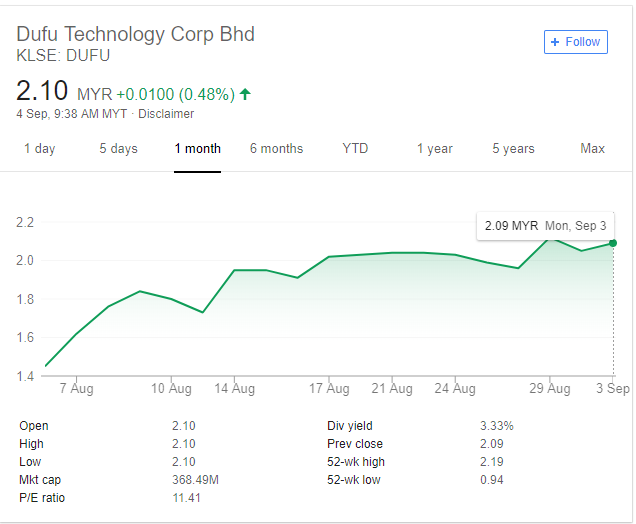

Why Genetec? Another alternative to investors who miss Dufu (HDD company) - PE6.27

itjustabouttheprofit

Publish date: Tue, 04 Sep 2018, 12:26 PM

Miss the rally for Dufu for the last one month? Dont worry. I am here to recommend you another undervalue hard disk drive company which is more undervalue than Dufu... If you interested, just continue reading my article till the end and only decide whether you want join me to invest in Genetec Technology Berhad

Company background

The company were incorporated as a private company on 3 September 1997 under the name of Genetax Technology Sdn Bhd and operating out in Taman Semarak, Nilai with a floor space of 3,800 sq ft.

The Company was converted to a public limited company and changed its name to Genetec Technology Berhad.

As per reported in the annual report as at 31 March 2018, the company's business and operations primarily consists of two core sectors, namely HDD and Automotive. The Group currently has two (2) manufacturing operations in Selangor which are located at Bandar Bangi and Subang Jaya respectively.

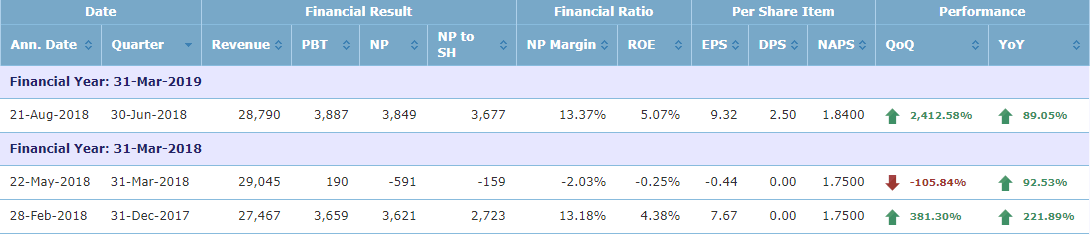

From the table above, you can noticed that there is an loss of 0.44sen for quarter ended 31 March 2018. For the quarter ended 31 March 2018, the company have incurred one off expenses on share-based payment under ESOS of RM3.221million. If excluded this expenses, the company have a profit of RM3.062million, which translated into earning per shares of 8.51sen for quarter ended 31 March 2018.

If excluding the one off expenses on ESOS, the company profit have been improving quarter by quarter. (From 7.67sen to 9.32sen)

So now the question is why the profit improving? Here is what i found from my research.

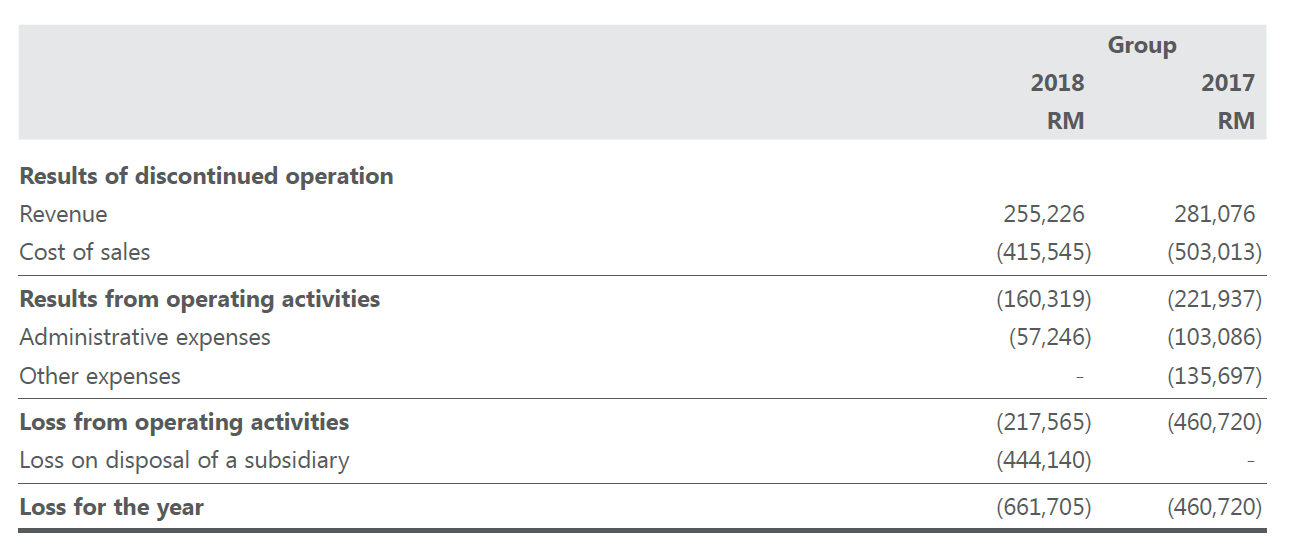

1) Disposal of loss making company, CLT Engineering (Thailand) Co. Ltd.

On 17 January 2018, the company have announced that they have disposed one of their loss making subsidiary, CLT Engineering (Thailand) Co. Ltd.

Below shows the profit and loss for the company.

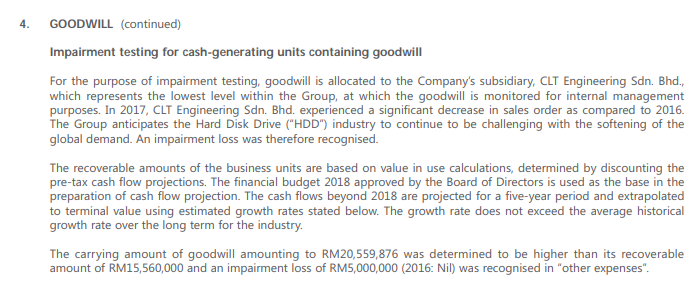

2) No more impairment loss on goodwill for CLT Engineering (Thailand) Co. Ltd.

On 31 December 2016 and 31 March 2017, the company have incurred one-off impairment for goodwill for CLT Engineering (Thailand) Co. Ltd.

As the loss making subsidiary disposed, I believe they won't be any impairment loss incurred in the near future.

So why buy Genetec Technology Berhad?

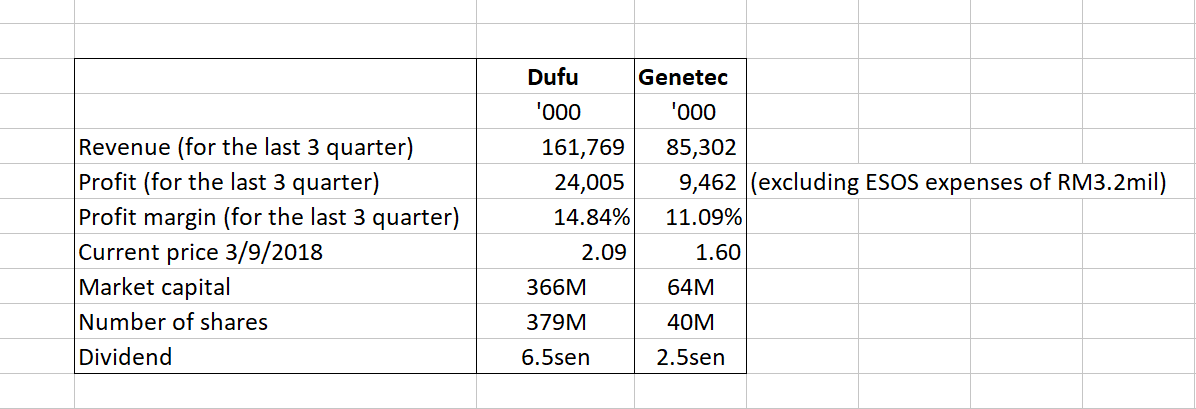

1) Peer to peer comparison - super cheap (PE 6.27 only if calculate using latest 3quarter)

For the purpose of comparison the effect after disposal of loss making subsidiary, I am using the latest 3 quarters result for comparison between Genetec Technology Berhad and Dufu Technology Corp Berhad

From the table above, you can noticed that Dufu Technology Corp Berhad generated almost 2 times of revenue and 2.5 times of profit of Genetec Technology Berhad.

I admit that Dufu is better tha Genetec in many ways. However, the market capital of Dufu is 5.72times of market capital of Genetec!!!

Hence, Genetec Technology is very undervalue currently!!!

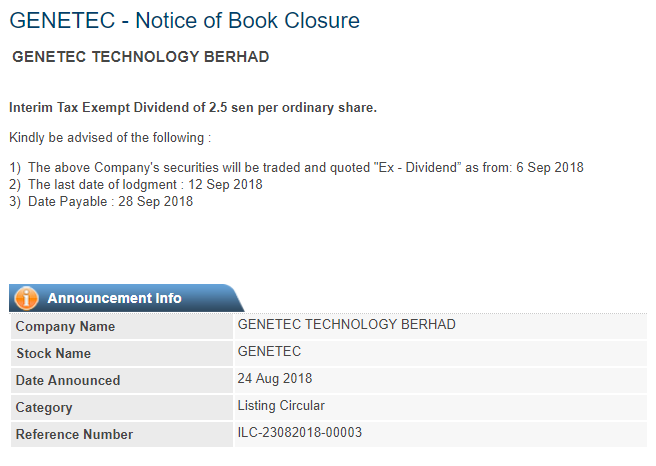

2) First dividend declared since 23 September 2011

After 7 years long await, the company have finally declared an interim dividend of 2.5sen. As the management started to pay dividend to shareholder, it is a good sign that the company is doing well.

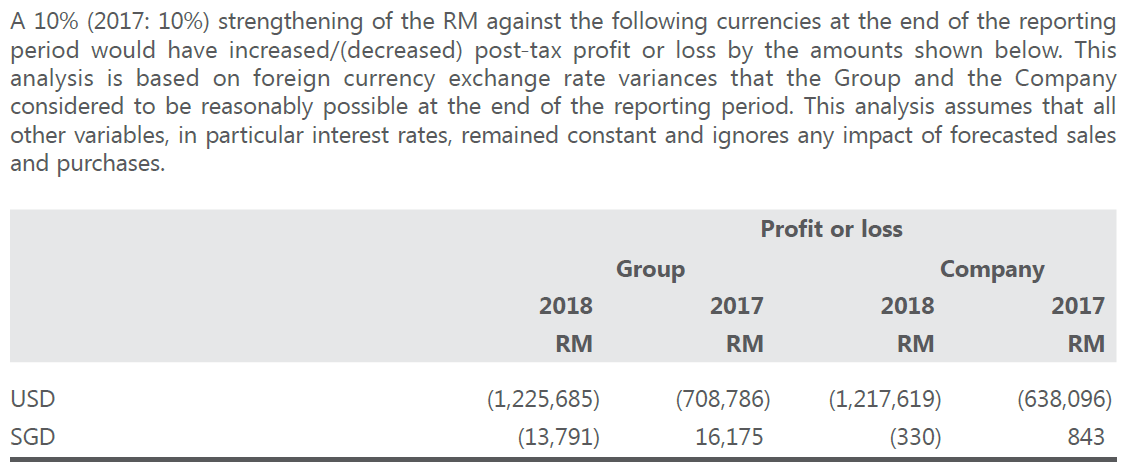

3) US dollar appreciation

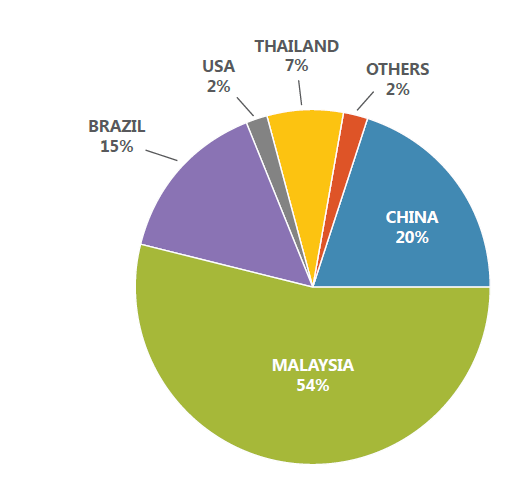

As mentioned in the early part of the article, the company export 46% of their product to oversea. As the company using US dollar in the oversea sales, hence appreciation of US dollar will also help the company generated more profit.

As you can see from the graph (USD to MYR) above, the red column is the currency rate after 1 July 2018. It shows that the currency rates are higher than previous quarter. Hence the company expected to be better off than quarter ended 30 June 2018.

Also, from the annual report, the company stated that a 10% stengthening of the RM will be reduced the profit by 1.2million. In another way, it means that the company's profit will be increased by 1.2million if a 10% weakening in RM.

Thank you for your times. Please feel free to leave a comment below.

Disclaimer: The aritcle written for sharing purpose. It do not represent any buy or sell call. Please do your research before any investment!!!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Ultimate undervalue club

Created by itjustabouttheprofit | Dec 08, 2020

Created by itjustabouttheprofit | Aug 28, 2016

Created by itjustabouttheprofit | Jun 05, 2016

Created by itjustabouttheprofit | Apr 16, 2016