I think CIMB, Credit Suisse, CLSA, UOB report is v fair & oso consider ur worry of post Covid-19 FY 22 /23 into their valuation. U can use d assumption from those report. Just dont use Macquarie report which is garbage.

I think u shud read author write up. Explain better den me.

2020-09-11 17:35

why macquarie report is garbage, their arguement is valid and reasonable. We look at long term not just short term.

2020-09-11 18:15

Flip flop and u-turn, eat back their own shits, conscience? integrity? Credibility? Reliability? Reputation? All go into toilet and longkang overnight. Ha, ha. Everyone can vote and judge clearly.

2020-09-12 14:36

I think investors look at things on 2 fronts ; consistent dividends (long term) and trading shares of whatever counters (regular short term). The Big 4 consistently pay out dividends twice a year. The smaller players just don’t quite have the cash.

It is entirely up to everyone to decide what their strategy is. Mine is as per my first sentence above.

2020-09-12 15:08

After 4 months, it is clear that you have chosen wrong

You must never forget that human kind will always prevail

That nothing can hold up to the human spirit

That this too, shall pass

I suggest you suggest to your paying followers to switch to true recovery stocks

Top pick is Genting Berhad

In 1 years time we shall see the performance of gaming companies vs the hype of gloves

The stock market is a voting machine in the short term, a weighing machine in the long term

Gaming is forever and eternal and will once again show its enduring quality

Sincerely,

EMSVSI

2020-12-23 17:09

It is clear Sekarang, the 1 who is wrong is u, EMSVSI. How much ur losses now Genting + GentingM + all the warrants? Counting chicken before it keluar? Lu ingat lu pandai?

2021-01-08 15:57

walao esmsvi ... seeing genting still wanna go in now meh ... tourist tak de but covid cases got lar ... really need to wake up already. i think those who keep promoting genting now really need to say sorry already ... to tradeview as well.

2021-01-08 19:38

.png)

megat36

Im just gonna stick with glove.im in deep red almost 50%.might as well just ride and test my luck.

2020-09-10 14:20