GENM: A relook into Genting Malaysia from Profitability, Volume Spread Analysis and what’s Insiders Report are telling they are doing now ?

TradeVSA

Publish date: Sun, 22 Sep 2019, 02:07 PM

Comment what stock you like us to cover below for the next article....

Genting Malaysia Berhad (GENM) (4715.KL) listed in the Bursa Malaysia

Background of Genting Malaysia (GENM) (4714.KL)

Genting Malaysia (GENM) is one of the leading leisure and hospitality corporations in the world which consist of gaming, hotel, entertainment and amusement. Genting Malaysia (GENM) operates through two segments.

- The Leisure & Hospitality segment comprises integrated resort activities, which include the gaming, hotel, entertainment and amusement, tours and travel related services and other supporting services.

- The Properties segment is involved in property developments, property investment and management.

Genting Malaysia (GENM) owns and operates major properties including Resorts World Genting in Malaysia, Resorts World Casino New York City, Resorts World Bimini in the Bahamas, Resorts World Birmingham and over 40 casinos in the United Kingdom and Crockfords Cairo in Egypt. Genting Malaysia also owns and operates two seaside resorts in Malaysia, namely Resorts World Kijal in Terengganu and Resorts World Langkawi on Langkawi island.

Revenue for Genting Malaysia improved by 11% yoy to RM5,337.1 m on 1H19. The improvement mainly contributed by higher revenue from the leisure and hospitality business in Malaysia by 14.9% yoy to RM3,665.6 m. However, the overall business volume from gaming segment declined in 1H19 due to reduction in incentives offered to the players. Strengthening of the USD against MYR helped to achieve higher revenue from the leisure and hospitality businesses in US and Bahamas by 7.8% yoy to RM745.1 m.

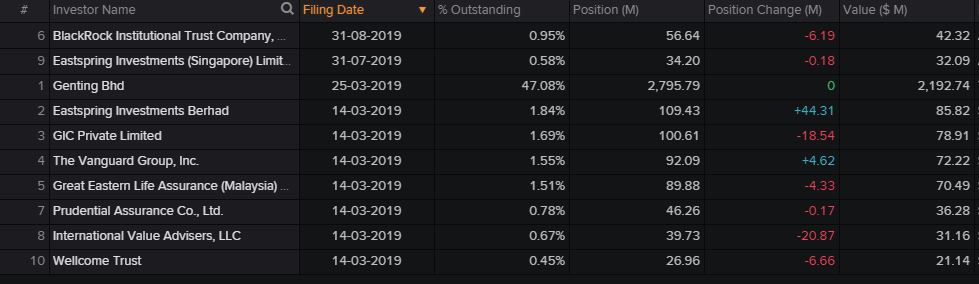

Recent Insider Report for Genting Malaysia (Bursa Malaysia)

In Genting Malaysia (GENM), it is interesting to note that their parent company, Genting Bhd is their largest shareholders owning almost 49% of the company with floating share of 46.6% in the Insider Report of Genting Malaysia (GENM).

Bursa Malaysia listing requirement stated a listed company like Genting Malaysia (GENM) has to meet a 25% public spread requirement. Public investors are defined as investors with less than 5% shareholding and not related to directors of the company. The 25% public spread must also meet the minimum requirement of 1,000 public shareholders holding no fewer than 100 shares each.

There’s sufficient shares for anyone to move the share up or down, thus liquidity of Genting Malaysia (GENM) can maintained.

The major shareholder Genting Berhad had not resorted to reducing or selling their shareholding as per Insider Report in the past nor I will see that happening in future, so the base of support @ RM3.00 for Genting Malaysia (GENM) is solid.

There’s look like exchange of major shareholder between Eastspring Investments and GIC Private Limited (Singapore equivalent of Khazanah Malaysia) in the Insider Report.

Is this a pure coincident or by design ? We will never truly know unless unit trust holder equivalent ask their fund manager Eastspring Investments Berhad.

Know Insiders in Insider Report for Genting Malaysia (GENM)

Known Major Shareholders (2)

As of 14 Mar 2019

49.53 % Genting Bhd

< 2 % Government of Singapore

Number of Shares: 5938 Million with floating shares 46.63%.

Conclusion: In the Insider Report, Genting Malaysia (GENM) didn’t see major selling but more of a reshuffle of shareholders between GIC Singapore and EastSpring Investment Berhad. I believe support for Genting Malaysia (GENM) @ RM3.00 is solidified within the scope of the Insider Report.

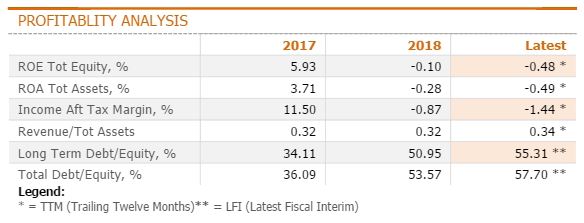

Profitability Analysis of Genting Malaysia

The return of equity for Genting Malaysia (GENM) is in negative area and does look similar to the parent company Genting Bhd doing slightly better.

With the opening of the overseas casino (Empire in NYC) and rebranding of theme park (with Fox and non-Fox brand) in Malaysia, we will see the company Genting Malaysia return to black profitability soon but not so soon though.

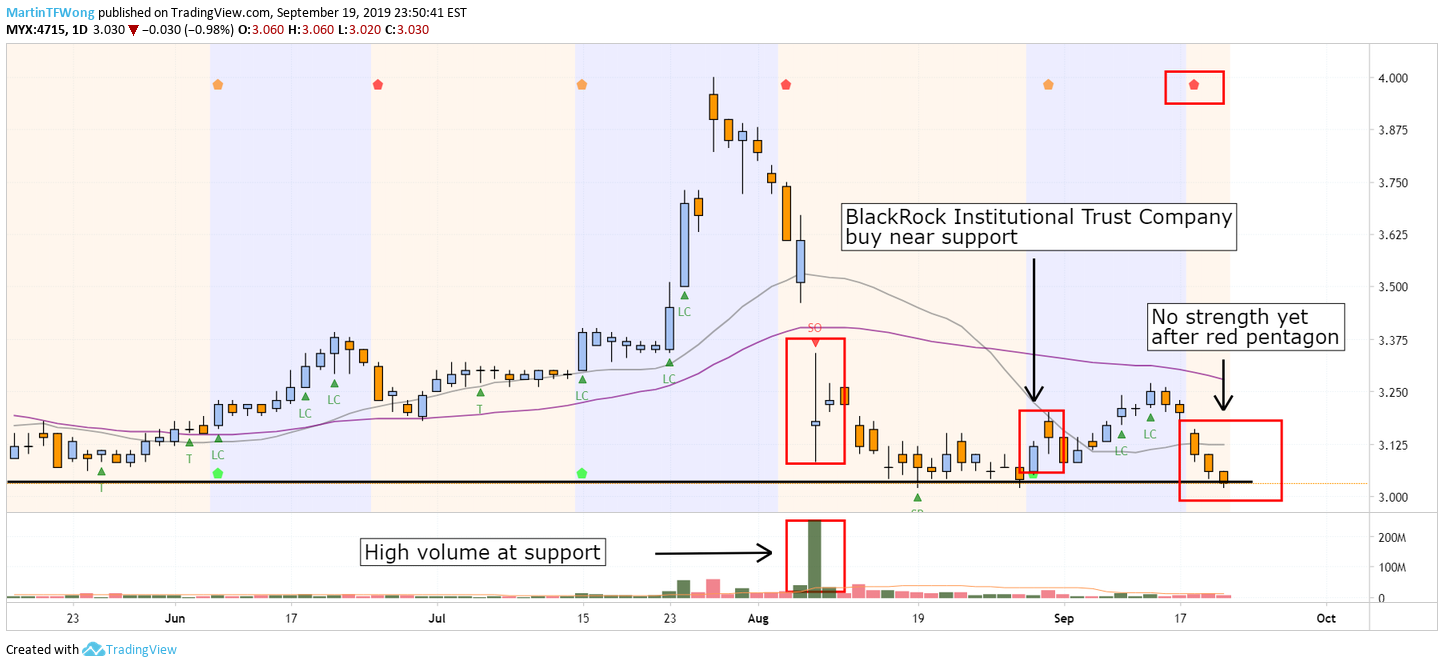

Weekly & Daily Chart VSA (Volume Spread Analysis) Review

Based on the weekly VSA chart, Genting Malaysia started to show strength by looking at the volume and market stages. Notice the distribution started on 22 May 2017 followed by mark-down stage. Genting Malaysia caught our attention as VSA trader due to high volume sell-off bar on 5 & 26 November 2018. Market stages subsequently change to accumulation and this offering us as VSA trader or investor for potential entry.

The accumulation in the weekly chart for Genting Malaysia are well supported with Spring bar. Trader or investor is advised to exit if the Spring bar fail to support at RM3.00. Look for next Sign of Strength above support if you looking for potential entry.

Similar with weekly VSA chart, daily Genting Malaysia chart showing temporary weakness back to the major support level. However, it is interesting to see another high-volume Sell-Off bar on 7 August 2019. The Sell-Off stopped near support level and price continue to move sideways in the accumulation.

From the Insider Report of Genting Malaysia (GENM), we also found BlackRock Institutional Trust Company are entering near the support after the Sell-Off. As for current setup in Genting Malaysia, we prefer to have a sign of strength signal with Pentagon to ensure the removal of weak hand holders are completed before the testing the resistance again at RM3.54.

*Pentagon Guider System has Buy or Sell Indicator indicated by Green Pentagon Icon and Red Pentagon Guider Icon in the field of Volume Spread Analysis. However, we advised reader that not all pentagons are buy or sell taken literally 100% of the time in Volume Spread Analysis method.

Contact us via: email at support@tradevsa.com or Call/WhatsApp at +6010 266 9761 if you have any queries about this Genting Malaysia (GENM) Group and its Insider Report article or opinion to clarify.

Invite all of you to Market Conference 2019, Oct 19 2019 TradeVSA for your next Event !

Improve your Financial Literacy & learn new Research/Insights of Investing and Trading from Insider Report perspective from our panel of speakers Oct 19, 2019 Market Conference 2019, co-partner with Macquarie Malaysia and media partner with TradingView. Early Bird Tickets available to 30 Sep 2019 !

https://www.eventbrite.sg/e/market-conference-2019-tickets-70882582713

Join our FREE Education via Telegram Channel: https://t.me/tradevsatradingideas

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on TradeVSA - Case Study

Created by TradeVSA | Nov 01, 2021

Created by TradeVSA | Oct 15, 2021

Created by TradeVSA | Oct 06, 2021

Discussions

@Alan Wong,

Big thanks to TradeVSA trader.

I'm very appreciate this article information. Can not I use VSA too.

Like I said VSA alone still lack of …. something.

Until you find out the true of live trading skills that you need to equip with. Then you know why I said so. I learn VSA more than 10 years back.

Stingray_EA is 100% hand free trading robot expert advisor integrate with VSA too but VSA is 25% of key decision why???

Case 1

========

Japan government agency announcement of japan recovery is very much late than my bog announcement. Plz check yourself their announce date.

Japan Full Recovery - Stingray_EA Prediction 2019

Author: stingray_ea | Latest post: Mon, 17 Jun 2019, 8:01 PM

https://klse.i3investor.com/blogs/stingray_ea/blidx.jsp

Case 2

=======

Stingray predition on Dow Jone 22000 to 27000 since Jan 2019.

Target 30K. No analyst dare... But Stingray_EA predited DJ will hit 30K since Jan 2019. World business channel busy talking about this now...

Case 3

=========

Armada buy call 0.14(bottom) since Jan 2019. Armada price closed at 0.34

now.

Case 4

sapnrg

========

Buy call at bottom 0.26 since Jan 2019. Target hit 0.37. High 0.375.

2019-09-24 06:46

Practise patient and calm investing in both Genting counters ....most will not dissapoint at the end ...only those who has offloaded too early are making all the noises

2019-09-24 22:13

stingray_ea

sad is that VSA alone still lack of …. something.

2019-09-23 11:29