Why MSC?(RM3.94) The world 2nd largest tin metal supplier which benefited from increase of tin price

itjustabouttheprofit

Publish date: Sun, 25 Dec 2016, 01:47 PM

Company background

The MSC Group is currently one of the world's leading integrated producers of tin metal and tin based products and a global leader in custom tin smelting since 1887. In 2015, the Group maintaining its position as the second largest supplier of tin metal in the world. MSC is listed both on the Main Market of Bursa Malaysia since 15 December 1994 and the Main Board of Singapore Exchange (SGX-ST) since 27 January 2011, and is a 54.8% subsidiary of The Straits Trading Company Limited of Singapore.

In the mid 90's the Group started a tin marketing and trading arm under the smelting division. The downstream unit provides the Group with hedging, pricing and marketing linkages to the Kuala Lumpur Tin Market / London Metal Exchange markets as well as the end-user markets worldwide. MSC Straits refined tin brand which is registered at LME and KLTM is accepted worldwide and has purity ranging from the standard Grade A (99.85% Sn) to the premium grade electrolytic tin (99.99% Sn).

In November 2004, MSC expanded upstream in mining through the acquisition of Rahman Hydraulic Tin Sdn. Bhd. (RHT), Malaysia's long established and largest operating open-pit hard rock tin mine. Since the takeover, extensive exploration works and improvements of milling / concentrator circuit and recovery operations have been undertaken and today RHT is a sustainable and significant tin producer in Malaysia.

The Group's 40% equity interest in Redring Solder (M) Sdn. Bhd. provides vertical integration to the its tin smelting business and an entry into a profitable downstream solder manufacturing business with significant growth potential. Redring Solder's principal activities are the manufacture and sale of solder products for jointing and semi-conductor applications in the electrical and electronics industries.

Total EPS for the past 5 years:

2011 - 62.6sen

(RM2mil) - Impairment provision for investment in Guilin Hinwei Tin Co. Ltd.

(RM6.4mil) - Impairment provision for investment in Asian Mineral Resources Limited

(RM0.3mil) - Loss on disposal group classified as held for sale

(RM16.6mil) - Impairment provision for investment in TMR Ltd

(RM18.2mil) - Provision for mine rehabilitation

RM8mil - Investment income

(Total extraordinary item = (RM35.5mil) or (EPS35.5sen))

EPS without extraordinary item = 98.1sen

2012 - (61sen)

(RM2.1mil) - Provision for investment in Guilin Hinwei Tin Co. Ltd.

(RM8.6mil) - Impairment provision for investment in TMR Ltd

(RM6.6mil) - Impairment provision for investment in KM Reosurces, Inc

(RM7mil) - Deferred exploration and evaluation expenditure written-off

(RM1mil) - Loss arising from cessation of significant influence in a former associate

RM4mil - Investment income

(RM3.2mil) - Provision for mine rehabilitation

(Total extraordinary item = (RM24.5mil) or (EPS24.5sen))

EPS without extraordinary item = (36.5sen)

2013 - (7.40sen)

RM6mil - Reversal of impairment for investment in KM Resources, Inc

(RM9.1mil) - Impairment for investment in TMR Ltd

(RM1.9mil) - Impairment for investment in Asian Mineral Resources Limited

(RM1.9mil) - Impairment for investment in Alphamin Resources Corp

RM2.8mil - Investment income

(Total extraordinary item = (RM4.1mil) or (EPS4.1sen))

EPS without extraordinary item = (3.3sen)

2014 - (9.9sen)

(RM4.2mil) - Impairment of investment in KM Resources, Inc

(RM25.3mil) - Loss on disposal of disposal group classified as held for sale

(RM3.5mil) - Loss on disposal of a subsidiary

(RM9.6mil) - Provision for financial guarantee

RM2.7mil - Investment income

(Total extraordinary item = (RM39.9mil) or (EPS39.9sen))

EPS without extraordinary item = 30.0sen

2015 - 13sen

(RM4.2mil) - Impairment of investment in KM Resources, Inc

RM2.5mil - Investment income

(Total extraordinary item = (RM1.7mil) or (EPS1.7sen))

EPS without extraordinary item = 14.7sen

2016 - 31.9sen (3 quarters)

RM2.1mil - Investment income

(RM30.5mil) - Share of losses from KM Resources

(Total extraordinary item = (RM28.4mil) or (EPS28.4sen))

EPS without extraordinary item = 60.3sen

Current PE ratio using EPS without

extraordinary item: 6.47 (RM3.90)

Net assets: RM2.7098

I am here to ANSWER a simple question.

Why MSC?

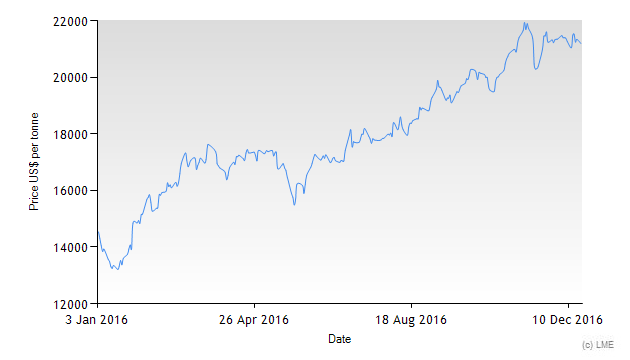

1) Increased in tin metal price per tonne by

50% since January 2016

2) Tin ore reserves of Rahman Hydraulic

Tin Sdn Bhd (subsidiary of MSC) can last

for at least 15years

3) Improved in fundemental of the company

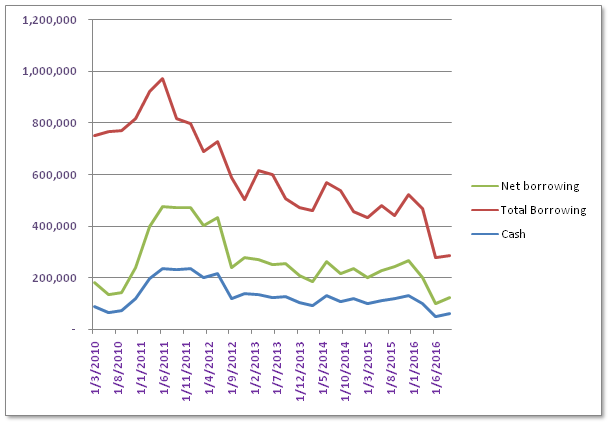

by reducing debt from net borrowing

position of RM572mil (31/12/2010) to

RM162mil (30/9/2016)

4) The company's stays profitable since

2014

5) Others

1) Increased in tin price per tonne by 50%

since January 2016

Sources: London Metal Exchange

Refer to the graph above, the tin price have been significant increased by 50% since Jan 2016 from USD14,000 per tonnes to near to USD21,500 as per today. As 2nd largest suppliers in the world, the spike in tin price will bring significant improvement in MSC's profit in the coming quarters.

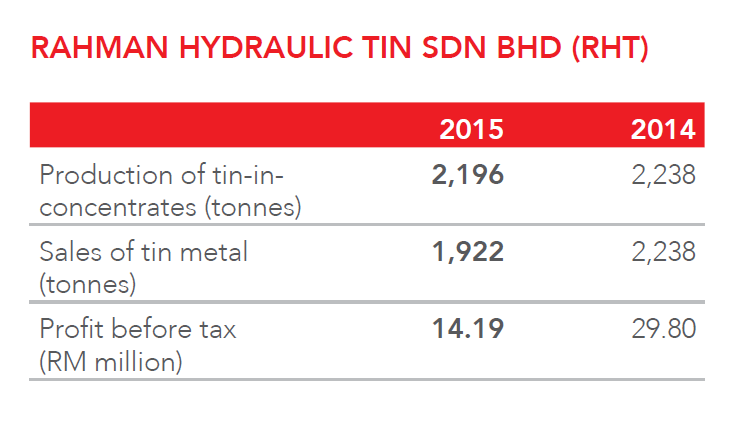

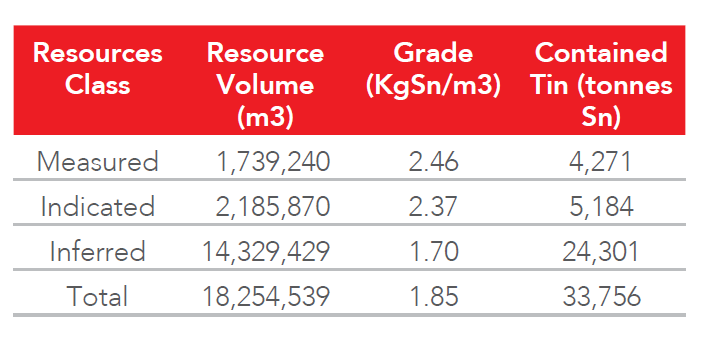

2) Tin ore reserves of Rahman Hydraulic

Tin Sdn Bhd (subsidiary of MSC) can last

for at least 15 years

Sources: Annual report 2015

As per above, the production of tin-in-concentrates for 2015 is 2,196 tonnes while the total contained tin for Rahman Hydraulic Tin Sdn Bhd is 33,756 tonnes.

Total useful life - 33,756 tonnes / 2,196 tonnes = 15.31 years

In 2015, the mine maintained its position as the largest producer of tin-in-concentrade in Malaysia, producing about 57% of the country's tin production.

3) Improved in fundemental of the company

by reducing debt from net borrowing

position of RM572mil (31/12/2010) to

RM162mil (30/9/2016)

As per graph above, it shown that the net borrowing have been significant decreased since 31/12/2010. It have been decreased from RM572million to RM162million. The company did not declared dividend since 2012. Hopeful with the reduction in net borrowing position, the company will start paying dividend again this year.

4) The company's stays profitable since

2014

5) Others

https://www.fastmarkets.com/base-metals-news/base-metals/tin-today-stronger-demand-offsets-supply-response-91199/

TIN TODAY – Stronger demand offsets supply response

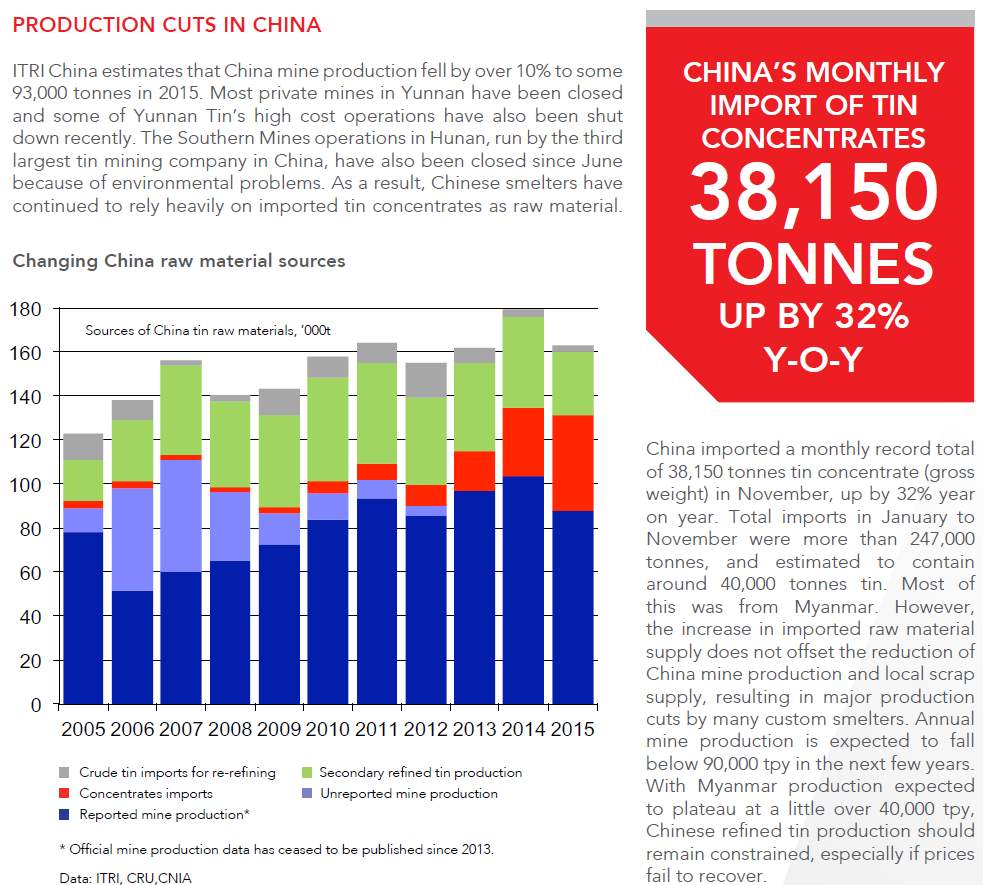

Macro drivers

LME tin is a little stronger so far this week but seems to lack upside conviction despite a firm increase in global risk sentiment (e.g. US equities are surging to record highs), a fall in the dollar and solid Chinese data yesterday and today. We think prices are capped on the upside because of a supply response to current attractive price levels.

Looking at the forward spreads, forward selling (hedging activity) seems to be picking up. The 3m-15m spread has averaged a backwardation of $544 per tonne so far in December compared with $260 in November. This explains why prices have been capped over the past month.

But supply in Indonesia has remained tight so far this year. According to ITRI, Indoenesian exports dropped 18% year-on-year in January-November 2016. But we would not be surprised by a pick-up in Indonesian shipments in the coming months because smelters may take advantage of higher prices.

On the brighter side, demand seems to have improved in recent months. According to the WSTS, global semiconductor sales rose 3.4% month-on-month in October after rising 4.2% in September and 3.5% month-on-month in August. The WSTS also revised its forecasts upwardly. It now expects global sales of semiconductors to be broadly flat (-0.1%) in 2016 and to rise 3.3% in 2017 and 2.3% in 2018.

Flows in visible inventories (LME & SHFE):

Visible inventories have picked up on net since November, which could explain tin’s lack of upside conviction.

LME stocks – at 3,375 tonnes as of December 13 – are up 190 tonnes or 6% since the start of December after rising 290 tonnes or 10% in November and falling 615 tonnes or 18% in October. In the year to date, stocks are down 2,765 tonnes or 45%.

SHFE stocks – at 1,702 tonnes as of December 9 – are down 205 tonnes or 11% since the start of December after being flat in November and falling 817 tonnes or 30% in October. In the year to date, though, stocks remain up 929 tonnes or 120%.

Supply/demand balance:

The deficit in the global refined market was 20,500 tonnes in January-August. This confirms that the fundamental outlook in the global refined tin market continues to improve.

Conclusion

We maintain our constructive stance on tin over the very short term (around one month) because we think that any short-term price weakness will attract buying on the dips. Still, we would be forced to turn neutral in case of a firm break below the 50 DMA, which has proved to be reliable support in recent months.

We remain positive over the short and medium terms – although a supply-side response is likely, stronger global macro dynamics, especially in China, may translate into firmer demand for tin. As well, visible inventories remain so low that any renewed tightening in the supply/demand balance would provoke a strong price reaction, we think.

We think the balance of risks to our forecast made at the end of the third quarter for a year-end target at $21,000 per tonne is tilted to the upside in this environment.

Trade at your own risk!!! Do research before any investment decision!!!

Merry Christmas and happy new year :-)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Ultimate undervalue club

Created by itjustabouttheprofit | Dec 08, 2020

Created by itjustabouttheprofit | Sep 04, 2018

Created by itjustabouttheprofit | Jun 05, 2016

Created by itjustabouttheprofit | Apr 16, 2016

Discussions

Many uncles & aunties followed Icap buy MSC, they all trapped.

Hard to go up, unless got a big brother to free all those uncles & aunties trapped inside. Including Icap too.

2016-12-25 16:58

stocker

Wow. Good analysis profit bro

2016-12-25 14:08