Why KESM (RM4.81)? Stunning quarter result, net cash company with high NTA (RM6.52)

itjustabouttheprofit

Publish date: Sun, 05 Jun 2016, 05:32 PM

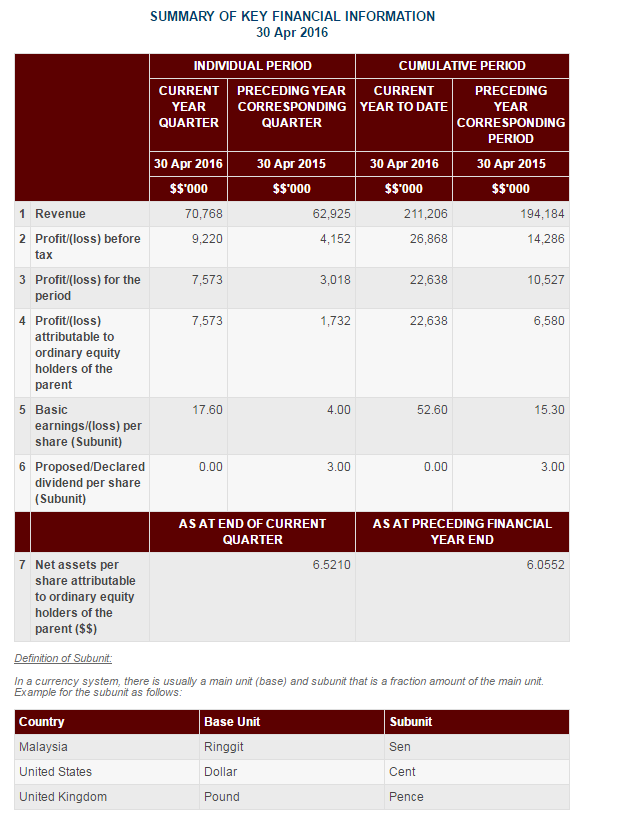

Latest quarter result:

30/4/2016 - 17.6sen

31/1/2016 - 16.3sen

31/10/2015 - 18.8sen

31/7/2015 - 24.3sen

Total - 77sen

Current PE ratio : 6.25 (RM4.81)

Company background

The company owned by a listed company in

Singapore, Sunright Limited (48.41%).

On 1 Apr 2015, the company proposed to

acquire the remaining shares (34.62%) of

KESM Test (M) Sdn Bhd.

Since the acquisition completed on 13 May

2015. the company's EPS have been spiked

up.

I am here to ANSWER a simple question.

Why KESM?

1) Low PE ratio company (PE 6.25)

2) Net cash company with net assets which

higher than their market price

3) Market leader in independent burn-in

test' service provider

4) Others

1) Low PE ratio company (PE 6.25)

2) Net cash company with net assets which

higher than their market price

Total cash : RM108mil

Total borrowing: RM45mil

Net cash position = RM63mil or RM1.46 per

share

As per quarter ended 30 April 2016, the

company's net assets position is at RM6.52,

which is 35% lower than current share

price of RM4.81!!

3) Market leader in independent burn-in

test service provider

As per disclosure from annual report, the

group (Sunright Limited) is the market

leader in independent burn-in test service

provider.

Other than that, recently the company has

won Stmicroelectronics Awards

on"Operation Excellent & Lean Awards".

![]()

4) Others

But with the release of the latest stunning

quarter result, I foresee the company will

be able to maintain or improved the result

in the next couple quarter.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Ultimate undervalue club

Created by itjustabouttheprofit | Dec 08, 2020

Created by itjustabouttheprofit | Sep 04, 2018

Created by itjustabouttheprofit | Aug 28, 2016

Created by itjustabouttheprofit | Apr 16, 2016

Discussions

one must understand the Company's business before investing in it... I would like to know more what is the business of "independent burn-in test' service provider"?

2016-06-06 08:25

Danny Tan, who would dare to listen to what crazy guy said like you? Please continue to act as you know all bosses of PLC, including Gadang.

2016-06-07 11:48

Too much cash in the kitty is a negative reflection on management.........have not used resources in a,beneficial way. TQVM for sharing your take on KESM. Cheers.

2016-06-07 16:41

boss of KESM rather enjoy holding cash than distributing out from his pocket to all other shareholders.

2016-06-07 18:35

KESM last minute buyer so strong, total 105.5 K unit worth RM543K at RM5.15 unable to match.

Any good news?

2016-06-08 22:37

U need to go to AGM to support Koon Koon...not being a keyboard warrior only..

2016-06-09 08:24

dannytansionkee

Post removed.Why?

2016-06-05 18:43