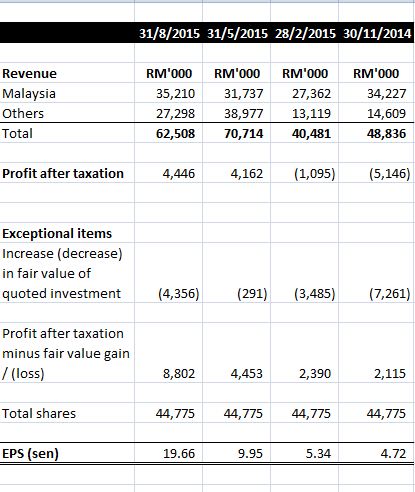

EPS estimation :

9.3sen (31 May 2015)

9.93sen (31 Aug 2015)

16.42sen (estimated for 30 November

2015) using 9.93sen (result for 31 Aug

2015)+ 9.7sen (decrease on fair value of

quoted investment on 31 Aug 2015)

+ 5.4sen (increase in fair value of quoted

investment on 30 Nov 2015) - 8.61sen

(foreign exchange gain on 31 Aug 2015)

11.02sen (estimated for 28 February 2016)

using 9.93sen (result for 31 Aug 2015) +

9.7sen (decrease on fair value of quoted

investment on 31 Aug 2015 - 8.61sen

(foreign exchange gain on 31 Aug 2015)

Total: 46.67sen

PE ratio : 8

Target price : RM3.73 (6 months)

Current price : RM1.81 (12/1/2016)

Number of shares: 44,775,000 shares

I am here to ANSWER a simple question.

Why CEPCO?

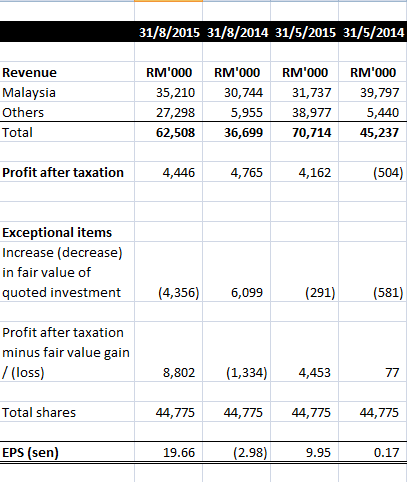

1) Export and profit increased significantly

in last two quarters. For the latest quarter,

EPS hit 19.63sen (exclusive the effect of

decrease in fair value of quoted

investment)

2) For the financial result for quarter ended

30 November 2015, increase of fair value of

quoted investment RM2.91million will

incurred

3) Overall outlook for ASEAN economies

this year are positive

4) Company stay profitable for the last 4

quarters

Introduction

The Company was established in 1983 under the name of Concrete Engineering Products Sdn. Bhd. with the objective of producing high quality concrete engineering products to meet the needs of the rapidly developing Malaysia and other ASEAN countries.

In May 1991, the Company assumed the name of Concrete Engineering Products Berhad when it was converted into a public listed company. In January 1992, the Company was listed on the Kuala Lumpur Stock Exchange.

The Company currently operates five factories, strategically located in Penisular Malaysia, fully certified with both requirements of SIRIM QAS International MS ISO 9001: 2000 (Quality Management Systems for the Manufacture of Pretensioned Spun Concrete Piles and Poles), and the IKRAM QA Services MS 1314 : Part 4 : 2004 (Product Certification for Class A, B and C of Precast Pretensioned Spun Concrete Piles from 250mm to 1000mm diameters).

Since its founding, the Company has been constantly striving for product excellence and today enjoys the reputation of being one of the market leaders in this region on prestressed spun concrete piles and poles. The Company currently exports substantial quantities of its products to the overseas markets covering Singapore, Brunei, Indonesia, Myanmar and the Gulf region.

The five main divisions of the Company are as follows:

a) Engineering Design and Research

b) Sales and Technical Services

c) Planning and Production

d) Quality Assurance and Control

e) Financial and Human Resource Management

Why CEPCO?

1) Export and profit increased significantly

in last two quarters. For the latest quarter,

EPS hit 19.63sen (exclusive the effect of

decrease in fair value of quoted

investment)

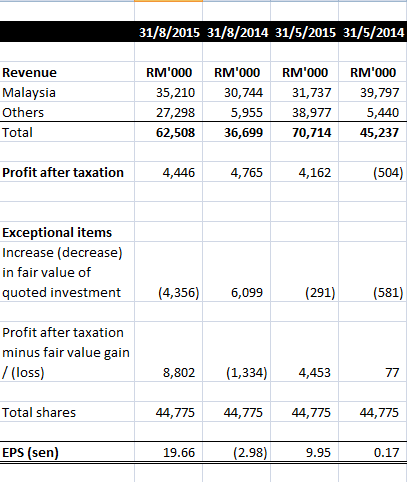

Refer to table above, the revenue have increased significantly during May 31, 2015 and Aug 31, 2015. For earning per share excluded the fair value loss on quoted investment, both of the earning per shares have improved significantly compare to last year.

From the revenue from quarter report, you can see

that the sales to others (ASEAN country) increased

significantly in this 2 quarters. From the explanation from

the management in the quarter, it is due to more

deliveries to oversea project

.

.

I believe that the increased in export are due to depreciation of Malaysia ringgit as it made their product cheaper in term of US dollar, more competitive and appear cheaper to foreigners in term of US dollar. Hence foreigners will more willing to buy from CEPCO as it is more cheaper compare to other countries.

As the US dollar still trading around RM4.20 to RM4.40 after 1 September 2015 until today, i foresee that the export for the company will maintain or improved.

Refer to the link below:

http://www.economicshelp.org/macroeconomics/exchangerate/effects-devaluation/

Refer to the article above, here is the effects of devaluation

1. Exports cheaper. A devaluation of the exchange rate will make exports more competitive and appear cheaper to foreigners. This will increase demand for exports

2. Imports more expensive. A devaluation means imports will become more expensive. This will reduce demand for imports.

3. Increased AD. A devaluation could cause higher economic growth. Part of AD is (X-M) therefore higher exports and lower imports should increase AD (assuming demand is relatively elastic). Higher AD is likely to cause higher Real GDP and inflation.

2) For the financial result for quarter ended

30 November 2015, increase of fair value of

quoted investment RM2.91million will

incurred

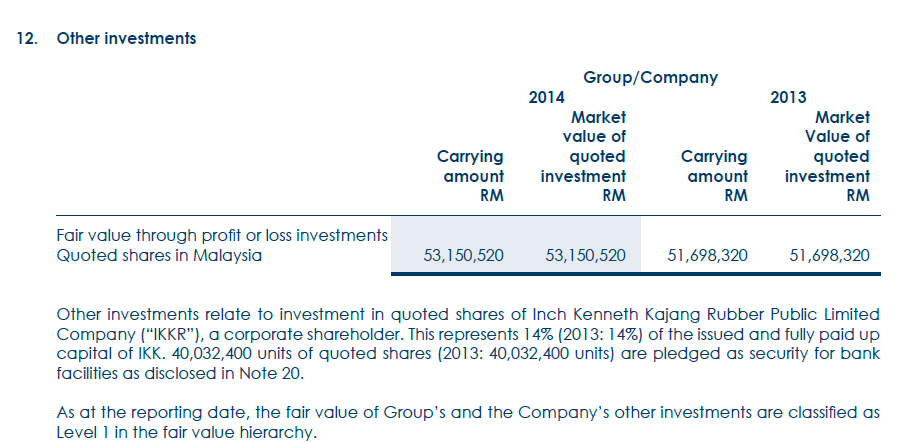

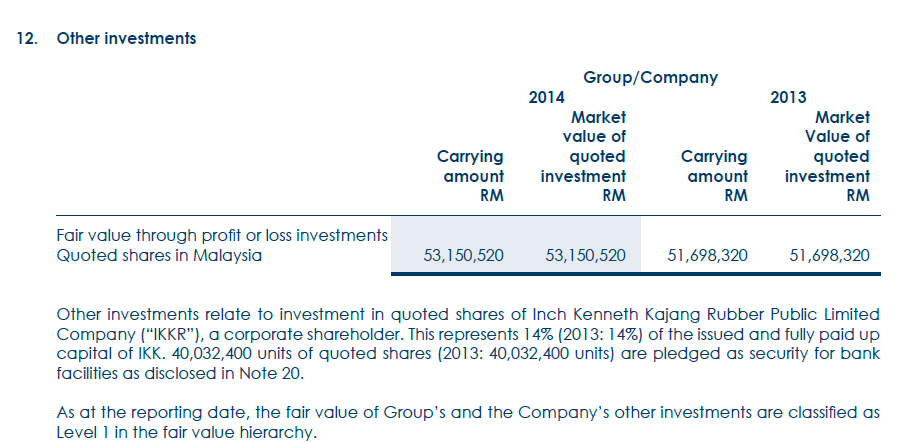

From the pages 59 of annual report on 31 Aug 2014, the investment in quote shares for CEPCO is in Inch Kenneth Kajang Rubber Public Limited Company (Incken - Stock number:2607). CEPCO holds 40,032,400 units of Incken.

Below are the closing price of Incken:

|

Date |

Share price |

|

30/11/2015 |

RM0.700 |

|

31/8/2015 |

RM0.650 |

|

29/5/2015 |

RM0.725 |

|

27/2/2015 |

RM0.730 |

|

30/11/2014 |

RM0.780 |

sources :

https://sg.finance.yahoo.com/q/hp?s=2607.KL&a=10&b=29&c=2014&d=10&e=30&f=2015&g=d&z=66&y=198

From the table above, you noticed that the share price of Incken have incurred loss from 30/11/2015 to 31/8/2015. However, for share price jumped from RM0.65 to RM0.70 during quarter ended 30 November 2015.

Below are the increase or decrease of fair value from quoted investment extraced from quarter report:

|

Date |

Increase (decrease) of fair value from quoted investment |

|

31/8/2015 |

(RM4.356million) or (EPS9.7sen) |

|

29/5/2015 |

(RM0.291million) or (EPS0.6sen) |

|

27/2/2015 |

(RM3.485million) or (EPS7.8sen) |

Refer to the table above, you have three consecutive decrease of fair value from quoted shares. For the last the fair value loss have reached RM4.356mil. The main reason due to the share price of Incken have dropped from RM0.725 to RM0.65 during the quarter.

For every 1sen dropped in Incken shares, the company will incurred RM582k of loss on fair value. Also, for every 1sen increased in Incken shares, the company will incurred RM582k of gain on fair value

However, during 1 September 2015, Incken's share price have jumped from RM0.65 to RM0.70 during quarter ended 30 November 2015. Hence the fair value gain of RM2.91million will incurred for quarter result ended 30 November 2015.

3) Overall outlook for ASEAN economies

this year are positive

According to newspaper report, ASEAN

economies sees strong growth for 2016

http://www.straitstimes.com/politics/economist-sees-strong-growth-for-asean-despite-china-turmoil

Economist sees strong growth for Asean despite China turmoil

Despite China's economic turmoil, Asean is likely to experience its best growth this year since 2012, when it grew by 5.9 per cent, an economist said yesterday at an annual forum on the outlook of the region's economics and politics.

The reason is that the fallout from China's slowdown will be offset by the recovery of major economies like the United States, said Mr Manu Bhaskaran, founder of economic consultancy Centennial Asia.

Another factor is that domestic economic and political pressures are fading in major Asean countries such as Indonesia, Thailand and Malaysia, he added at the forum held by the Iseas-Yusof Ishak Institute.

"The global economy in terms of its demand for Asean exports is going to turn out somewhat better than expected," he said.

"We should not underestimate the slow but reinforcing recoveries in the G-3 economies, now further strengthened by lower oil prices," Mr Bhaskaran added, referring to the US, euro zone and Japan.

POSITIVE OUTLOOK

We should not underestimate the slow but reinforcing recoveries in the G-3 economies, now further strengthened by lower oil prices.

MR MANU BHASKARAN, founder of economic consultancy Centennial Asia

His positive outlook comes amid pessimistic headlines in the past week, as fears over the weakening Chinese economy led to a market rout that wiped out trillions of dollars in value. Pointing to the US, he noted the "gradual, slow" improvement in its labour market, as well as in housing, bank lending, and business and consumer confidence.

Similarly, the "fragile recoveries" in the euro zone and Japan are gradually gaining more strength, which, barring any political setbacks, is set to benefit Asean.

More than half of the world's emerging market economies are also expected to accelerate this year, Mr Bhaskaran said, fuelling greater demand for Asean exports.

Later, he told reporters: "If Singapore has some flexibility to switch our efforts from servicing China to the US or other markets... we can manage the Chinese slowdown."

Singapore's electronics sector will get a boost if G-3 capital spending recovers, he added. But he warned that Singapore faces such risks as real-estate deflation and a loss in business competitiveness.

He told the forum that he also expects Thailand, Malaysia and Indonesia to recover from recent political stresses. Malaysia's leadership, for example, appears to have "contained" the fallout over allegations on the finances of its state-backed investment fund, 1Malaysia Development Berhad. This should lead to less uncertainty this year.

Several policy reforms in recent years that had a negative impact initially might finally bear fruit, he added, citing Indonesia's removal of fuel subsidies in 2014.

Another expert, Mr Sam Cheong, held up the Asean Economic Community, formed on Dec 31 last year, as a "crucial cog in the wheel for unleashing Asean's potential".

"Any alternative to an integrated Asean will only weaken the attractiveness of the region, making it less competitive to its rising peers like China, India and other emerging economies," said Mr Cheong, head of United Overseas Bank's Foreign Direct Investment Advisory, at a separate panel. But some issues need to be ironed out, he said, citing red tape in business licence applications.

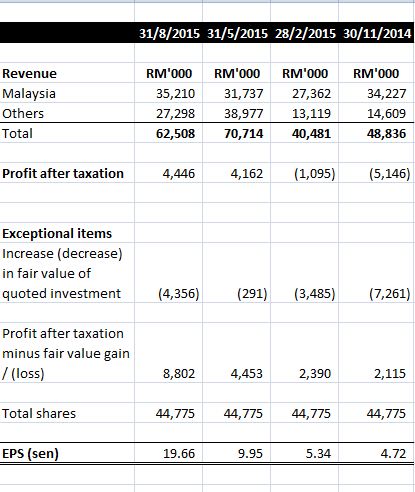

4) Company stay profitable for the last 4

quarters

Refer to the table above, the company have stay profitable for the last 4 quarter if it did not calculate the fair value loss on quoted investment. Since 30 Nov 2014, the company in profit position for four consecutive quarters.

Trade at your own risk!!! Do research before any investment decision!! Happy trading :-)

.

.

Ven Felix

Thumb up. Very good article .

2016-01-14 03:09